Collect

Share

WeChat

Share With Friends Or Circle Of Friends

Ki Young Ju

@ki_young_ju

Strategic #Bitcoin Reserves to offset U.S. debt is a feasible approach.

Over the past 15 years, $790 billion in realized capital inflows have propelled Bitcoin’s market cap to $2 trillion. This year alone, $352 billion in inflows have added $1 trillion to its market cap.

However, using a pumpable asset like Bitcoin to offset dollar-denominated debt—rather than gold or dollars—could make gaining creditors’ consensus challenging. For Bitcoin to achieve broader market acceptance, Bitcoin must attain global, nationwide authority on par with gold. Establishing a Strategic Bitcoin Reserve (SBR) could serve as a symbolic first step.

With 70% of U.S. debt held domestically, offsetting 36% of it by acquiring 1 million Bitcoin by 2050 becomes feasible if the U.S. government designates Bitcoin as a strategic asset. While the remaining 30% of debt held by foreign entities may resist this approach, the plan does not rely on settling all debt with Bitcoin, making the strategy practical.

@matthew_sigel

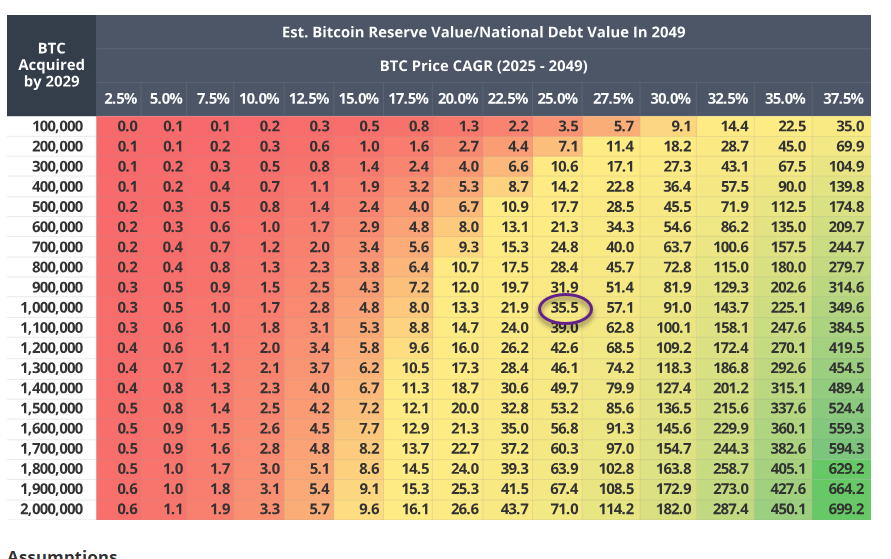

We did some math on this topic in this month's ChainCheck.

Assume the US Treasury starts buying 1M Bitcoin over 5 years at a starting price of $200k.

Assume US debt grows at 5% (vs. last 10 years 8% CAGR) & BTC price compounds at 25%.

In such a scenario, the US Strategic BTC Reserve would hold assets equivalent to 36% of debt by 2050.

Disclaimer: The copyright of this article belongs to the original author and does not represent MyToken(www.mytokencap.com)Opinions and positions; please contact us if you have questions about content

About MyToken:https://www.mytokencap.com/aboutusLink to this article:https://www.mytokencap.com/platformsocial/15437649