Bitcoin's Resilience Succumbs to Market Mayhem

A single market crash conveys a message about Wall Street's opinion of Trump's trade policies around the world. However, if it happens twice in a row, with the second day being considerably worse, it could be a sign that irreversible harm is being caused.

Global markets are still reeling from last week's devastating losses and rising trade tensions. However, investors are already preparing for what some fear will be another Black Monday-style collapse like the one in 1987.

The reason is a surge in US recession bets from Trump's tariffs. Analysts have made analogies to the 22% market crash in October 1987 following Friday's more than 5% Nasdaq and 2,200 point Dow drop.

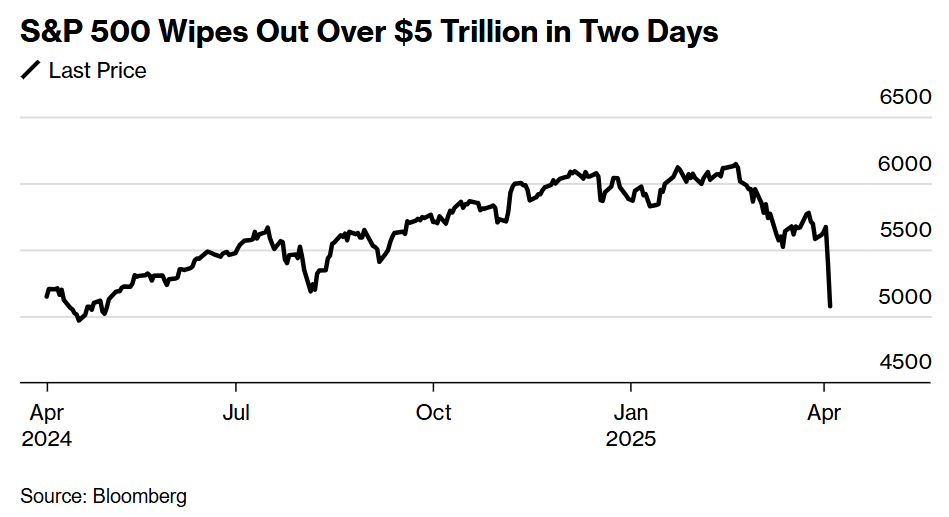

Last week's deep selloff wiped out more than $5 trillion in just two days—on Thursday and Friday. To put that market value loss into context, the wipeout is more than the GDP of three of the top five countries: Japan, Germany, and India.

While the resilience of cryptos amid the broader market mayhem played out last week, Bitcoin's deep crash into Monday shows a broader stink in risk assets.

Analysts were "genuinely shocked" that Bitcoin's price wasn't crashing like stocks last week. That narrative has changed since the weekend. Bitcoin crashed over 7% on Monday to below $75,000 at one point.

The latest crash comes after cryptos marked the worst Q1 in a decade. Cryptos have lost over $80 billion since Wednesday; the fall, though, has been limited compared to the overall market losses.

Trump's tariff war has caused traditional financial assets to plummet, but Bitcoin had managed to avoid a severe decline until the weekend. The OG token held in a small range before falling off the cliff and is now down around $30,000 from its all-time peak reached in December 2024.

In financial markets terminology, Bitcoin is in a correction territory like many other assets.

