ECB and European Commission Divided on MiCA Amid Concerns Over US Stablecoin Expansion Under Trump

Favorite

Share

Scan with WeChat

Share with Friends or Moments

The European Central Bank (ECB) and European Commission are divided on how to strengthen Europe's crypto regulations in response to U.S. efforts to expand its stablecoin industry.

At the heart of the disagreement is the regulation known as the Markets in Crypto Assets Regulation (MiCA). The ECB believes MiCA is insufficient to counter potential financial instability driven by U.S. policy changes under President Donald Trump.

According

to POLITICO, ECB concerns primarily center on the possibility that a booming U.S. stablecoin market could destabilize Europe’s economy. Meanwhile, the Commission insists that the current rules are robust enough to manage the risk.

ECB’s Alarm Over U.S. Stablecoin Growth

The ECB’s latest analysis warns that

President Trump’s support

for the U.S. crypto industry, especially stablecoins, could lead to financial contagion. The central bank highlighted that if dollar-backed stablecoins were to flood European markets, it could divert significant capital from the EU to the U.S., undermining efforts to make Europe’s financial system more independent.

Furthermore, the ECB argued that MiCA, introduced just months ago, needs an urgent revision to address these risks more effectively. Specifically, the ECB is concerned about the "multi-issuance" model, which allows European stablecoin issuers to collaborate with third-country firms, increasing exposure to potentially destabilizing external forces.

In response to these concerns, analysts from Standard Chartered have projected that dollar-backed stablecoins could grow dramatically, from $240 billion to $2 trillion by 2028. This projection has further fueled the ECB’s worries that such growth could spill over into Europe, creating risks of instability and a potential "run" on assets.

ECB officials, including President

Christine Lagarde

and digital payments head Piero Cipollone, have repeatedly emphasized that MiCA might not be prepared to handle this new challenge.

European Commission Pushes Back

On the other hand, the European Commission has sharply disagreed with the ECB’s assessment. According to the Commission, the existing MiCA framework is designed to manage risks associated with global stablecoins.

The EU executive emphasized that it is too early to determine the exact impact of U.S. reforms on European markets. Moreover, the Commission pointed out that

MiCA

already requires crypto firms to meet stringent criteria, which has led some companies, including the popular Tether stablecoin, to delist from EU exchanges.

The Commission also defended MiCA by stating that the regulation allows for proactive measures against potential risks.

For example, the Commission highlighted that the law grants the ECB the authority to block stablecoin issuers if they threaten Europe’s payment systems, monetary policy, or sovereignty. This legal provision, the Commission argues, ensures that any major disruptions can be quickly mitigated.

ECB Chief on the Need for a Digital Euro

The European Central Bank (ECB) has been vocal about the need to neutralize the stablecoin threats. ECB Chief Economist Philip Lane reiterated this message

in a keynote

address at the University College Cork Economics Society Conference in Ireland, where he emphasized the critical importance of digital currencies in maintaining Europe’s monetary sovereignty.

Lane raised alarms over the growing influence of foreign-controlled payment systems and stablecoins. He warned that these external forces could weaken the euro’s role in domestic and cross-border transactions.

He argued that the digital euro is essential for modernizing Europe’s financial system and ensuring the continent retains control over its monetary and financial future. Lane highlighted that Europe's financial autonomy is increasingly under threat in today’s fragmented geopolitical landscape.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/501662.html

Previous:逍遥kol:大饼以太凌晨行情分析4.23

Related Reading

Funding Fees Explained: How Perpetual Futures Keep the Crypto Market in Check

Perpetual futures are one of the most commonly traded products in crypto — especially among traders ...

This Historical Support Could Trigger a 200% Surge for Shiba Inu: Analyst

A veteran trader predicts a potential 200% surge for Shiba Inu, based on a major historical daily su...

