Avalanche (AVAX) Overextended—Is A Market Shakeup Imminent?

Avalanche (AVAX) is currently at a critical point, with its price alarmingly close to the $20 mark. This perilous situation arises in the middle of a widespread market decline, which has prompted a number of digital assets to reach multi-month lows. Investors are gradually abandoning the market, creating panic selling across the ecosystem, according to analysts.

Technical Indicators Show A Concerning Picture

The recent price movement of AVAX tells a story of eroding support and prolonged weakening. Since February 1, the token has been on a steady decline after failing to maintain momentum following a challenge of the $34.40 resistance level.

Technical analysis indicates that the Relative Strength Index (RSI) has entered oversold territory on daily charts, a condition that typically indicates an imminent reversal. Nevertheless, the Bull Bear Power (BBP) indicator continues to exhibit negative readings, indicating that adverse forces continue to exert a stronghold on the market.

Current conditions may result in an extended correction phase if this bearish dominance continues. The token’s inability to surpass its descending trendline serves to bolster this pessimistic perspective.

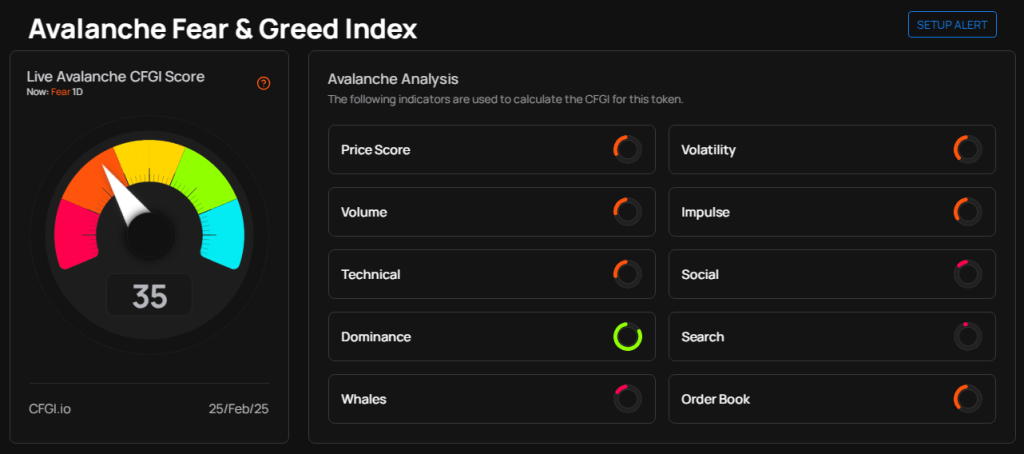

Avalanche Fear Index Reaches Critical Levels

The psychology of the market has undergone a significant shift toward extreme caution. The crypto fear and greed index, a critical indicator of market sentiment, has experienced a precipitous decline to a reading of 35, firmly establishing it in the category of “fear.” This widely-followed index operates on a scale of 0 to 100, with readings below 35 indicative of severe market anxiety.

Digital assets have seen turning points throughout history when faced with such high degrees of fear. Though they can sometimes be appealing starting points for contrarian investors, they can indicate the beginning of more market drops as selling momentum rises.

The latter scenario may be unfolding, as there is little evidence of “buy the dip” activity emerging to sustain AVAX’s price , as current market behaviors suggest.

On-Chain Data Confirms Resistance OverheadThe basic outlook seems to be similarly challenging when looking at on-chain measures. The In/Out of Money Around Price (IOMAP) analysis by IntoTheBlock shows that there is a sizable resistance zone at about $23.60.

At this pricing point, over 128,000 addresses control 3.31 million AVAX coins overall, a significant psychological barrier. Currently resting on unrealized losses, many of these holders could wish to sell their positions as soon as it becomes feasible to break even, therefore creating a “sale wall”.

Featured image from Pixabay, chart from TradingView

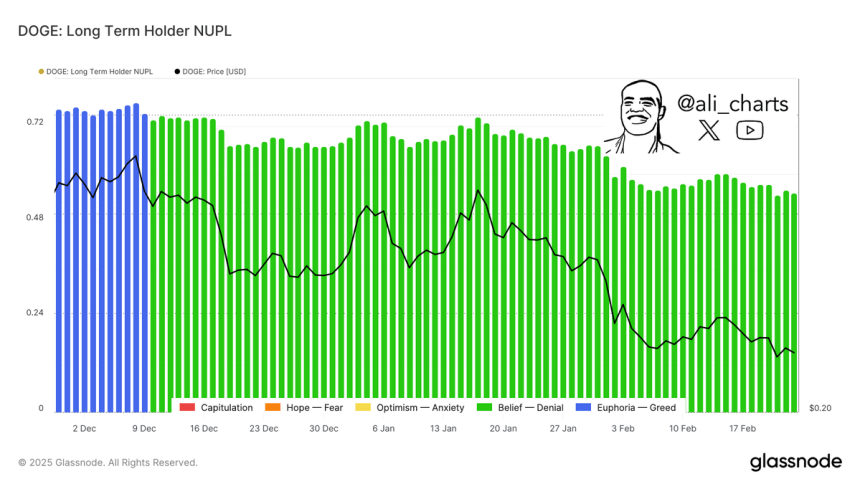

Long-Term Dogecoin Holders Are In “Denial” – On-Chain Metrics Expose Weakness https://www.newsbtc.com/news/dogecoin/long-term-dogecoin-holders-are-in-denial-on-chain-metrics-expose-weakness/

Dogecoin (DOGE) is trading at key demand levels after two weeks of intense selling pressure, with be...

SUI Uptick Sparks Hope, But Is This Fleeting Recovery? https://www.newsbtc.com/sui/sui-uptick-sparks-hope/

Sui (SUI) is showing signs of a potential rebound as its price climbs above the $2.80 mark, sparking...

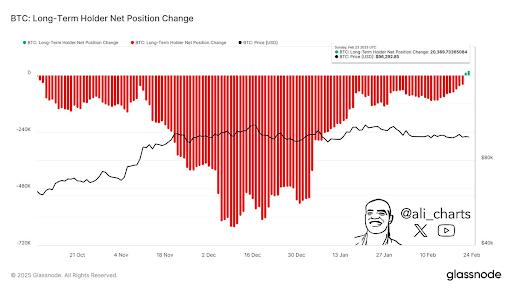

$16 Billion In Possible Liquidations Suggests Where The Bitcoin Price Is Headed Next https://www.newsbtc.com/news/bitcoin/bitcoin-next-destination/

Crypto analyst Kevin Capital has provided insights into where the Bitcoin price may be headed next. ...