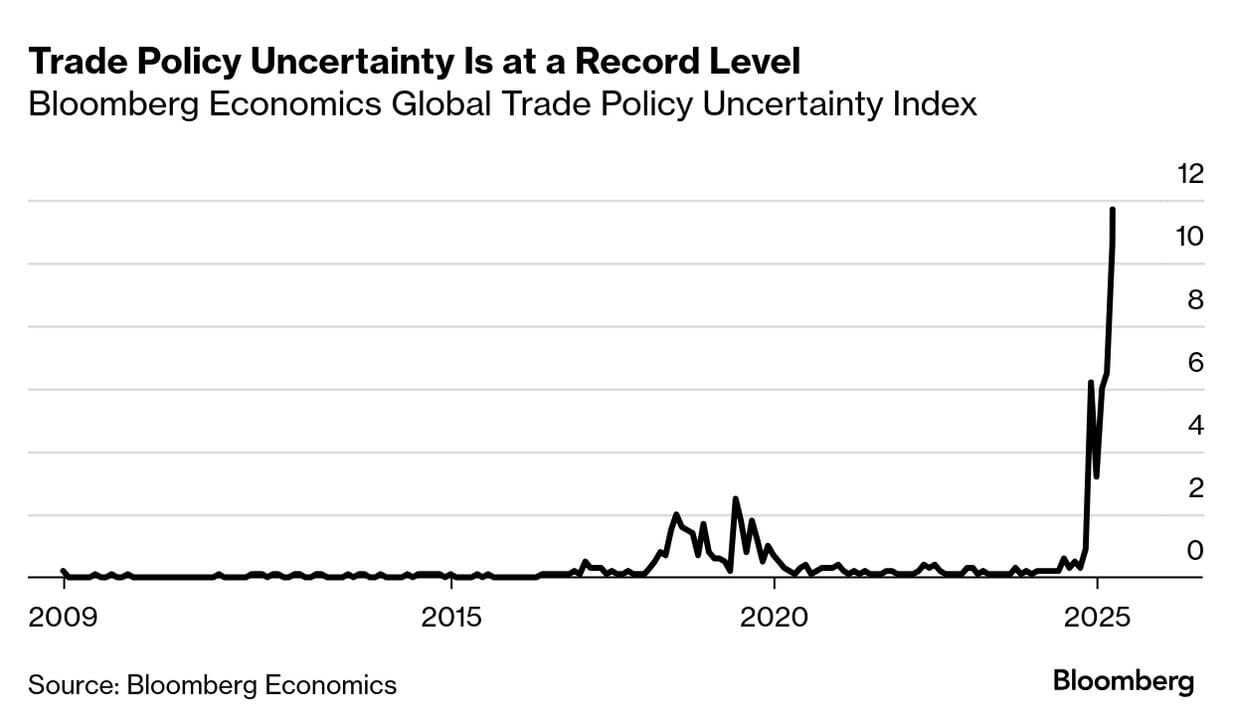

The world's financial markets are fraught with uncertainty.

Despite the deep fall into Monday, Bitcoin has shown the least amount of volatility among all major traditional assets.

People save money because they fear the unknown and want a way to store value for the future. Unfortunately, our flawed monetary system has rendered saving impossible, leading to an overabundance of speculation.

One of the most unpredictable eras is being ushered in by this trade war. This has caused a flight to conventional safe havens like gold and treasury bonds as well as a precipitous decline in the value of the stock market.

Notably, Bitcoin also had its most stable day in recent memory just last week, suggesting that its investors are content to hold onto their cryptocurrency even in the midst of this massive trade war.

Trade War & Market Mayhem

Most countries either don't have the resources or the determination to fight back when faced with tariffs on exports to the US of up to 50%.

To summarize, China has spoken.

The S&P 500 lost $5 trillion in market capitalization in just two days as a result of a 6% decline, which was aided by China's retaliatory tariffs.

With the exception of fourteen stocks, the S&P 500 ended Friday down 6%, its worst performance since March 2020.

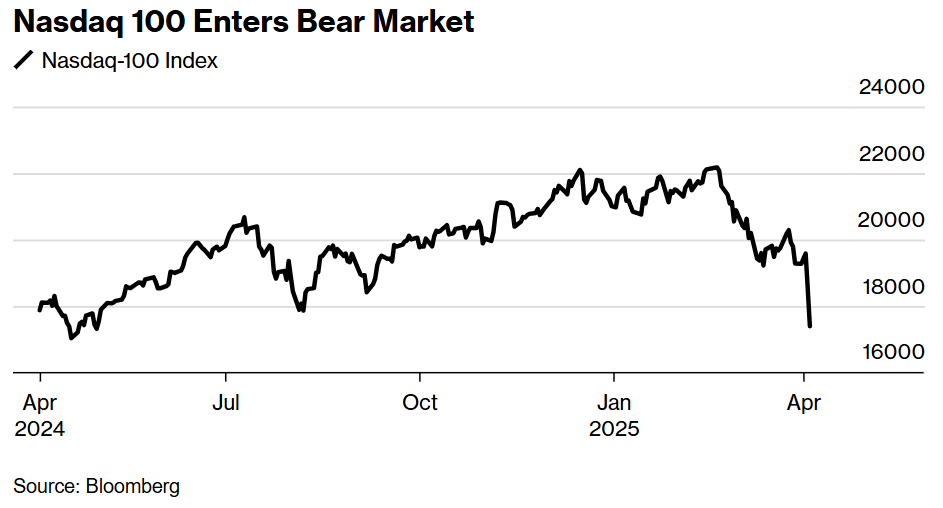

Following a 6.1% decline, the Nasdaq 100 entered a bear market.

