Markets Wanted Intervention Assurance; Did the Fed Give Enough?

Wall Street stocks, cryptos, and other risk assets have been taking a hit due to tariff worries and sought intervention assurance from the Federal Reserve if things worsened.

The Fed, for its part, was in a wait-and-watch mode leading up to the decision, and analysts were questioning whether the central bank could afford to maintain that stance. The clear question from markets was: would the Fed jump in if economic conditions deteriorated further?

Furthermore, what to expect from US President Donald Trump -led global trade wars is anyone's guess.

See-saw bets on 'will he' and 'won't he' started as strategy, but markets have taken a beating after Trump's rhetoric and as data and estimates clearly point to a hit to the US economy.

Concerns about the potential economic effects of US tariff measures had fueled an unforgiving market mood in the run-up to the Fed's monetary policy decision and commentary on Wednesday. Several Fed officials had cautioned against premature conclusions, emphasizing their intention to await concrete data on the effects of tariffs before altering policy.

However, markets were yearning for a clearer policy direction or at least a firm commitment from the Fed to act if needed. This anxiety was evident in the surge of gold to a new all-time high, finally breaking the $3,000 barrier last week, as investors sought the perceived safety of the metal.

Fed Chair Jerome Powell faced a tricky task during his Wednesday press conference. He needed to reassure investors about the economy while also signaling the central bank's readiness to adjust borrowing costs if an economic slowdown materialized. This was particularly crucial for the crypto market, where Bitcoin's performance indicated that the positive momentum from Trump's pro-digital asset policies was waning.

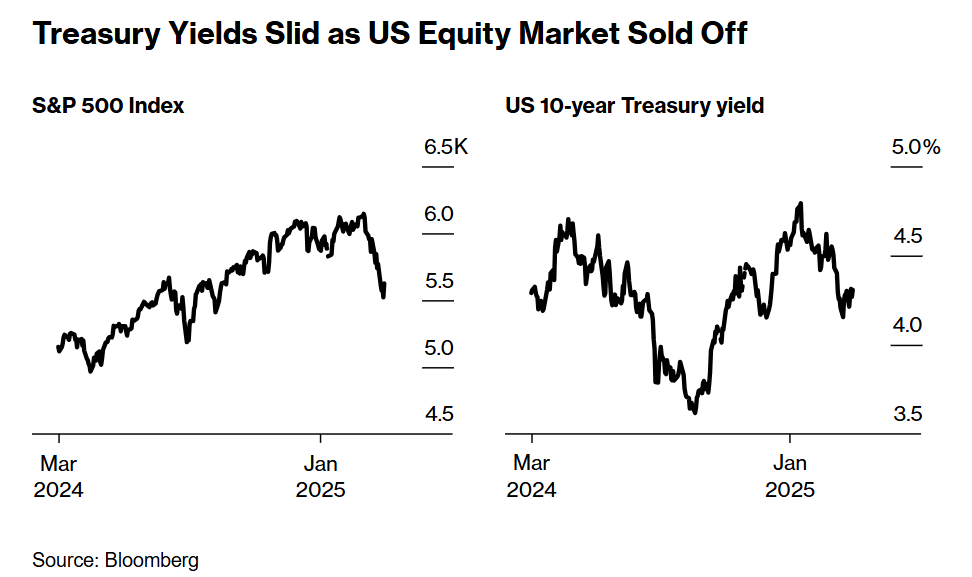

Bitcoin, prior to the FOMC meeting, was trading in the red, looking to potentially break below $80,000 again after a recent low of around $77,000. This was a significant drop from its peak of $109,000 on the day of Trump's inauguration, representing a decline exceeding 30%. Fears stemming from Trump's intensifying trade war had significantly impacted stock and crypto prices in the preceding 30 days, despite Powell's earlier positive remarks about the US economy's resilience. These concerns had also contributed to lower bond yields and a decline in consumer confidence.

