Bitcoin Is Warming Up: Analyst Maps 3 Scenarios That Could Trigger the Next Big Rally

Bitcoin is inching closer to the $100,000 milestone, continuing a steady upward trend that has characterized its recent market behavior . As of the time of writing, the asset is trading at approximately $96,091, marking a 3.6% increase over the past week.

This sustained climb follows a correction seen in early April and suggests that the broader market remains engaged, with momentum gradually building. As price action intensifies, analysts are increasingly focused on the indicators shaping short- to mid-term expectations.

Among them is CryptoQuant contributor Axel Adler Jr., who recently shared new data indicating that Bitcoin’s on-chain momentum has entered what he calls the “start” rally zone, with a momentum ratio of approximately 0.8. This threshold is considered critical in assessing whether Bitcoin is likely to push higher or enter a period of consolidation.

Three Scenarios Shaping the Road Ahead

In a QuickTake post titled “Bitcoin is warming up – 3 scenarios that could shape the next rally,” Adler outlined a set of possibilities based on current network data and previous cycle patterns.

He describes an “optimistic” case where the momentum ratio climbs above 1.0 and holds, indicating a potential rally toward the $150,000–$175,000 range. This scenario mirrors historical breakout phases observed in 2017 and 2021, where a decisive break in key metrics sparked extended bullish runs .

The “base case,” as Adler frames it, assumes that the momentum ratio stabilizes between 0.8 and 1.0, keeping Bitcoin in a broad trading range between $90,000 and $110,000. In this instance, market participants hold their positions but remain cautious about increasing exposure.

A more conservative view, the “pessimistic” scenario, would be triggered if the ratio drops toward 0.75. This would suggest that short-term holders may begin taking profits, potentially leading to a correction in the $70,000–$85,000 zone.

Adler emphasized, however, that with a recent correction already priced in, the optimistic and base case outcomes appear more plausible at present.

Bitcoin Short-Term Holder Activity Signals Accumulation

A separate analysis from CryptoQuant analyst Crypto Dan suggests further support for a bullish outlook. Dan notes that Bitcoin’s current structure bears similarities to past accumulation phases observed earlier in 2024.

He highlights that in both January and October, rising activity from short-term holders—those who keep their coins for between one day and one week—preceded significant rallies. This behavioral trend has returned in recent days, which, according to Dan, often signals that the market is positioning for a larger move .

These patterns have historically emerged just before major surges not only in Bitcoin but also in the altcoin space. If current activity mirrors past cycles , Bitcoin may be preparing to surpass the $100,000 mark and transition into a renewed uptrend.

Featured image created with DALL-E, Chart from TradingView

Dogecoin Eyes $1.80 In Summer Rally As Analyst Flags Breakout Structure

The Dogecoin monthly chart has begun to echo the rhythmic, momentum-laden structures that prefaced e...

Equity Fund Founder Reveals Why XRP ETF Is Anticipated, ‘There’s Value There’

The XRP ETFs have become one of the most anticipated filings in the crypto space, with over 10 alrea...

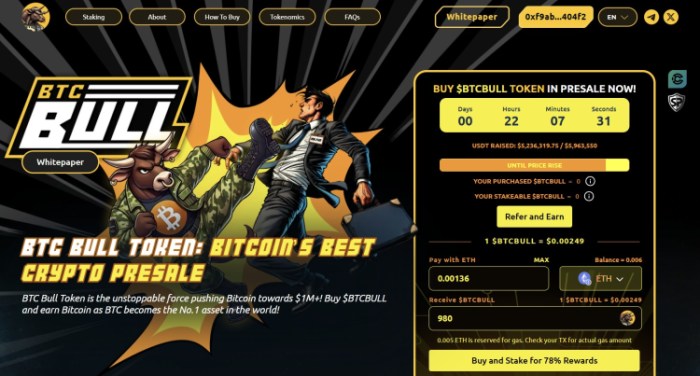

US-China Trade War to Ease Up as Bitcoin Aims for $100K. Here’s the Best Crypto to Buy

Bitcoin is currently trading above $97K amid positive sentiments regarding a possible US-China trade...