Next only to the pandemic crisis in 2020 and the dot-com implosion in 2000 in terms of how quickly the gauge fell from its February peak, by 20%.

There was a fall across all 11 S&P 500 sectors. Apple and Nvidia both declined by at least 7%, while Tesla shed 10% of its value.

Anxiety and the volatility index on Wall Street hit a five-year peak.

A bear market has begun in the Nasdaq 100. Treasuries' 10-year rates fell to 3.99%, while the dollar gained 1%.

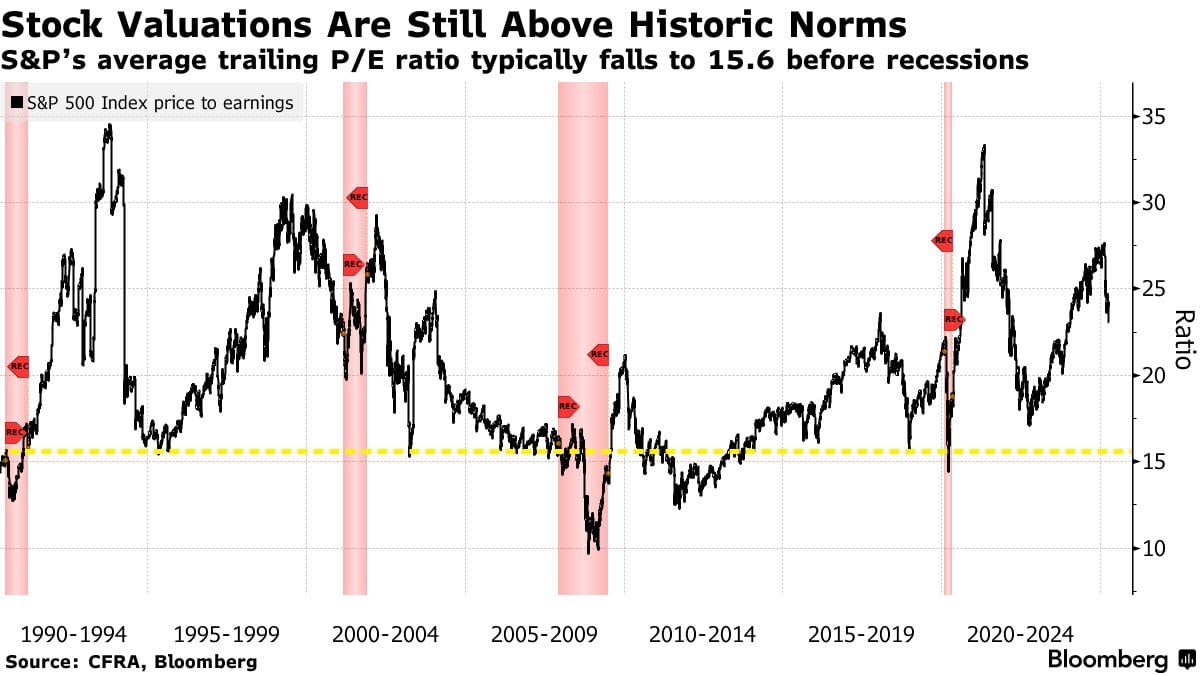

The US stock market has experienced the steepest decline in value since the COVID pandemic's lowest point, making prices appear inexpensive. However, when a worldwide trade war makes a recession likely, the concept of affordable becomes subjective.

Sam Stovall of CFRA produced the following data: during routs before economic downturns, the trailing price-to-earnings ratio of the S&P 500 typically drops to 15.6. Despite the latest selloff, it is currently trading around 22.

No Fed Rescue, Not Yet At Least

Hopes that Federal Reserve Chair Jerome Powell would offer solutions to mitigate the economic impact were misguided.

Powell maintained a cautious approach towards rates, despite the economic risks posed by President Trump's trade war, including China's response.

Along with the disclaimer that the "Track is AI-generated," this Chinese video makes fun of the United States.

Elsewhere

Cap Secures Seed Funding to Revolutionize Stablecoin Yield

The backing from a diverse range of investors underscores the growing interest in Cap's novel approa...

Volatility Erupts as Uncertainty Persists - Why We Advise Caution

Your daily access to the backroom....

Mantra Unleashes $108 Million Fund to Ignite Real-World Asset Tokenization

This investment initiative aims to fuel the growth and adoption of innovative projects within the MA...