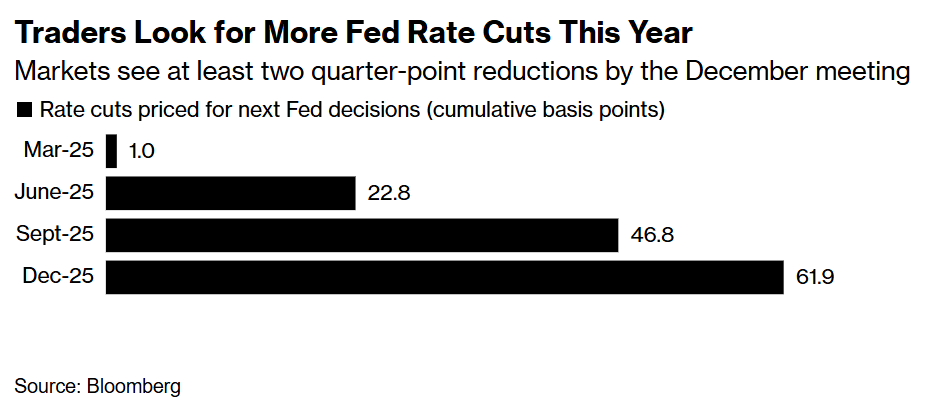

Despite these market signals pointing towards potential economic stress, pre-meeting predictions largely anticipated the Fed to keep interest rates unchanged. However, analysts and futures traders were projecting two Fed cuts this year, aligning with the central bank's previous signals for 2025. The crucial point was that if the Fed maintained its guidance of only two cuts in 2025, strong messaging about their readiness to act more decisively if needed was paramount.

The FOMC did announce its decision to slow the pace of balance-sheet runoff, starting April 1st, Reuters reported . The Fed will reduce the monthly pace of quantitative tightening (QT) to $5 billion from the current $25 billion.

However, Powell emphasized that "slowing QT shouldn't be seen as a policy move," suggesting it is more of a technical adjustment rather than a signal of a shift in the overall monetary policy stance.

This becomes essential for the crypto market as Bitcoin's moves show that the momentum from Trump-led pro-digital asset policies is fast losing its sheen.

Inflation Again, Anyone?

There's a lot of back-and-forth over the "Fed put" and the "Trump put"—the practice of the US government implementing market-friendly measures in response to a decline in asset prices.

However, the Trump administration hasn't done much to dismiss the possibility of a recession, and that's in addition to the rising and unpredictable tariff threats against the country's biggest trading partners.

Treasury Secretary Scott Bessent said a "detox" is necessary for the US and its markets after the president acknowledged on March 9 that the US economy is going through a "period of transition."

Since its mid-January peak, the two-year Treasury yield—which is most affected by the Fed's policy—has fallen over 60 basis points, reaching a low of about 3.83% this month, the lowest level in more than five months.

Last week, the VIX, Wall Street's so-called fear indicator, reached levels not seen since August during the carry yen trade selloff.

Market anxiety has intensified as new economic forecasts are set to be released, which could shed light on the extent to which officials expect Trump's policies to impact the economy.

