Spot Bitcoin ETFs pulled in just $1.2 million, as retail enthusiasm has cooled alongside the dragging US shutdown. But beneath the surface, institutional conviction remains rock-solid. Ahead of historically strong months, the best altcoins for the next bull run moonshots are most likely to be early-stage projects that pair real tech utility and steady fundamentals.

Among these, DeepSnitch AI has already raised over $518,000 at $0.02244, in a 49% jump from its $0.0151 launch price. The project runs five AI agents that track whale wallet activity, spot potential scam contracts, and push real-time market intelligence straight through Telegram channels.

Bitcoin ETF demand stalls, but institutional conviction holds firm

The US government shutdown is ending after 41 days , yet spot Bitcoin ETF money stayed flat on November 10. The modest $1.2 million in fresh capital stands in stark contrast to the explosive growth seen earlier in 2025, when institutional money flooded into these investment vehicles.

But according to research published by Swiss crypto banking group Sygnum on November 11, institutional appetite for digital assets remains surprisingly robust, despite October’s brutal market turbulence. The survey polled 1,000 institutional investors globally and found that 61% plan to expand their cryptocurrency holdings soon, while 73% cited expectations of superior future returns as their main motivation.

The institutional focus is shifting well beyond Bitcoin and Ethereum. Over 80% of surveyed institutions expressed interest in crypto ETFs covering alternative digital assets, with 70% saying they’d significantly boost allocations if these products offered staking rewards.

This preference for yield-generating assets could accelerate capital flows into proof-of-stake networks and DeFi protocols once regulatory clarity improves.

Meanwhile, Bitcoin’s price action has steadied nicely after recent volatility. Following a drop to $99,300 on November 7, BTC bounced back to around $106,000 by November 10 as the Senate advanced legislation to end the government shutdown.

Social media was buzzing around Bitcoin during this period, and blockchain analytics noted increased bullish sentiment across major platforms. Bitfinex analysts called the recent correction a mid-cycle consolidation rather than anything structural, pointing out that about 72% of Bitcoin’s supply stayed comfortably in profit even when prices briefly touched $100,000.

Best altcoins for next bull run and top altcoins to watch in 2026

1. DeepSnitch AI (DSNT)

Market research firm Gartner projects that global AI spending will hit $1.5 trillion in 2025, which means a massive opportunity for infrastructure projects positioned at the intersection of AI and blockchain. And DeepSnitch AI works as a picks-and-shovels investment in this growing sector, selling intelligence tools to market participants rather than speculating on specific outcomes.

The platform has five AI agents and one mission: snitch on whales, rugs, and hidden alpha before retail loses out. The crypto market has always run on information asymmetry, with institutional players and well-connected insiders always ahead. But DeepSnitch AI tackles this imbalance head-on through five specialized AI agents that work as an intelligence network for everyday investors.

As of November, the platform isn’t theoretical or still in development but officially operational. From checking out new token contracts to flagging sudden sentiment shifts, running rapid contract analysis to pushing relevant updates to users in real time, each of DeepSnitch AI’s agents, or “snitches,” has its own critical task.

The intelligence infrastructure is deployed and actively processing market data. Those who buy early will secure priority access as features roll out gradually, and the staking program kicks in shortly after the presale wraps, offering rewards that compound every few seconds.

The platform also targets Telegram’s billion-plus user base, providing built-in distribution advantages that traditional crypto projects typically spend years building. Given that institutions are specifically hunting for projects with staking capabilities and diversified exposure, DeepSnitch AI’s structure lines up perfectly with what institutions actually want.

Projects like Render and Bittensor have already shown that investors will pay premium valuations for AI infrastructure within crypto ecosystems. DeepSnitch AI enters this space at an earlier stage, currently priced very low at $0.02244 with institutional-grade audits and staking mechanisms to encourage long-term holding.

Forums discussing what the most promising altcoins in November could see are increasingly mentioning how early-stage AI utility projects offer better risk-adjusted returns. And DeepSnitch AI’s presale has pulled in over $518,000 at speed, with all it takes to make a moonshot. It’s undoubtedly one of the very best altcoins for the next bull run success.

