What Will the ECB Do?

Investors and analysts evaluating the impact of Trump's tariffs have come to the conclusion that inflation will be less severe, leading to increased expectations of interest-rate reduction from the European Central Bank (ECB).

However, progress will be hindered.

On the heels of U.S. President Donald Trump's major tariff announcement at the White House, markets are now pricing in three additional reductions in borrowing costs for the Eurozone this year, up from two previously.

Economists predict that Trump's tariff policy will act as a drag on economic growth, ultimately leading to a substantial decrease in inflation. Bloomberg Economics, for instance, projects that inflation could fall by as much as 1% in the medium term, a significant figure given the European Union's overall output.

This deflationary outlook is the primary driver behind the heightened expectations for ECB rate reductions, with the initial cut now widely expected in April.

Adding to the complexity of the economic picture is the unexpected behavior of the U.S. dollar. Contrary to predictions, the dollar has weakened, effectively alleviating concerns that a weaker euro would lead to a surge in import prices within the Eurozone. This unexpected dollar weakness has provided a degree of relief, but it has not eliminated the underlying anxieties about the broader economic impact of the tariffs.

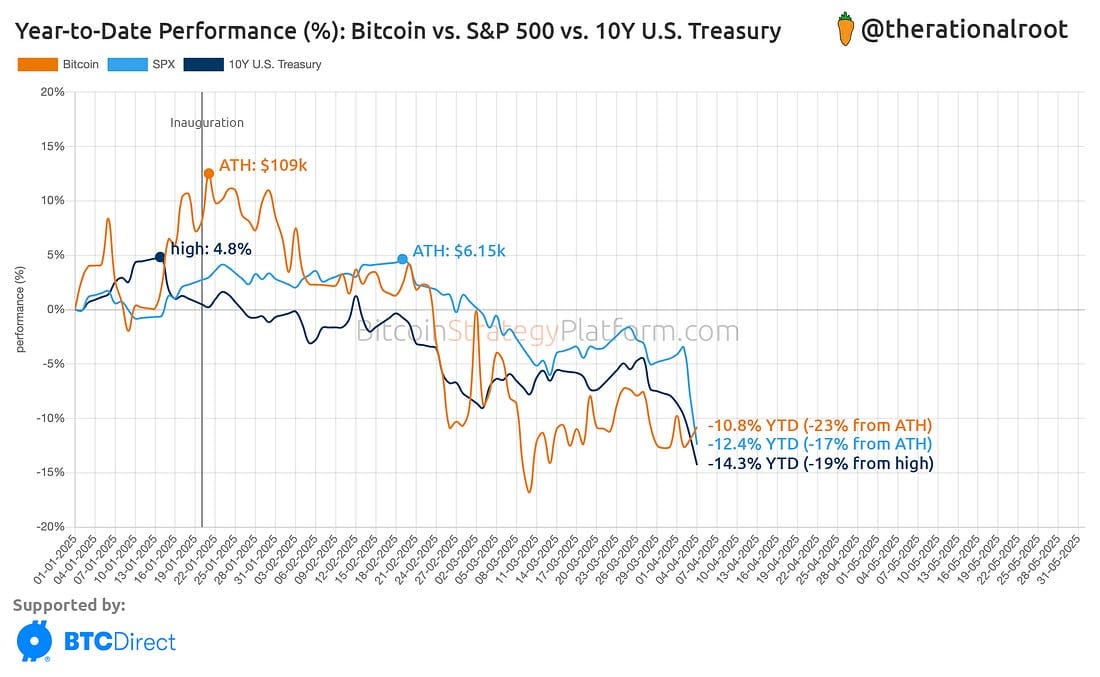

Amidst this economic uncertainty, the performance of traditional financial instruments, such as the 10-year U.S. Treasury note, paints a concerning picture. With Trump's inauguration came increased market volatility, and the 10-year Treasury yield, which initially fell from 4.8% to 3.9%, has since rebounded to 4.285%, reflecting the market’s continued unease.

Also, the performance of Bitcoin has been noted, and is being compared to the stock market, which is also a sign of the current economic uncertainty.

HashKey Capital Launches Asia's First XRP Fund With Ripple's Backing

The fund will provide professional investors with a regulated and potentially less complex avenue to...

Perpetual Crypto Futures With Massive Leverage Coming Soon?

While popular among investors outside the US due to their user-friendly interface and high earning p...

OSL to Power Staking for ChinaAMC (HK)'s Ether ETF, Following Hong Kong's Staking Green Light

Staking of the ETF's underlying Ether, facilitated by OSL, is slated to commence on May 15, 2025....