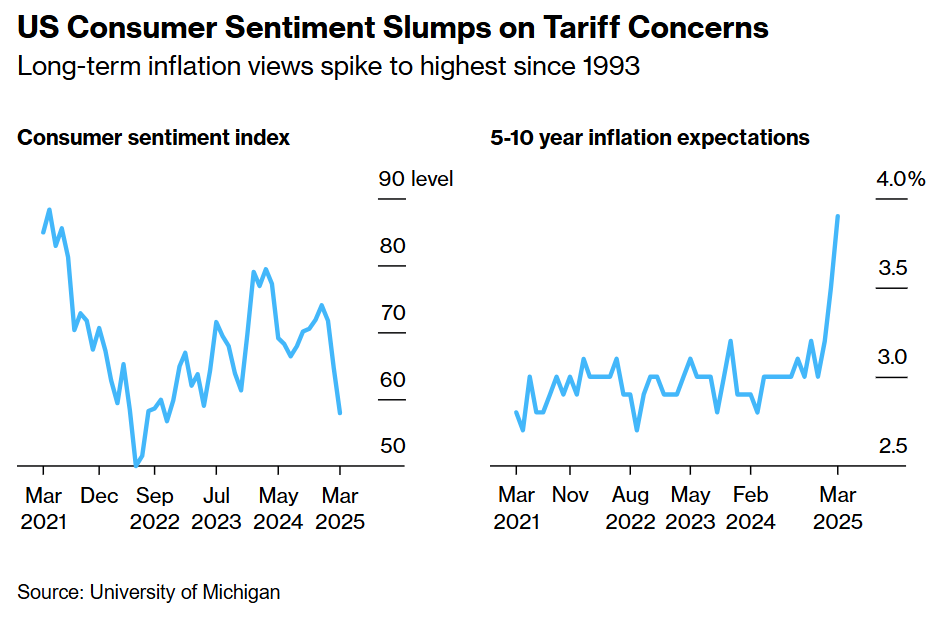

As measured by the Federal Reserve's preferred metric, the personal consumption expenditures price index, inflation was mostly higher in February despite slower price increases for consumers and no change to the producer price index.

For the third consecutive month, a widely followed indicator of long-term inflation expectations rose to a level not seen in over 30 years.

Inflation data will limit the central bank's capacity to act until the job market clearly shows signs of economic deterioration.

According to economic polls, 65% of analysts believe the Fed will remain neutral in the face of persistently high inflation even if the economy falters.

That is outright bad news for the crypto sector, which needs a boost for the next leg up.

Trump's other proposed measures, such as tax cuts, immigration reform, and deregulation, could impact the economy and inflation in the coming months, further complicating the picture.

Powell and his colleagues have clarified that they are waiting for further information about the "net effects" of Trump's proposals on the economy before making any adjustments.

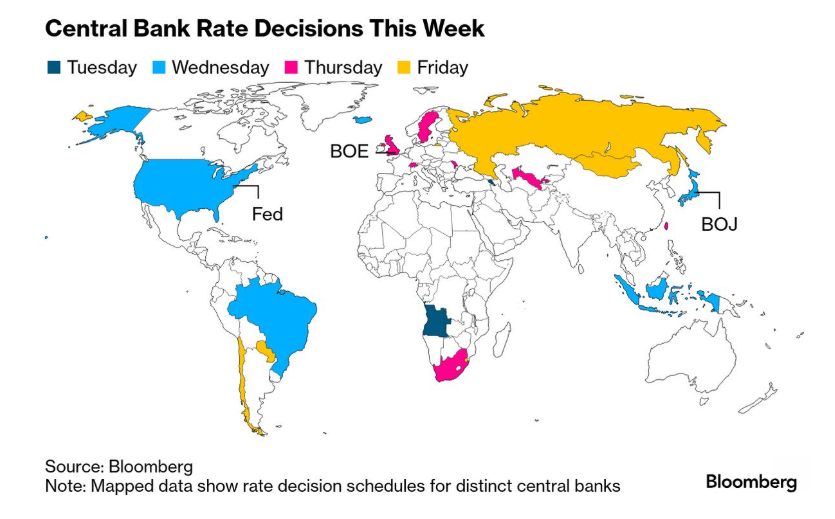

In addition to the Fed's decision, many other countries' rate decisions are due, including the Japanese early Wednesday and the Swiss and the UK later in the week.

Elsewhere

Blockcast

Kathy Zhu has been involved with the crypto industry from both inside and out, from her days as a journalist to her current role as APAC lead at Mezo, an EVM blockchain-based platform that allows users to stake BTC assets to secure itself and serve as Bitcoin's economic layer.

In this episode, Zhu explains the evolving role of Bitcoin and its various stakeholders, including miners, institutional investors, retail holders, and developers. She also highlights how asset management firms and staking protocols have emerged to help Bitcoin holders generate passive income while maintaining custody of their assets.

Previous episodes of Blockcast can be found on Podpage , with guests like Samar Sen ( Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!

Subscribe on LinkedIn

Pakistan to Legalize Crypto to Attract Foreign Investment

Pakistan plans to legalize crypto to attract global investment, aiming to become South Asia's crypto...

Kraken Eyes $1.5 Billion Acquisition of NinjaTrader to Launch US Crypto Futures

Kraken's reported pursuit of NinjaTrader underscores the growing importance of derivatives in the di...

Crypto Markets See Gains Despite Cautious Fed Stance on Rate Cuts

The cryptocurrency market's gains suggest that investors may be looking beyond the immediate timelin...