Bitcoin Hits First Bull Market Support Levels Amid Tariff Drama

Bitcoin whipped around on Tuesday and hit a fresh four-month low but ended the session about 5% higher, snapping a five-day losing streak.

The rise in Bitcoin extended to Wednesday as the general risk appetite is recovering broadly.

Bitcoin's Critical Threshold

After Bitcoin fell below $79,000 and declined further to $76,600, it recovered to above $83,000.

However, the OG token must recover to $89,000 to sustain the bullish momentum. Otherwise, it risks declining to $74,000 or $62,400, potentially concluding the bull cycle.

That is according to Martin Leinweber, the Director of Digital Asset Research & Strategy at MarketVector Indexes and the author of "Mastering Crypto Assets."

The Fear and Greed Index stands at 24, reflecting last year's top of $73,000 but with a reversed attitude.

The price has not yet established a bottom; further decline is plausible through April-May 2025.

Distress in Crypto Tokens

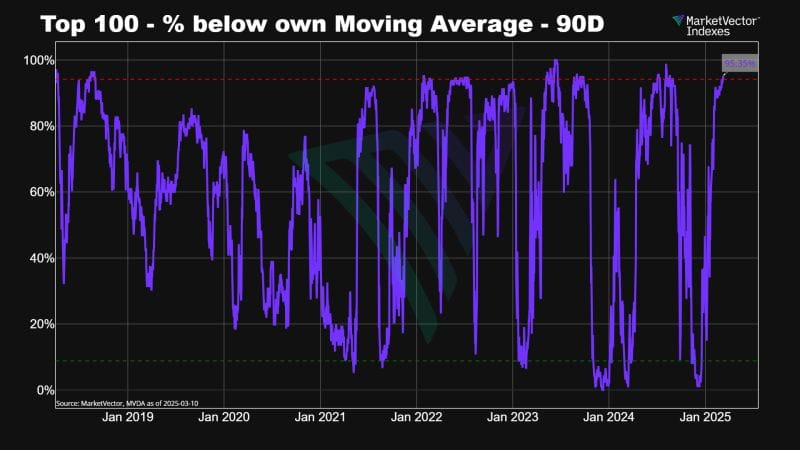

Over 95% of the top 100 cryptocurrencies are trading below their 90-day moving average.

This is a situation not witnessed since the Yen carry trade unwound in August 2024 and June 2023, when Bitcoin was around $30,000 and the market was starting to rise.

These values frequently indicate capitulation before a reversal.

Another Sea of Red as Tariffs Trump Ceasefire Hopes

The story is not different for the S&P 500.

Q1 weakness is common in election years, and risk assets like the S&P 500, which is down 9% from its peak, are having a tough time right now because Quantitative Tightening (QT) is still a factor.

Unless the Fed ends QT sooner, which may be prompted by a 20% collapse in the S&P to 5100 or 4,900, then expect further volatility until March options expiry, with probable reprieve in April.

A decline in exchange volume and $1 billion worth of liquidations (mainly longs) indicate a lack of strength.

Uncertainty is heightened by recent news regarding Donald Trump (tariffs, strategic reserve delays) and upcoming economic data like CPI & PPI.

If past trends are any indication, we should expect a downturn in March and a possible upturn in April.

A more optimistic setup may occur if Bitcoin maintains a price over $74,000 and the S&P 500 bounces back.

Nevertheless, for Bitcoin's bullish momentum to be confirmed, the price has to regain the $89,000 mark.

Similarly, for the S&P 500 to avoid a larger decline, it must close above 5,900.

For now, though, market sentiment is more dazed as the threat of escalating trade wars and recession risks remain in play.

US President Donald Trump's irrational new tariff threats and reversals sent stock prices deep into the red.

The president's economic broadsides have left investors fleeing shares, and the market hue remained red as markets closed on Tuesday.

Wall Street stocks continued their steep decline on Tuesday, adding to the largest monthly loss, as investors fretted over the potential effects of fresh tariff threats on international trade.

Progress toward a truce between Russia and Ukraine momentarily bolstered stocks, but trading remained turbulent due to conflicting tariff announcements.

At one point, the Nasdaq surged over 1% as investors rejoiced at the announcement.

However, traders observed a pervasive decline in their screens as the day concluded, with the announcement of Trump's decision to elevate taxes on imported steel and aluminum items from Canada to 50% being a significant contributing factor.

Following Trump's all-caps social media tweet threatening Canada with more steel tariffs, he promptly retracted his stance after Ontario announced the suspension of a 25% fee on power exported to the US, which was largely symbolic.

Stocks Fall Amid Trade Drama

Wall Street's three main benchmark indices ended near new five-month lows.

