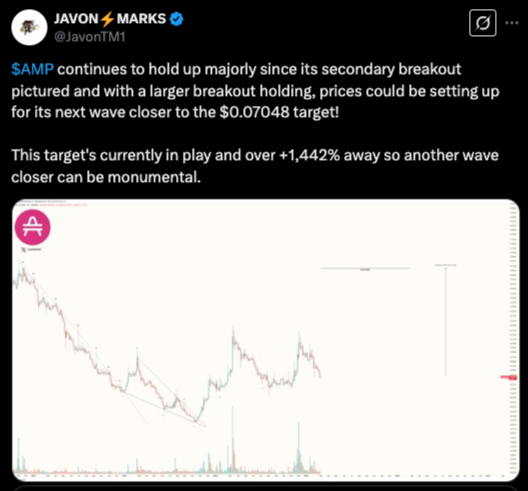

AMP Holds Strong After Breakout, Eyeing 1,442% Rally Toward $0.07048

AMP continues to sustain its momentum following a major secondary breakout, reinforcing bullish sentiment. With price action stabilizing above key breakout levels, the token is setting up for another potential wave higher. The next target of $0.07048, currently over 1,442% away, remains in play, signaling a monumental upside if the trend holds.

AMP has maintained key breakout levels despite recent market fluctuations. The chart shows a significant downtrend reversal, with a falling wedge breakout leading to a sustained uptrend. After testing higher highs, AMP is now in a retracement phase, which could be a setup for another bullish leg.

Volume spikes during breakout periods indicate strong investor interest, while the current price structure suggests consolidation before another move. If AMP holds its higher lows and reclaims resistance levels, a breakout toward the projected target remains feasible.

Price Target Signals Potential for Massive Surge

With a long-term target of $0.07048, AMP’s projected move represents an astronomical 1,442% gain from current levels. While such an increase would require strong market conditions, the technical structure supports the potential for another rally.

The previous breakout confirmed a shift in trend, and sustained accumulation at these levels could fuel the next leg up. If buyers maintain control, AMP could gain momentum and push toward its long-term target, offering significant upside potential for traders.

AMP’s ability to maintain support levels will determine the strength of its next move. A failure to hold the current structure could lead to further consolidation or a retest of lower levels. However, with momentum still intact and historical patterns favoring extended runs, AMP remains one to watch as it inches closer to its ambitious price target.

Whale Bets on Hyperliquid, Accumulates 116,147 HYPE Tokens Amid Price Decline https://blockchainreporter.net/whale-bets-on-hyperliquid-accumulates-116147-hype-tokens-amid-price-decline/

The whale acquired $2.36 million HYPE tokens, showing strong interest and confidence in the asset. I...

Is Elon Musk Steering DOGE into Turmoil? Trump & Democrats Clash Over Legalities While Investors Shift to Web3Bay https://blockchainreporter.net/is-elon-musk-steering-doge-into-turmoil-trump-democrats-clash-over-legalities-while-investors-shift-to-web3bay/

As Elon Musk's role in DOGE stirs legal controversies, Web3Bay's presale crosses $1.5M. Here’s why s...

Arctic Pablo Coin Presale Raises $1.64M – Early Investors Are Cashing In Big While Pudgy Penguins and TRUMP Meme Coin Gain Momentum! https://blockchainreporter.net/arctic-pablo-coin-presale-raises-1-64m-early-investors-are-cashing-in-big-while-pudgy-penguins-and-trump-meme-coin-gain-momentum/

Discover the top meme coins to invest in this week, including Arctic Pablo Coin, Pudgy Penguins, and...