Ethereum 2025 Price Prediction as Trump Announces US Crypto Reserve

Following its inclusion in Donald Trump’s newly announced US Crypto Reserve, Ethereum’s price prediction for 2025 has become one of the hottest topics of debate among crypto enthusiasts and pundits.

While a vast majority is expecting $ETH to ride the positive momentum and finally break out of its long-drawn sideways channel, some say there’s more price correction in store.

In this guide, we’ll let Ethereum speak to us; we’ll analyze its technicals and fundamentals to draw out a clear picture of where we think the second-biggest crypto in the world could be headed in the coming 10 months.

Ethereum 2025 Price Prediction at a Glance

If you’re after a quick answer, here’s everything you need to know about $ETH’s upcoming performance:

- Ethereum is holding a major support zone on the weekly chart – BULLISH

- It’s continually respecting the important $2K level and 200 EMA – BULLISH

- The current support zones contain major accumulation areas – BULLISH

- Lower highs and lower lows are being made on the daily chart – BEARISH

- Moving averages sloping downwards on the lower timeframes – BEARISH

- Inclusion is Trump’s US Crypto Reserve – BULLISH

- Upcoming Pectra Upgrade – BULLISH

Overall, since the higher timeframes override the smaller ones, and because the market sentiment also screams bullishness, $ETH’s larger picture looks very positive.

Once it breaks and holds above a lower high, many feel we can expect $ETH to reach new highs, including the $6K mark, in 2025.

Diving Deeper Into Ethereum’s Chart

The best way to go about technical analysis is to start from the higher timeframes and then scoot lower. This helps establish a strong understanding of the overall direction of the cryptocurrency — whether certain short-term trends are aligned with the larger picture or just temporary price corrections.

With that in mind, we’ll start our analysis at $ETH’s weekly chart.

The Larger Picture Is Extremely BullishRight off the bat, we notice that the crypto is at a major support zone (between $1.9K and $2.3K). This is where $ETH took support in November last year before bouncing to $4K.

Additionally, this support zone also contains the $2K mark, which is an important psychological number. For those unaware, round figures such as this often act as strong support and resistance levels.

The $2K level, in particular, is a very notable one, seeing as $ETH has reacted to it almost every single time ever since it first touched it all the way back in February 2021.

Another massive positive sign is that $ETH (on the weekly chart) is currently at and reacting to the 200 Exponential Moving Average (EMA), which is one of the most prominent indicators of technical analysis.

Given that $BTC (on the daily chart) bounced off the 200 EMA less than a week ago, we can expect $ETH to do the same.

According to Glassnode, a blockchain analytics firm, the $1.9K price point is also a major accumulation zone, with over 1.82M $ETH being bought at it by long-term investors since August 2023.

Having mentioned the various reasons $ETH looks ripe for an upward rally, the biggest clue we get about its upcoming prices is through the good old rectangle pattern. Simply put, Ethereum has been trapped between the $2K and $4K levels.

Plus, given that this has been the case for almost a year now, a breakout above the ceiling ($4K) could see $ETH reach a new high that’s as far away as the breadth of the rectangle. The upper and lower limits of the rectangle, in this case, are $2K apart, meaning we can expect $ETH to cross $6K once it breaks above $4K.

Lower Timeframes Suggest a Battle Against the BearsAlthough the weekly timeframe is the boss and dictates the larger picture, the daily and 4-hour timeframes often provide an excellent outlook for the short term.

Unfortunately, though, the two major moving averages (50 EMA and 200 EMA) are both sloping downwards on these timeframes. This suggests that institutional buying is yet to enter the market.

However, trends in crypto could change in hours because large buying often results in towering candlesticks, and just a couple of those would be enough to throw $ETH over the EMAs.

Ethereum’s Market Sentiment

$ETH is up 5.75% today and is currently trading at around $2,200 . The latest surge in its price is likely due to its inclusion in Trump’s Crypto Strategic Reserve. It is, after all, one of the only five cryptos that made it to the list.

Not only is the amount huge, but $ETH also makes up nearly 65% of the firm’s entire $300M+ crypto portfolio. Clearly, Trump is backing Ethereum to hit it out of the park, which is one of the biggest reasons the $6K target looks extremely realistic.

Also, Ethereum is the only other crypto besides Bitcoin to have spot ETFs (exchange-traded funds), which is a huge positive as far as investor participation in $ETH is concerned.

The fact that BlackRock ‘likes’ Ethereum is nothing to sniff at, either. The asset management company launched a tokenized money market fund last year, and it chose Ethereum as its blockchain of choice for this fund.

Pectra UpgradeIn other news, Ethereum is also nearing a huge Pectra upgrade . It was successfully deployed on the Sepolia testnet today, and Pectra’s mainnet is expected to launch in April.

This update will consist of 11 major features, which will together make the Ethereum ecosystem more user-friendly, affordable, and efficient.

For instance, the validator staking limit will be increased from 32 ETH to 2,048 ETH. In addition to being a game-changer for validators, who will be able to compound their earnings, this move is expected to reduce selling pressure over a long enough time period.

What’s more, we’ll see a bunch of wallet and security improvements, too. These include batched transactions, gas sponsorship, application-wise spending limits, and different recovery mechanisms.

Ethereum’s a Good Investment, but $MEMEX Could Be a Better One

With Ethereum expected to nearly triple in price this year, it’s certainly shaping up to be a great investment choice for traditional crypto traders. However, for those with an appetite for higher risks and rewards, the Meme Index ($MEMEX) presale could be a better pick.

The $MEMEX presale is fast approaching the $4M mark, and each token is currently available for just $0.0166883 — here’s how to buy $MEMEX if you’re looking to get in as an early investor. What’s more, you’ll also be able to benefit from the project’s 579% staking rewards.

Last but not least, we’d like to mention that although our analysis and experience tell us that both $ETH and $MEMEX are excellent crypto investment opportunities , this article shouldn’t be considered a substitute for professional financial advice. You must always do your own research before investing.

PEPE Price: Analyst Says Watch This Level To Trigger 400% Move Toward $0.0001

Meme coin PEPE has been hovering near a crucial support level over the past few weeks, following a s...

Billionaire Warns Of Financial Turmoil—Will Bitcoin Save Investors?

The United States, with its cycle of growing debt and debt servicing, may face a financial crisis in...

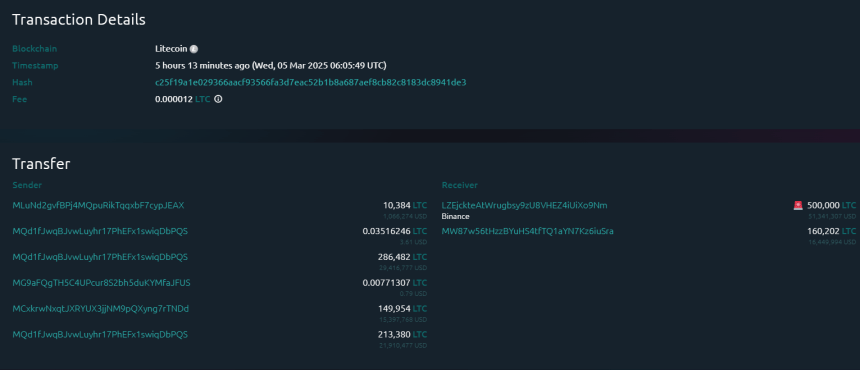

Litecoin Whale Deposits 500,000 LTC To Binance: Price Decline To Extend?

On-chain data shows a Litecoin whale has made a huge deposit to the cryptocurrency exchange Binance ...