Bitcoin Tumbles as Macro Risks, Liquidations Weigh on Markets

Bitcoin and the broader cryptocurrency market extended losses on Monday as investors reacted to renewed macroeconomic risks, a sharp selloff in technology stocks, and a high-profile exchange hack .

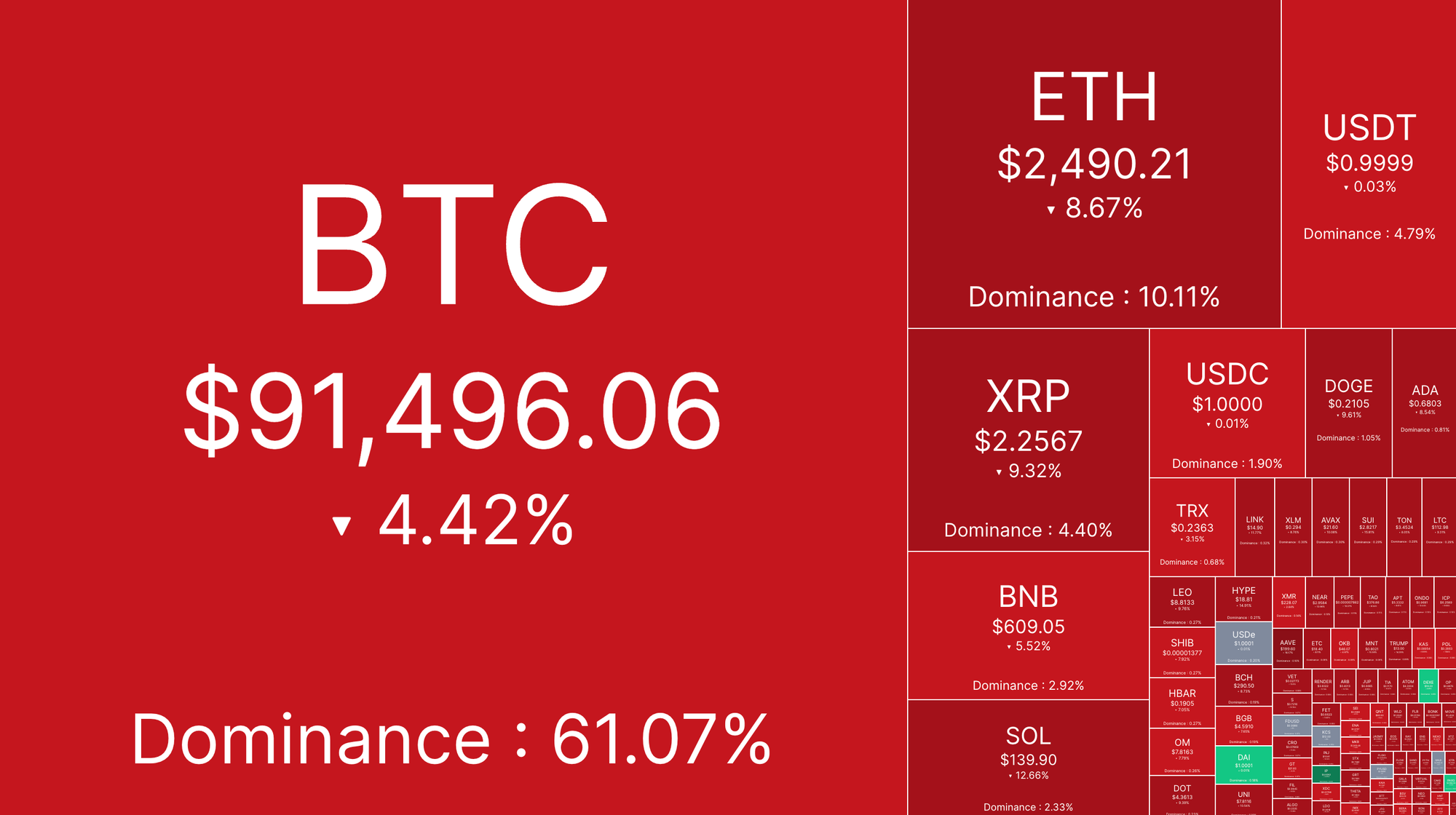

The world’s largest cryptocurrency slid 5% to $91,000, marking its lowest level since February 3, while Ethereum plunged 11% to $2,500, according to CoinGecko data.

The selloff coincided with a decline in U.S. equities, particularly in the tech sector, as the Nasdaq Composite dropped over 1%, weighed down by concerns over artificial intelligence demand and upcoming earnings from chipmaker Nvidia. Meanwhile, the S&P 500 fell for a third straight session, reflecting broader risk-off sentiment in financial markets.

Macro Risks and Tariff Uncertainty

Adding to investor anxiety, U.S. President Donald Trump confirmed that planned tariffs on Canadian and Mexican imports would move forward, reigniting fears over inflationary pressures and economic growth.

U.S. Treasury yields edged lower on Monday, indicating some reassessment of inflation expectations, but uncertainty over monetary policy and geopolitical developments kept investors cautious.

Beyond macro factors, crypto markets were also hit by industry-specific risks. The recent Bybit hack, which saw over $1.4 billion in ETH and stETH drained from the exchange’s hot wallet on Friday, dampened sentiment further. The security breach has fueled investor concerns over exchange vulnerabilities, particularly after the collapse of FTX in 2022.

Leveraged positions also exacerbated the downturn. More than $686 million in crypto-leveraged positions were liquidated over the past 24 hours, according to data from Coinglass. Forced selling amplified volatility, leading to sharper declines across major digital assets.

Solana and Broader Crypto Market Struggles

Among major cryptocurrencies, Solana (SOL) suffered the steepest decline, tumbling 10% in the past 24 hours and 41% over the past month. The selloff follows concerns over token unlocks in March and a 30% increase in Solana’s inflation rate due to the recent implementation of SIMD-96, which adjusted the network’s fee structure. At $140, SOL has now surrendered its post-election gains.

BRN analyst Valentin Fournier noted that Bitcoin's performance amidst market jitters and negative news on state reserves only highlights its resilience: "The delays in Bitcoin reserve adoption present a long-term opportunity—accumulation ahead of eventual acceptance."

"We maintain a bullish stance on crypto, recommending staying heavily invested. Solana, in particular, stands out as a high-upside play, with potential for outsized gains on the next rebound," the analyst added.

Could Bitcoin Solve America's $35 Trillion Debt Problem? https://www.blockhead.co/2025/02/25/could-bitcoin-solve-americas-35-trillion-debt-problem/

As US debt is rising, a shift to crypto reserves may redefine global finance...

Citadel Securities Ventures into Cryptocurrency Market-Making https://www.blockhead.co/2025/02/25/citadel-securities-ventures-into-cryptocurrency-market-making-2/

Citadel Securities’ pivot toward cryptocurrency is notable given the firm’s previously skeptical sta...

Robinhood, Coinbase, OpenSea, Michael Saylor Meet With SEC's Crypto Task Force https://www.blockhead.co/2025/02/25/robinhood-michael-saylor-meet-with-secs-crypto-task-force-2/

The SEC met with CCI, Saylor, and Robinhood to discuss crypto regulations as it drops probes into Op...