Bitcoin Faces Key Test as New CME Gap Forms Between $82,500 and $84,100

Favorite

Share

Scan with WeChat

Share with Friends or Moments

An expert analyst has identified a new CME Gap on the Bitcoin 1-day chart between $82,500 and $84,100, which remains unfilled.

Bitcoin's value has continued to slide since Friday, reaching a two-week low of just above $81,000 earlier today. The leading crypto has struggled to regain momentum, recording a substantial 6.28% drop over the past week.

Meanwhile, altcoins have been hit harder, experiencing significant declines in double digits.

CME Gaps and Bitcoin Futures

Bitcoin's price movement has caught the attention of technical analysts, especially regarding CME Gaps. A chart shared by Rekt Capital highlights that

Bitcoin

has recently filled the general CME Gap area between $82,000 and $85,000.

However, a new CME Gap has

formed

over the weekend, ranging from $82,500 to $84,100. This unfilled gap has become a key area of focus for traders, who are closely monitoring whether Bitcoin will continue its upward momentum or if the gap will be filled.

For context, a CME gap occurs when Bitcoin's price moves significantly over the weekend while the CME Bitcoin futures market is closed, creating a gap on the chart when the market reopens. Historically, Bitcoin has often filled these gaps, making them an important area of focus for traders.

The current unfilled gap between $82,500 and $84,100 has garnered attention, as it could influence Bitcoin's short-term price action and potential market moves. The market is expected to react strongly when this new CME Gap is tested.

Potential Upside for Bitcoin Price

Meanwhile, Bitcoin's long-term prospects have sparked optimism among some analysts. Captain Faibik

pointed out

that Bitcoin has been consolidating within a falling wedge pattern for the past four months. He believes the correction phase is nearing completion, and Bitcoin may be preparing for a bullish rally.

Faibik anticipates a breakout from the Falling Wedge pattern at the start of April, with a potential new all-time high above $109K by the end of the month.

Moreover, Faibik noted that big players in the market have been accumulating Bitcoin heavily while newer investors are still waiting for a potential dip.

Whale Activity and Short-Term Holder Data

In addition to the technical analysis, Glassnode data provides insight into Bitcoin's network wealth distribution.

Short-term holders now account for approximately 40% of Bitcoin's network wealth, a drop from nearly 50% earlier in 2025. This figure remains significantly lower than the peak of previous cycles, where new investor wealth reached 70-90%.

https://twitter.com/glassnode/status/1906692436476227682

Elsewhere, Bitcoin whales have shown increased confidence, with recent data revealing an accumulation of 129,000 BTC since March 11. This marks one of the strongest accumulation periods since August 2024. Typically, accumulation periods are followed by price surges as supply declines.

For context, a CME gap occurs when Bitcoin's price moves significantly over the weekend while the CME Bitcoin futures market is closed, creating a gap on the chart when the market reopens. Historically, Bitcoin has often filled these gaps, making them an important area of focus for traders.

The current unfilled gap between $82,500 and $84,100 has garnered attention, as it could influence Bitcoin's short-term price action and potential market moves. The market is expected to react strongly when this new CME Gap is tested.

Potential Upside for Bitcoin Price

Meanwhile, Bitcoin's long-term prospects have sparked optimism among some analysts. Captain Faibik

pointed out

that Bitcoin has been consolidating within a falling wedge pattern for the past four months. He believes the correction phase is nearing completion, and Bitcoin may be preparing for a bullish rally.

Faibik anticipates a breakout from the Falling Wedge pattern at the start of April, with a potential new all-time high above $109K by the end of the month.

Moreover, Faibik noted that big players in the market have been accumulating Bitcoin heavily while newer investors are still waiting for a potential dip.

Whale Activity and Short-Term Holder Data

In addition to the technical analysis, Glassnode data provides insight into Bitcoin's network wealth distribution.

Short-term holders now account for approximately 40% of Bitcoin's network wealth, a drop from nearly 50% earlier in 2025. This figure remains significantly lower than the peak of previous cycles, where new investor wealth reached 70-90%.

https://twitter.com/glassnode/status/1906692436476227682

Elsewhere, Bitcoin whales have shown increased confidence, with recent data revealing an accumulation of 129,000 BTC since March 11. This marks one of the strongest accumulation periods since August 2024. Typically, accumulation periods are followed by price surges as supply declines.

