The Art of Doing Nothing Amid Market Chaos

Are you disturbed by the market impact of Trump's tariffs?

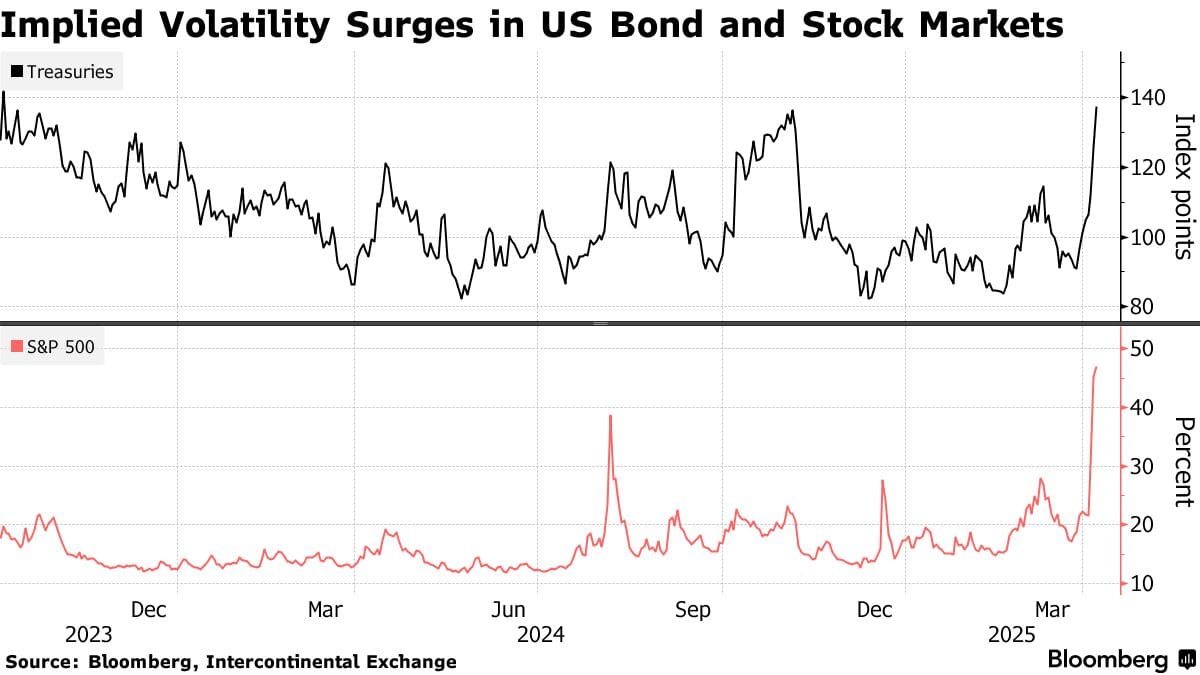

US President Donald Trump's decision to increase trade tariffs to a 100-year high and increase pressure on China caused global stocks to fall, and Treasuries continued their slide on Wednesday.

Concerns regarding the safety of US sovereign bonds caused the 30-year Treasury yield to rise to its highest level since November 2023.

There was a second day of dollar weakness.

As tensions and volatility escalate in the markets, investors are increasingly concerned that the financial system may collapse.

Billionaire Ray Dalio, founder of Bridgewater Associates, predicts a "once-in-a-lifetime" collapse of monetary, political, and geopolitical systems.

The policy-sensitive two-year note is excelling due to expectations over interest rate reductions, which are manifesting in the Treasuries market. However, the decline in longer-term debt has questioned the US government's status as the world's safest asset.