2. Solana (SOL)

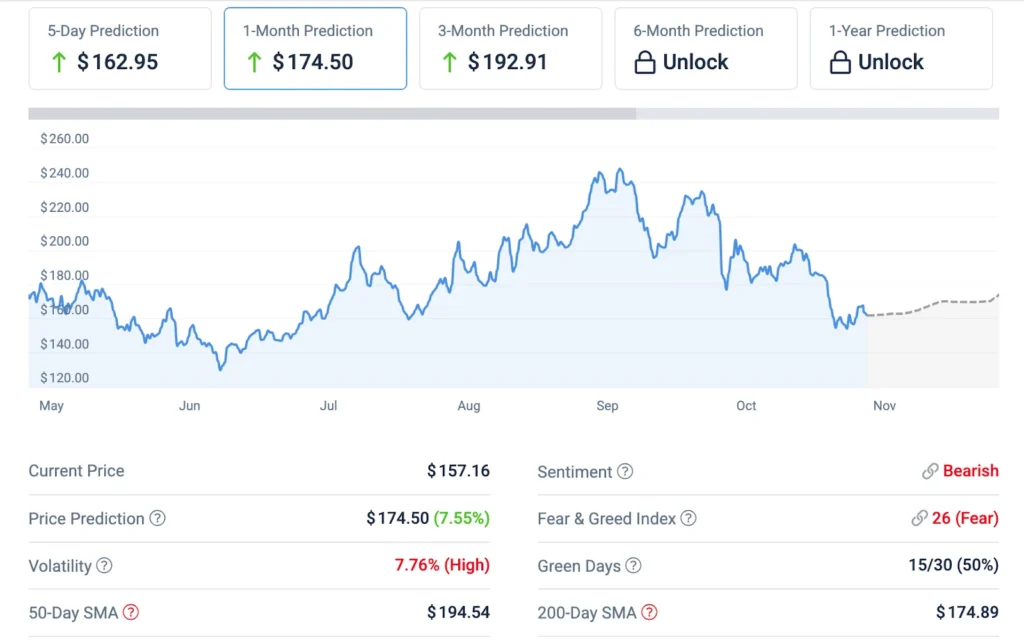

Solana showed resilience after October’s correction, with the token trading at around $163 on November 10, holding support as speculative capital flowed back into NFT and memecoin markets.

Global NFT market cap jumped from roughly $3.5 billion on November 5 to $3.9 billion one week later, amounting to nearly 12% growth. Combined meme coin valuation climbed from $47 billion to $52 billion over the same stretch, and Solana’s ecosystem caught the lift during this rotation. Among the best altcoins for the next bull run success, Solana’s coin Bonk saw gains approaching 12% over seven days, while Dogwifhat surged over 14%.

Things look weaker near-term with the Fear & Greed Index at 26. But the 200-day moving average targets roughly $176 by December 11, while the 50-day trends near $172, suggesting some potential upside from current levels.

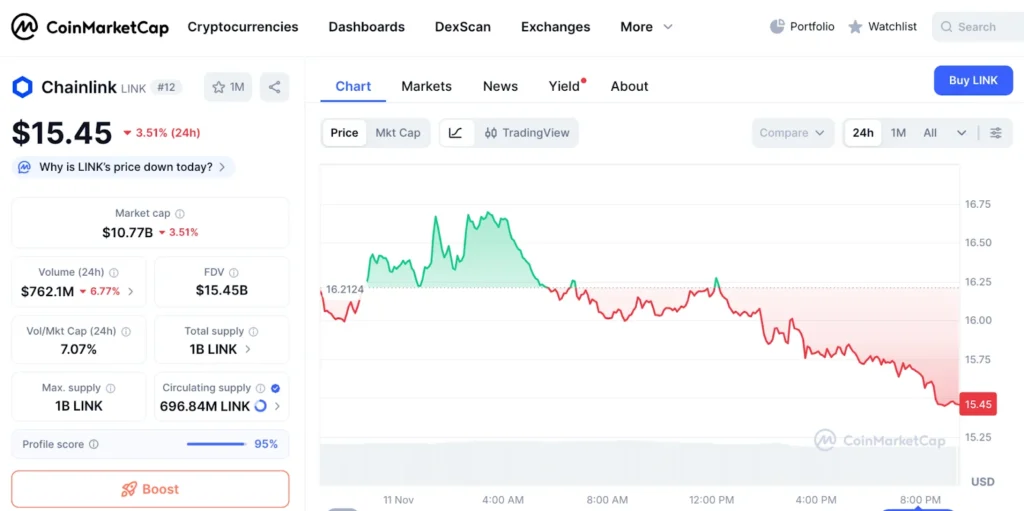

3. Chainlink

Chainlink sat at around $15.5 on November 11, with Brazil’s central bank having just classified stablecoin payments as foreign exchange , pulling crypto under banking oversight. As compliance tightens globally, demand for reliable oracle services verifying off-chain data could increase.

LINK posted 16 positive days out of 30, with volatility averaging around 7%. The 200-day moving average tracks toward roughly $18 by December 11, with the 50-day near $16, despite near-term weakness.

The final word

Bitcoin maximalism is being swapped out for diversified exposure across projects offering real utility and yield. And DeepSnitch AI addresses exactly this, with security audits from Coinsult and SolidProof, staking launching post-presale, and operational intelligence tools processing data now.

At presale valuation, DeepSnitch AI has ample more room to run compared to established networks like Solana or Chainlink, making it one of the best altcoins for the next bull run 100x gains.

While major protocols drive market direction, only early-stage projects priced as low as this, with functional infrastructure to boot, can realistically deliver 100x returns within a single cycle.

Visit the website to buy into the presale and follow X and Telegram for official updates.

FAQs

Which are the best altcoins for the next bull run cycle gains?

Solana and Chainlink have established ecosystems, but newer presales like DeepSnitch AI have far more room to outperform, now priced at $0.02244 in Stage 2.

Is Solana still worth buying in 2026?

Solana has deep ecosystem support and caught the recent NFT and meme coin rebound, but with a market cap above $76 billion, the 100x days are done. Traders seeking altcoins ready to explode next cycle may prefer smaller caps like DeepSnitch AI with a higher moonshot range.

Why is DeepSnitch AI being called a top altcoin to watch in 2026?

This mix of utility, quick operational deployment, and presale pricing is beyond rare, which is why traders rank it among the most promising altcoins in November.