For context, a CME gap occurs when Bitcoin's price moves significantly over the weekend while the CME Bitcoin futures market is closed, creating a gap on the chart when the market reopens. Historically, Bitcoin has often filled these gaps, making them an important area of focus for traders.

The current unfilled gap between $82,500 and $84,100 has garnered attention, as it could influence Bitcoin's short-term price action and potential market moves. The market is expected to react strongly when this new CME Gap is tested.

Potential Upside for Bitcoin Price

Meanwhile, Bitcoin's long-term prospects have sparked optimism among some analysts. Captain Faibik

pointed out

that Bitcoin has been consolidating within a falling wedge pattern for the past four months. He believes the correction phase is nearing completion, and Bitcoin may be preparing for a bullish rally.

Faibik anticipates a breakout from the Falling Wedge pattern at the start of April, with a potential new all-time high above $109K by the end of the month.

Moreover, Faibik noted that big players in the market have been accumulating Bitcoin heavily while newer investors are still waiting for a potential dip.

Whale Activity and Short-Term Holder Data

In addition to the technical analysis, Glassnode data provides insight into Bitcoin's network wealth distribution.

Short-term holders now account for approximately 40% of Bitcoin's network wealth, a drop from nearly 50% earlier in 2025. This figure remains significantly lower than the peak of previous cycles, where new investor wealth reached 70-90%.

https://twitter.com/glassnode/status/1906692436476227682

Elsewhere, Bitcoin whales have shown increased confidence, with recent data revealing an accumulation of 129,000 BTC since March 11. This marks one of the strongest accumulation periods since August 2024. Typically, accumulation periods are followed by price surges as supply declines.

For context, a CME gap occurs when Bitcoin's price moves significantly over the weekend while the CME Bitcoin futures market is closed, creating a gap on the chart when the market reopens. Historically, Bitcoin has often filled these gaps, making them an important area of focus for traders.

The current unfilled gap between $82,500 and $84,100 has garnered attention, as it could influence Bitcoin's short-term price action and potential market moves. The market is expected to react strongly when this new CME Gap is tested.

Potential Upside for Bitcoin Price

Meanwhile, Bitcoin's long-term prospects have sparked optimism among some analysts. Captain Faibik

pointed out

that Bitcoin has been consolidating within a falling wedge pattern for the past four months. He believes the correction phase is nearing completion, and Bitcoin may be preparing for a bullish rally.

Faibik anticipates a breakout from the Falling Wedge pattern at the start of April, with a potential new all-time high above $109K by the end of the month.

Moreover, Faibik noted that big players in the market have been accumulating Bitcoin heavily while newer investors are still waiting for a potential dip.

Whale Activity and Short-Term Holder Data

In addition to the technical analysis, Glassnode data provides insight into Bitcoin's network wealth distribution.

Short-term holders now account for approximately 40% of Bitcoin's network wealth, a drop from nearly 50% earlier in 2025. This figure remains significantly lower than the peak of previous cycles, where new investor wealth reached 70-90%.

https://twitter.com/glassnode/status/1906692436476227682

Elsewhere, Bitcoin whales have shown increased confidence, with recent data revealing an accumulation of 129,000 BTC since March 11. This marks one of the strongest accumulation periods since August 2024. Typically, accumulation periods are followed by price surges as supply declines.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/497320.html

Related Reading

Expert Says Only 1% Will Be Able to Afford XRP Soon: Here’s Why

Edoardo Farina, founder of Alpha Lions Academy, has again shared bold XRP predictions, warning that,...

Samson Mow Defends Strategy’s Bitcoin Purchase Price

Samson Mow, CEO of JAN3, has responded to growing criticism over Strategy’s Bitcoin purchase price....