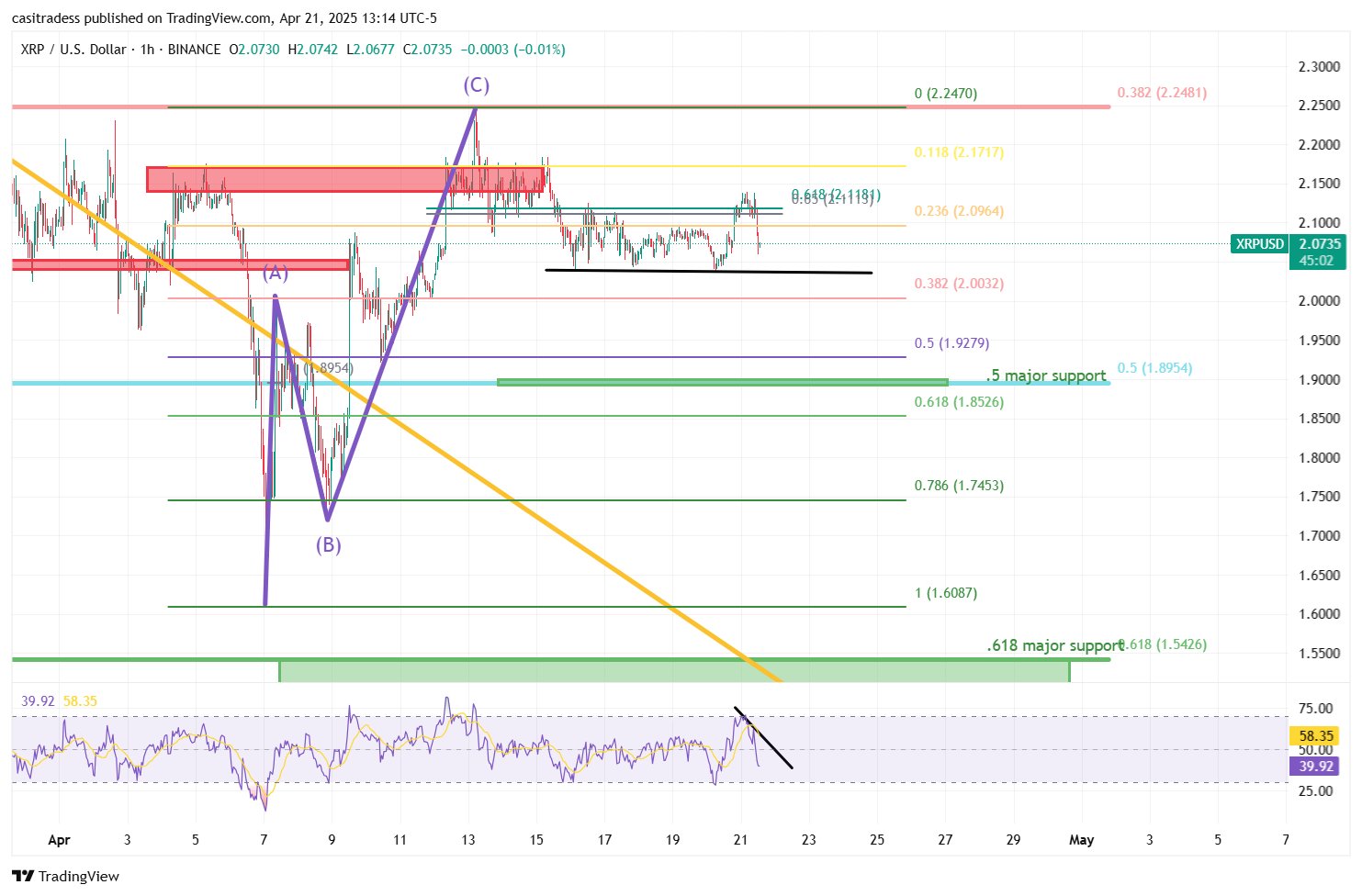

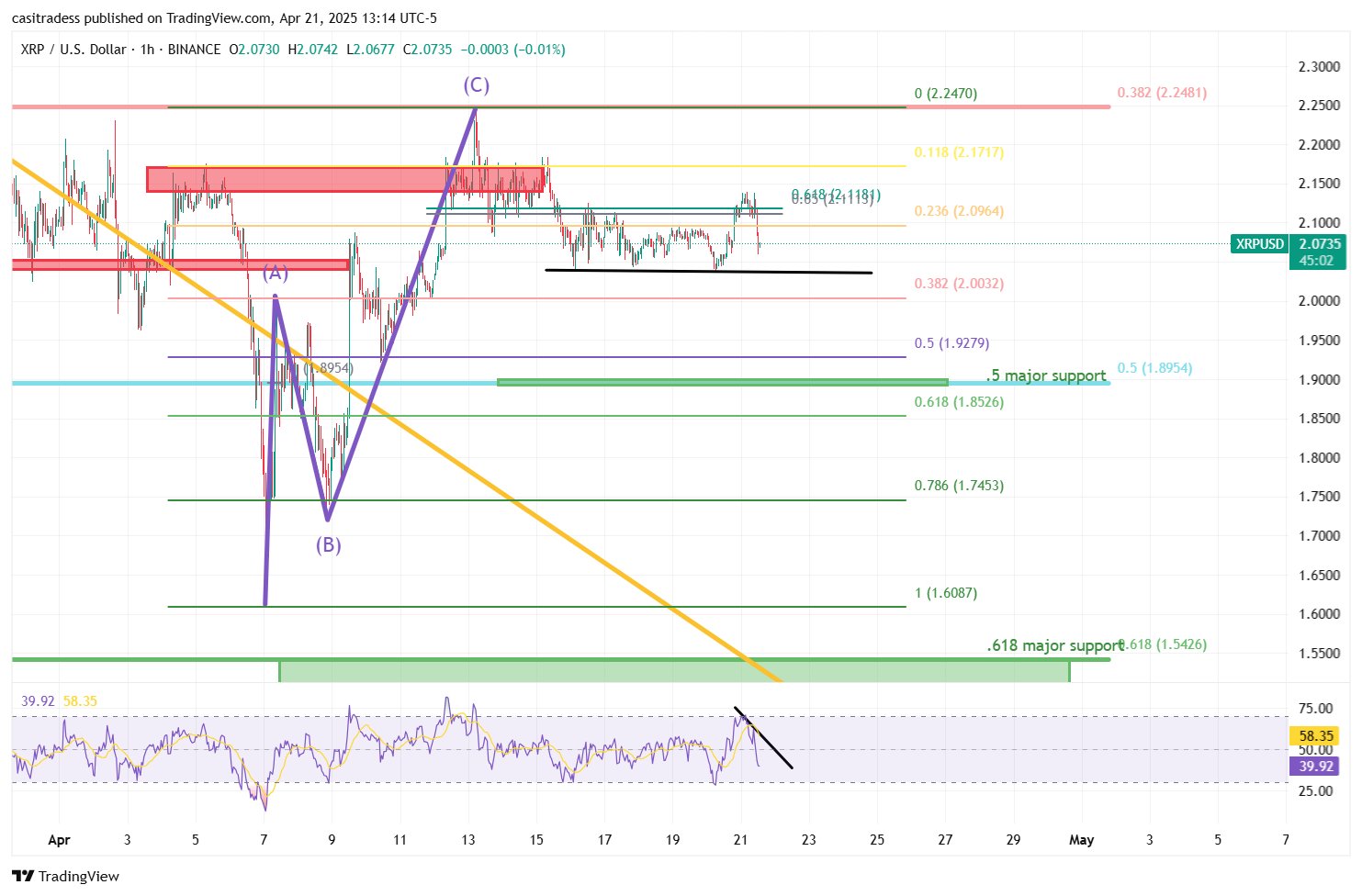

Analyst Says These XRP Price Indicators Still Support a Macro Breakout

Market watcher Casi analyzes XRP corrective phase with Elliott Wave theory, highlighting key support...