Will Bitcoin Downtrend Continue? This Metric Suggests Yes

On-chain data shows the Bitcoin Network Value to Transactions (NVT) Golden Cross is currently showing a trajectory that could suggest a bearish outcome for the BTC price.

Bitcoin NVT Golden Cross Is Near Overheated Territory Right Now

As explained by an analyst in a CryptoQuant Quicktake post , the NVT Golden Cross has a high value at the moment. The “ NVT Ratio ” is an on-chain indicator that keeps track of the ratio between the Bitcoin market cap and transaction volume.

The market cap here is simply the total value of the cryptocurrency’s circulating supply at the current spot price, while the transaction volume is a measure of the total amount of the asset that’s becoming involved in transfer activities on the network.

When the value of the NVT Ratio is high, it means BTC’s value (that is, the market cap) is high compared to its ability to transact coins (the transaction volume). Such a trend can be a sign that the coin is overvalued.

On the other hand, the metric being low suggests the cryptocurrency’s price could be due a rebound to the upside, as the market cap isn’t overheated compared to the volume.

In the context of the current topic, a modified form of the NVT Ratio known as the NVT Golden Cross is the indicator of interest. The NVT Golden Cross is a metric similar to the Bollinger Bands, which compares the short-term trend of the NVT Ratio against its long-term one to determine whether a top or bottom is near. The indicator uses the 10-day moving average (MA) for the short-term trend and the 30-day MA for the long-term one.

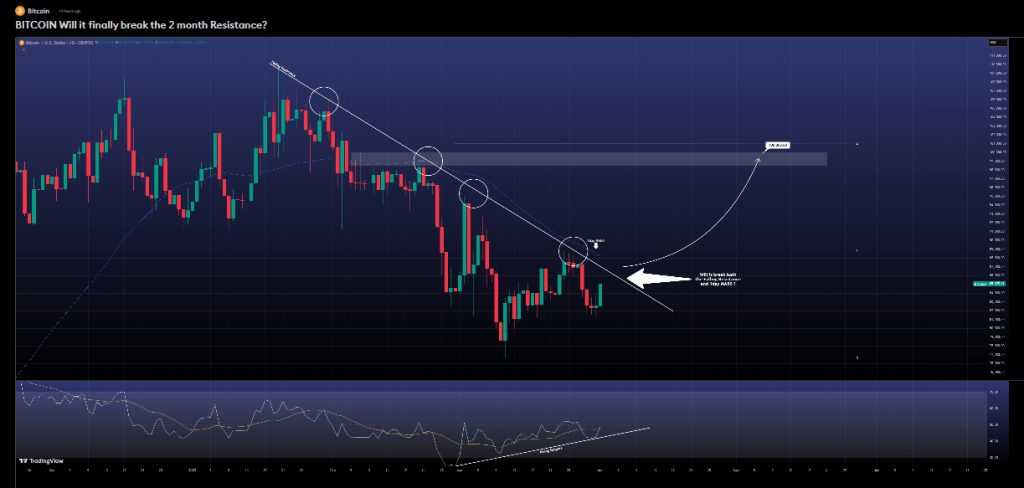

Now, here is a chart that shows the trend in the Bitcoin NVT Golden Cross over the past year:

As displayed in the above graph, the Bitcoin NVT Golden Cross recently touched a high value. The indicator’s rise was so sharp that it entered into a special zone past the 2.2 mark.

In this region, the asset’s price has often formed some sort of top. The same also held true during the visit into the zone this time around, with BTC’s price witnessing a bearish reversal .

As the coin’s price has gone through a retrace in the past week, the metric has also cooled off. Despite the decline, however, its value still remains relatively high. As the quant notes,

Currently, the NVT indicates that the pullback is likely to continue and that the recent price rise was driven by manipulation. For the upward trend to be sustainable, transaction volumes on the network must increase.

Historically, bottoms have tended to occur when the Bitcoin NVT Golden Cross has gone under the -1.6 mark. So far, the indicator has only dropped to 1.8, meaning that it still has quite the ways to go before it enters into this region.

BTC Price

At the time of writing, Bitcoin is trading around $83,300, down almost 6% in the last seven days.

Dogecoin Eyes 100% Rally As Key Resistance Nears Breakout: Analyst

The Dogecoin price is once again at are critical point after retesting the mutli-year trendline. How...

US Treasury to Reveal Crypto Holdings as SEC and Gemini Shake Hands – Will the Hype Rally These Best Altcoins?

A seismic shift is happening in the U.S. cryptocurrency landscape, with two major developments poise...

Bitcoin Reverses Losses—Analysts Say $100K Is On The Horizon

Bitcoin prices have jumped to $85,020 in the last 24 hours, marking a 1.2% increase that reverses so...