Markets in February Reflect Deep Concerns

Last week, the US stock market exhibited concerning indicators as investors' exuberant post-election sentiment confronts some difficult realities.

The big technology stocks that have driven significant increases in market indices over the past two years are beginning to falter, prompting traders to seek refuge in safer investments.

Concerns of an economic downturn are escalating following many weak data reports in the last fortnight.

Concerns regarding US President Donald Trump's tariff-laden trade plans persist.

Concerns regarding the persistent conflict in Europe intensified on Friday during a tumultuous White House meeting between Trump and Ukrainian President Volodymyr Zelenskyy, which devolved into a heated exchange between the two leaders.

Given the current uncertainties, the S&P 500 Index declined for two consecutive weeks and four out of the last five.

It has nearly eliminated all of its gains since the excitement of Trump's election.

The benchmark closed at 5,782.76 on Election Day, November 5, and finished at 5,954.50 on Friday following an intense late-session rise.

Nonetheless, it is far below the peak of 6,144.15 recorded in February.

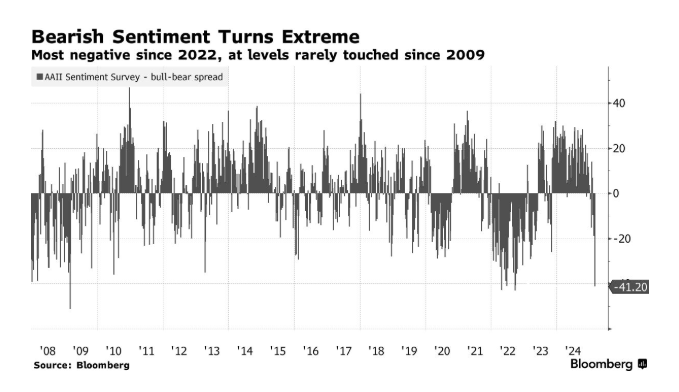

According to the most investor sentiment poll from the American Association of Individual Investors, the gap between positive and pessimistic forecasts hit its lowest point since 2022 in the week ending Wednesday, indicating that investor sentiment has become an important indication for traders.

The indicator was last this low before 2022 in 2009, during the height of the financial crisis.

In spite of all the worries, investors are still holding onto their equities, according to a Bank of America poll of global fund managers conducted in early February.

Most people are still undecided about this.

Consequently, in the weeks to come, traders will monitor the sentiment indicator for changes.

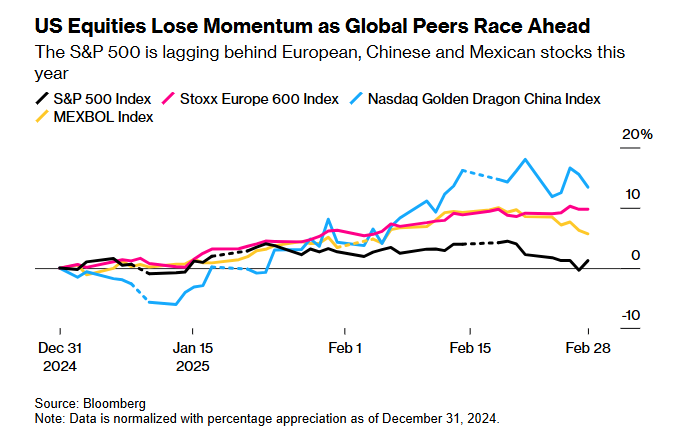

As the Trump administration has stepped up its tariff warnings, US stocks have fallen behind their international counterparts.

Indexes following Chinese ADRs and European equities have climbed by 10% or more in 2025, while the Canadian stock market benchmark has beaten the S&P 500 by a ratio of two.

According to Trump's announcement this week, imports from Canada and Mexico will be subject to 25% tariffs starting on March 4. He said an extra 10% duty might hit China.

Since the noise isn't going away soon, investors will closely monitor the gap between US and non-US stocks.