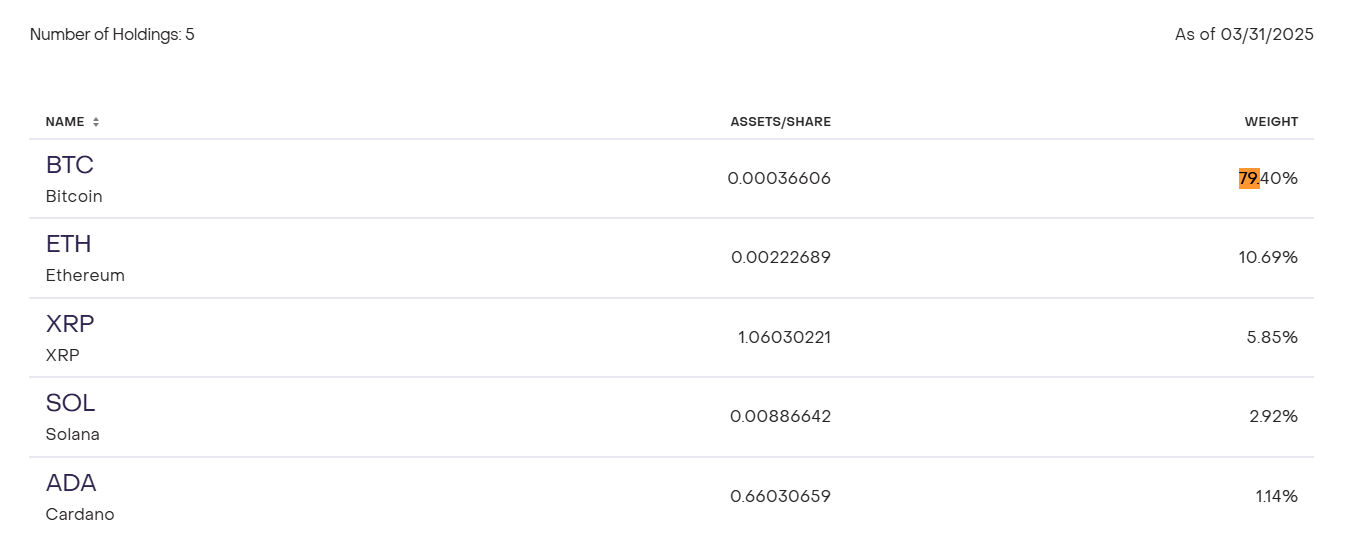

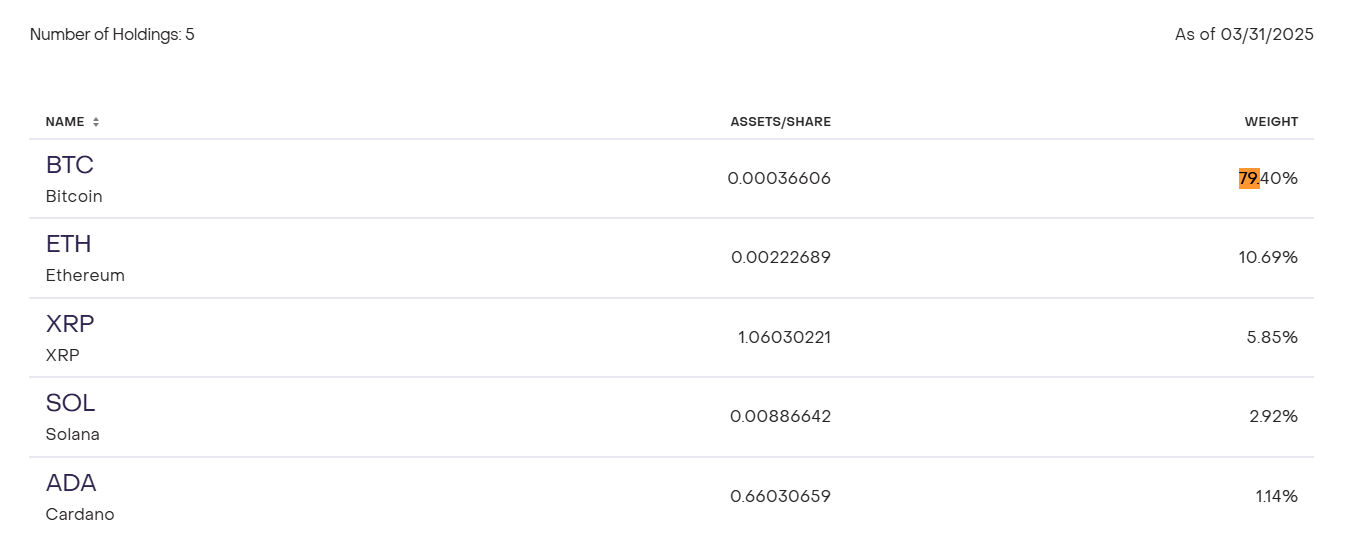

Grayscale Moves to Convert XRP and Bitcoin Large Cap Fund Into Publicly Traded ETF

Multi-billion-dollar asset manager Grayscale has filed with the U.S. SEC to convert its Digital Larg...