Solana Faces On-Chain Weakness After $150 Rejection: Is a Price Pullback Ahead?

The post Solana Faces On-Chain Weakness After $150 Rejection: Is a Price Pullback Ahead? appeared first on Coinpedia Fintech News

The crypto market has become more unpredictable as investors wait for the Federal Reserve’s decision on interest rates. Recently, the price of SOL went up and got close to $150, but it couldn’t break through and was pushed back down. This caused a drop in some key on-chain metrics, as investors started diverting their investment. Experts believe that if the Fed lowers interest rates, it could help the market recover and reduce the current selling pressure for SOL.

Solana’s Network Activity Plunges Hard

Solana has been going through a period of high price swings in the last several hours. After failing to stay above the $150 mark, a large wave of liquidations took place, according to data from Coinglass. In the past 24 hours, over $7 million in Solana positions were wiped out. Of that, about $1.61 million came from buyers who were betting on prices going up (long positions), while sellers closed around $5.42 million worth of positions.

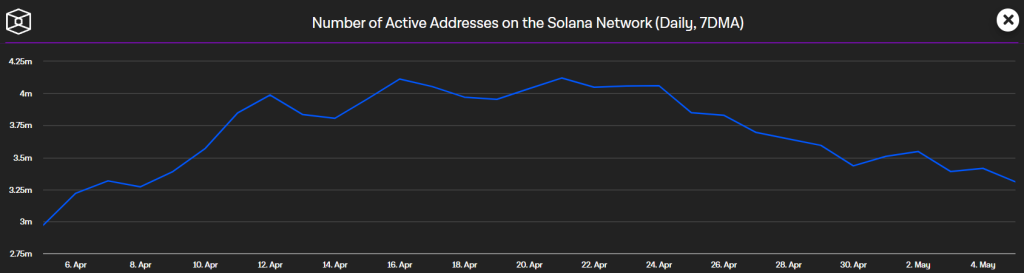

One reason Solana’s price is struggling to rise is the decline in network activity. Data from The Block shows that the number of active addresses on Solana has fallen sharply in recent weeks: from a high of 4.12 million to a low of 3.31 million. The number of new addresses has also taken a hit, dropping from 4.11 million to 3.2 million. This overall decline in usage is making it harder for Solana to break through its current price resistance.

Also read: Solana Price Prediction 2025, 2026 – 2030: SOL Price Targets $500 Next?

The market is now closely watching today’s U.S. Federal Reserve meeting, which could bring new volatility. While Donald Trump’s recent comments have sparked positive hope, the CME FedWatch Tool shows only a 2.3% chance of a rate cut happening today. Most experts expect the Fed to keep interest rates steady at 4.25% to 4.50%.

If the Fed cuts rates, Solana could jump above $150. If rates stay the same, SOL will likely keep moving sideways within its current trend.

What’s Next for SOL Price?

Solana is currently getting support around the 20-day EMA, showing that buyers are stepping in during price dips. However, bears are strongly defending a push above the resistance of $150-$160. As of writing, SOL price trades at $145.8, surging over 1.4% in the last 24 hours.

Buyers are likely to try pushing the price above the $150 resistance again. If they succeed, SOL could climb to $180. This will create a broad trading range within $110 and $215.

On the other hand, if sellers manage to push the price below the 20-day EMA, SOL might drop toward the $133 level. In that case, the price could stay stuck between $105 and $150 for some time.

The long/short chart for Solana shows a noticeable drop in the ratio, now sitting at 0.5122. This means about 66% of traders are betting that SOL’s price will continue to fall.

Bitcoin Price Advances to $100K-Has The BTC Bull Run Begun? Here are the Potential Highs for this Cycle

The post Bitcoin Price Advances to $100K-Has The BTC Bull Run Begun? Here are the Potential Highs fo...

Dogecoin Price Prediction: DOGE Price To Explode 500%, Hit $1 by August

The post Dogecoin Price Prediction: DOGE Price To Explode 500%, Hit $1 by August appeared first on C...

Pi Coin Price Prediction Today: Binance Listing Clues Spark 8% Rally, $1 in Sight

The post Pi Coin Price Prediction Today: Binance Listing Clues Spark 8% Rally, $1 in Sight appeared ...