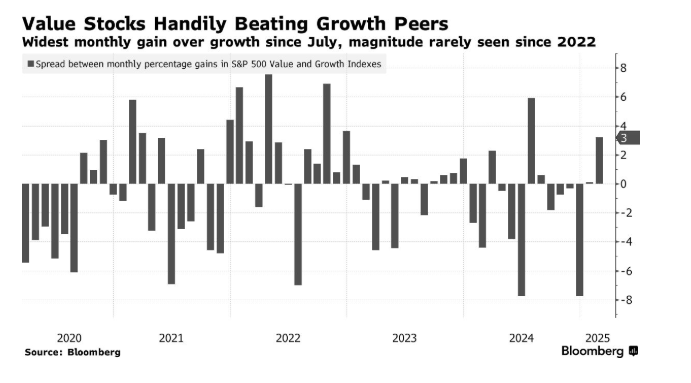

Anxieties over tariffs and the economy show people's declining willingness to take risks.

An index of the seven largest technology companies has entered correction territory, while shares of unprofitable tech businesses have plunged, and corporations that were extensively shorted have lost all of their gains from the post-election speculative frenzy.

As a result, investors are fleeing risky equities at a rapid rate.

With a rapid ascent that began at the beginning of 2023, the S&P 500 has increased in value by $18 trillion. Yet, semiconductors, a sector in the epicentre of the action, have not seen a corresponding increase in stock market value.

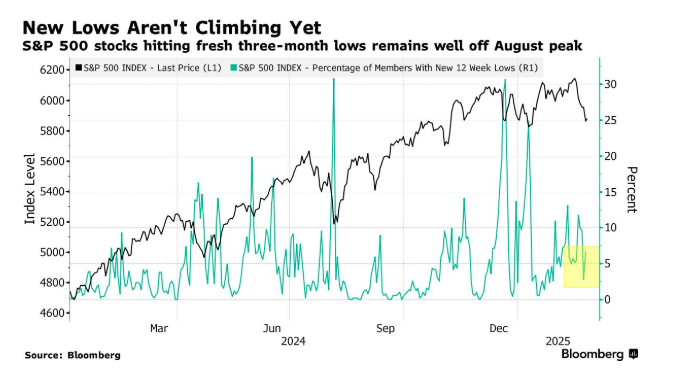

Another problem for bulls is that fewer stocks are making new highs. Since early November, when almost 25% of S&P 500 shares were making new 52-week highs, that number has dropped to only 8%.

Nevertheless, there isn't much downward pressure either, as only 9% of equities hit three-month lows, significantly lower than the 31% peak seen in early August during the unwinding of the yen carry trade.

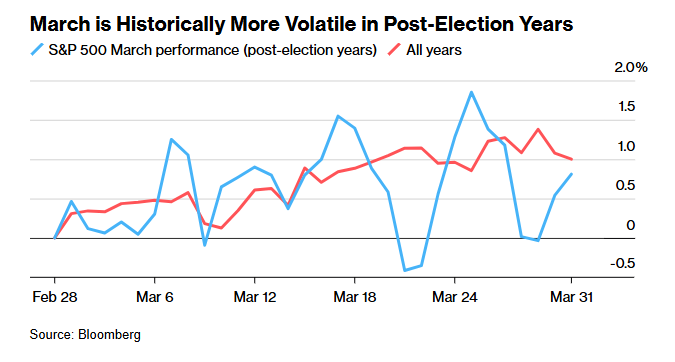

Although investors had a rough go of it in February, March seems even worse.

The Stock Trader's Almanac reports that March typically saw a strong start in the years following elections before losing ground as traders dealt with "triple-witching" and portfolio rebalancing at the end of each month and quarter.

The story wasn't very different for cryptos until a surge on Sunday.

In February, cryptos extended their retreat, with Bitcoin crashing over 25% from its all-time peak in January, though it has recovered slightly as of publication, and is up 9% over the past 24 hours on the back of Sunday's announcement that the US will create a national cryptocurrency reserve that will hold XRP, ADA, SOL, alongside BTC and ETH.

Trump's Crypto Reserve Plan Triggers Bitcoin Surge https://www.blockhead.co/2025/03/03/trumps-crypto-reserve-plan-triggers-bitcoin-surge/

Trump’s digital asset reserve announcement on March 2 sent Bitcoin soaring 11% to $94K, sparking a c...

DigiFT Secures Custodial License in Singapore https://www.blockhead.co/2025/03/03/digift-secures-custodial-license-in-singapore/

DigiFT has secured a custodial license under its CMS license from MAS, enabling end-to-end solutions...

BlackRock's IBIT ETF Breaks into Mainstream Model Portfolios https://www.blockhead.co/2025/03/03/blackrocks-ibit-etf-breaks-into-mainstream-model-portfolios/

The news adds further validation to Bitcoin's growing mainstream appeal....