New York Bill Pushes Crypto Payments as Attorney General Warns Against Digital Assets in Retirement Funds

- New York’s new bill specifies that transactions for taxes, fines, and public service can be paid with cryptocurrency.

- Letitia James, New York’s Attorney General, has called on Congress to enact laws that will rein in the crypto industry to secure investors.

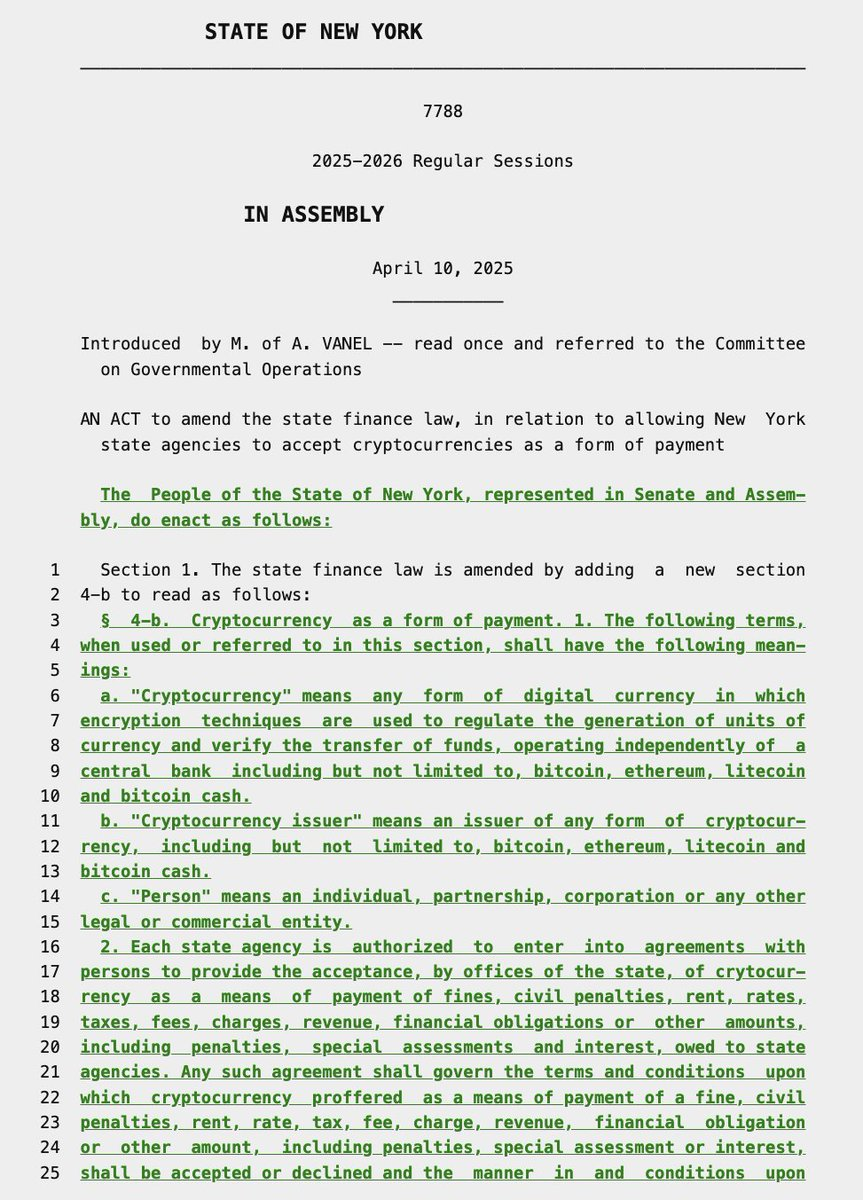

New York has begun the process of incorporating cryptocurrencies into its public finance. A new bill currently before the state legislature seeks to legalize the use of cryptocurrencies for paying fines, taxes, and other government services. The initiative means that there is a willingness among the states of America to integrate crypto into centralized finance.

If enacted, the bill would put New York amongst the first states to use cryptocurrencies to pay state debts and services. This comes at a time when authorities in the United States are focusing more on the issues of digital assets and their sustainability in the markets.

Attorney General Calls for Strong Federal Crypto Regulations

Similarly, the New York Attorney General Letitia James has urged Congress to impose federal legislation on the crypto markets. James outlined various threats in an extensive 14-page letter addressed to the congressional leadership on the dangers of unregulated digital assets.

James further argued that without regulation, the growth of crypto assets poses a significant risk to U.S. financial integrity. She noted that digital assets pose a risk that contributes to crimes, scams, and exploitation of investors. The letter reiterated that the value of cryptocurrency is unpredictable, which would deter many investors from investing in pension funds or even retirement accounts.

In order to mitigate these risks, James proposed that Congress make regulations regarding stablecoin issuers more stringent to force them to fall under U.S. regulation. She also proposed that stablecoins should be fully collateralized, with assets that include U.S. dollars and U.S treasuries.

She also was against the use of crypto in exchange-traded funds (ETFs) associated with retirement funds. James noted that crypto-related ETFs are at risk of permanent loss and hacking, unlike popular ETFs that are associated with stable assets like stocks and bonds. She voiced her worries after the news that large firms like Fidelity plan to offer crypto investing in retirement accounts like IRAs.

Political Momentum Grows Around Crypto Regulation

The desire for increased regulation comes as the cryptocurrency industry increases its presence in Washington. According to the financial disclosures, crypto companies donated more than $119 million to funded candidates in the 2024 election cycle.

At the same time, Donald Trump’s administration is working out the policy on the United States’ cryptos. The Council of Advisers on Digital Assets is aiming to pass a stablecoin bill before the current summer. Trump’s key adviser, Bo Hines, welcomed Paul Atkins to the SEC Chair, stating that he would be favorable to the creation of an environment that encourages innovation while also having an effective regulation system.

James’s call for regulation increases pressure on Congress to respond rapidly as the industry gets political muscle. In her speech to the lawmakers, she advised them to focus on financial stability, investors’ protection, and security rather than pushing the legislation of cryptocurrency.

Bitcoin Volatility Looms as Exchange Reserves Plunge and Dormant Coins Awaken

Bitcoin trades above $84K, but on-chain data warns of rising volatility as exchange reserves drop an...

1-Year-Dormant Ethereum Whale Transfers 1000 ETH, Awakes With 859.3% Profit

This Ethereum whale who has been in silence for one year has re-entered the market and transferred 1...

Don’t Miss the Crypto Boom! 3 Best Cryptos to Buy for 2025 Before Prices Explode

Qubetics, Bitcoin, and XRP lead 2025’s top crypto picks with innovation, legal wins, and strong grow...