The S&P 500 is near its 'correction' territory, declining about 10% from its peak in February, while the Nasdaq has fallen 15% from its zenith.

The latest tariff threat has exacerbated market apprehension that Trump's trade policies will likely lead to an economic downturn or induce a recession.

On Monday, the S&P 500 had its biggest substantial single-day decline since December 18, erasing roughly $1.3 trillion in market capitalization and an astonishing $4 trillion from its February all-time high.

The benchmark S&P index declined nearly 3.4% in the last two days, marking its most significant decrease since early August.

The technology-focused Nasdaq confirmed a 10% fall and correction late last week.

The Game Of Tariff Poker Dominates

Global markets have been disrupted since Trump initiated reciprocal tariff actions against significant trading partners, while recent economic indicators suggest a potential slowing of the economy.

A report on consumer prices on Wednesday will indicate whether progress is being achieved in mitigating inflation.

The dollar declined to a five-month low against a range of major currencies, lacking support from the resurgence in Treasury yields.

The primary catalyst for that movement is the euro, which surpassed $1.09 for the first time since October.

The possibility of a Russia-Ukraine truce offers investors a glimmer of optimism; however, it is insufficient to dispel the looming economic uncertainties.

The escalating global trade war is generating unprecedented uncertainty, leading to heightened anxiety among businesses and consumers.

Notwithstanding the market upheaval and the degree of uncertainty that his tariff plan has engendered, Trump exhibits no indication of retreating, and on Tuesday, he escalated the trade conflict further.

Approximately $5 trillion has been erased from the value of US stocks since the S&P 500 reached its zenith last month; the currency is depreciating, and both volatility and corporate bond spreads are escalating to levels not observed in months.

Deep Tariff Angst – Where Now For US Rates?

Trump characterizes this as essential to the "transition" to a restructured US economy. However, it is adversely affecting financial market valuations, expenditures, investments, and overall sentiment worldwide.

The dilemma it may create for the Federal Reserve is a consequence of the tariff turmoil.

Anticipations of interest rate cuts are resurging due to the declining GDP forecast and potential recession concerns.

Fed rate cuts are widely considered the next trigger for cryptos, but any easing under the current economic backdrop will do the opposite for the digital assets industry.

Experts are also increasing their inflation projections, and a very high CPI report on Wednesday would be undesirable for policymakers.

Although implied volatility in US Treasuries is increasing, there are no indications of market breakdown.

The significant decrease in open interest in the Treasury futures market warrants close observation in this stressful atmosphere.

Exposure to Treasury futures declines at a precarious juncture.

Open interest levels in the US Treasuries futures market often receive little scrutiny; nonetheless, this instance may be noteworthy, as Trump's tariff policy could significantly hinder the US economy, potentially leading to a contraction.

Data from the Commodity Futures Trading Commission indicates that open interest, the most comprehensive indicator of investors' exposure to US bond futures, is declining at an unprecedented rate.

The decline is the most pronounced on record in many instances, such as biennial contracts.

What is the Significance of this?

A recent report by Federal Reserve officials Andrew Meldrum and Oleg Sokolinskiy revealed that cash market depth "significantly affects liquidity fragility across all maturity sectors" of the Treasury market.

The decline in open interest may indicate that one of the globe's most significant markets has become more susceptible to disruption.

Despite a friendly US administration, that is not good news for the crypto sector.

Speculators are deleveraging since leveraged funds are cutting their "short" holdings more aggressively than asset managers are cutting their "long" positions.

This is the main reason for the recent decline.

Anything that affects the liquidity of the world's most significant market is definitely worth watching right now because of the precarious situation.

Elsewhere

Blockcast

Jess Zeng entered the crypto industry as an intern at Gemini while studying finance at SMU. She then moved on to work at Chainlink, where she transitioned from a business development role to an ecosystem-building focus.

After a stint at Fireblocks to gain institutional experience, she joined Mantle , where she now leads ecosystem growth for mETH - the liquid staking platform backed by Mantle.

Previous episodes of Blockcast can be found on Podpage , with guests like Samar Sen ( Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!

Subscribe on LinkedIn

Rumble, Bitdeer, Metaplanet Increase BTC Holdings Amid Market Uncertainty

Rumble buys 188 BTC for $17.1M, Bitdeer boosts holdings 75% to 1,039 BTC, and Metaplanet surpasses 3...

Crypto Giant Amber Goes Public via Nasdaq Merger, Trading Under "AMBR" Ticker Set to Begin

iClick announced today that it is moving forward with the closing of its merger with Amber DWM Holdi...

Franklin Templeton Files for Solana ETF One Day After XRP Filing

Franklin Templeton files for a Solana ETF after an XRP ETF bid, with Bloomberg predicting a 70% chan...