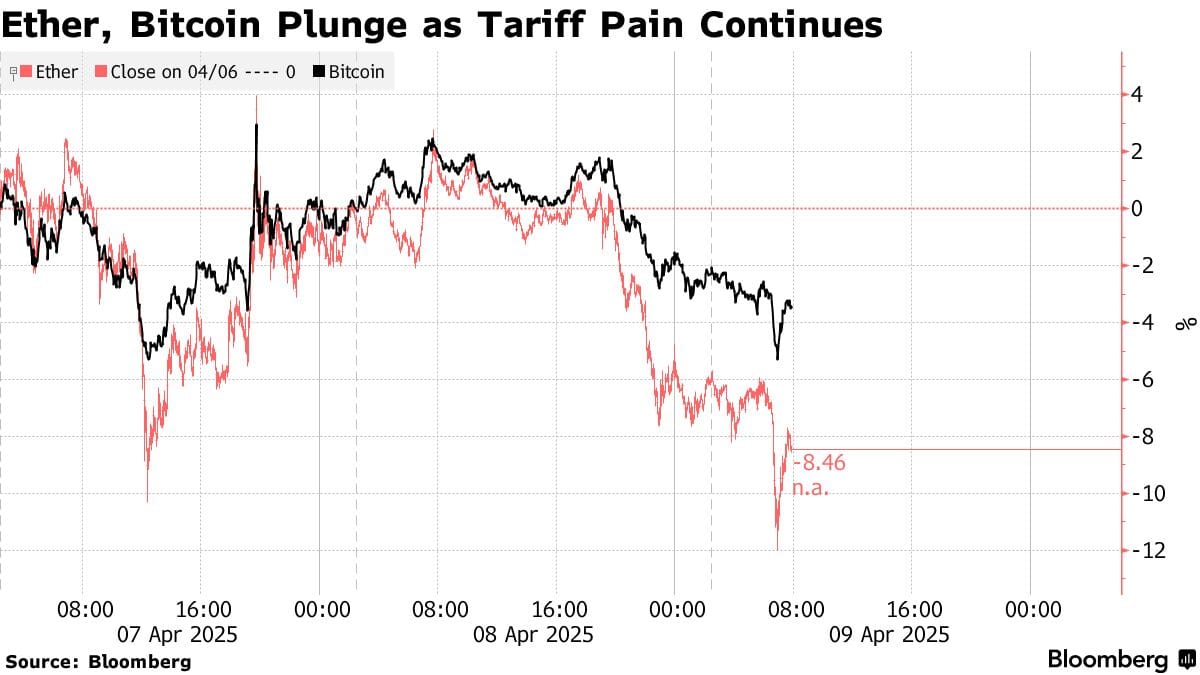

An influx of new investors bought digital assets. Still, the second-ranked cryptocurrency, Ether, led the fresh wave of selling in cryptos.

Ether last traded at $1,432 after plunging over 6% and reaching its lowest intra-day level since March 2023.

The leading cryptocurrency, Bitcoin, fell by over 3% before partially recovering.

However, amidst this chaos and market mayhem, experts recommend that the most prudent strategy for your portfolio is to refrain from taking any action.

This pertains to the broader crypto market investing too and not just limited to traditional assets like stocks, bonds, currencies and commodities.

In the realm of investment, inaction may be the most effective strategy—experts assert that occasionally, the skill of remaining passive is the pathway to success.

Counterintuitively, amongst the turmoil of purchasing at elevated prices and divesting at diminished values, individuals who adopt a passive approach, remain composed, and allow their investments to mature often attain substantial benefits.

"Passive" investors, or those who employ a "buy and hold" strategy, frequently outperform active traders who relentlessly pursue the latest trending stock.

The issue with excessive effort is straightforward: emotional impulses.

Investors often experience anxiety or greed due to the market's volatility, leading them to either enter at the peak or exit in a state of panic. Paradoxically, these emotional impulses become their own most formidable adversaries.

Consider this analogy to baking: often, opening the oven to inspect the cake prevents it from rising adequately.

Frequent stock trading inhibits the full growth potential of investments. Experts assert that a hands-off approach is historically the key to enduring market turbulence.

In a world where Trump's tariffs can disrupt the global economy, it is important to recognize that occasionally, the most effective strategy to endure turbulence is to remain passive, unwind, and allow your investments to generate returns.

Now, look at the rich 1% playbook to understand how some use such strategies to overcome brutal market moves, particularly how Warren Buffett has defied market trends, becoming the sole centi-billionaire to enhance his portfolio's worth. His counterparts in the 1% club have incurred substantial losses.

What can we learn from the Oracle of Omaha?

In a climate of market volatility that unsettles investors, it is evident that some are preserving their wealth while others face significant losses. President Trump's recent tariff increases reverberated across global markets, impacting the affluent and influential as well. Prominent figures such as Elon Musk, Jeff Bezos, Mark Zuckerberg, and luxury magnate Bernard Arnault had significant setbacks. Musk's losses in 2025 have exceeded $100 billion.

However, one investor is enduring the tumult. Buffett's net worth increased despite tariff apprehensions—he has added $12.7 billion to his wealth following tariff declarations, as his diversified portfolio enables him to navigate the challenges.

Reports indicate Buffett's net worth increased by $12.7 billion in 2025.

In an environment characterized by rapid financial gains and even swifter losses, Buffett's consistent, long-term strategy stands out as a paragon of wisdom, owing to his capacity to recognize enduring worth.

The 92-year-old billionaire's prudent investment strategy has enabled him to remain relatively undamaged compared to other technology magnates.

While some may be anxious or distressed about their portfolios, Buffett remains committed to his plan and allows his investments to yield returns.

Elsewhere

Blockcast

Inside the Crypto & AI-Powered Adult Playground with Oh's Nic Young

Ever wondered what happens when AI, crypto, and the adult entertainment industry collide?

This week, Blockcast delves into the developing space of digital interaction with Nic Young, CEO of Oh , a platform at the forefront of integrating artificial intelligence and cryptocurrency within the adult entertainment industry. Nic unpacks how Oh is building AI-powered digital companions, including realistic twins of creators, offering a personalized and uncensored experience underpinned by crypto transactions: "We felt that it was the perfect incubator... an industry that really needs crypto."

Perpetual Crypto Futures With Massive Leverage Coming Soon?

While popular among investors outside the US due to their user-friendly interface and high earning p...

OSL to Power Staking for ChinaAMC (HK)'s Ether ETF, Following Hong Kong's Staking Green Light

Staking of the ETF's underlying Ether, facilitated by OSL, is slated to commence on May 15, 2025....

Accumulation, Further Dips Expected Before a Stronger Rally

Your daily access to the backroom....