Amber Unveils $100M Crypto Reserve Plan, Seeks to Invest in XRP, Bitcoin, and Fuel Institutional Crypto Adoption

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Leading crypto finance company Amber International has announced plans to launch a $100 million crypto ecosystem reserve for XRP, Bitcoin, and other blockchain projects.

The company unveiled its crypto reserve initiative in a

press release

today. According to the announcement, this reserve differs from other companies' existing crypto treasury holdings.

Reason for the Reserve

It emphasized that the reserve would be deployed to solidify its leadership at the crossroads of decentralized (DeFi) and traditional finance (TradFi).

In addition, Amber will use part of the $100 million fund to support high-impact blockchain projects boasting enormous potential. The company will use its AI-powered decision tool to determine which blockchain projects to support.

So far, it has already made a strategic investment in Solana-based DeFi Development Corp (DFDV) and partnered with Web3 VC Hash Global on BNB Fund.

Amber to Acquire High-Conviction Cryptos

Further, it will use part of the $100 million fund to acquire high-conviction crypto assets. According to the announcement, Amber will initially focus on Bitcoin, XRP, Solana, Sui, Ethereum, and BNB.

Amber disclosed plans to add other ecosystem tokens, including stablecoins like World Liberty Financial USD (USD1). For context, most of the cryptos on Amber’s watchlist–SOL, BTC, XRP, and ETH–are

expected

to feature in the United States crypto reserve.

To meet institutional standards, Amber International said its crypto ecosystem reserve will operate within a comprehensive risk-management framework. This framework includes technical audits, legal and compliance reviews, constant monitoring, and economic considerations.

Amber Contrasts Its Reserve with Existing Treasury Holdings

Commenting on the development, Amber’s CEO Wayne Huo noted that the company’s crypto reserve initiative is unique, indicating that it is different from existing crypto treasury holdings.

According to him, the reserve is not just about holding cryptos and anticipating potential price gains in the future. Instead, the funds will be deployed to foster institutional adoption of cryptocurrencies.

He added that the company is currently aligning deeply with institutional clients while also enhancing its impact in the crypto ecosystem. According to Huo, the goal is to create a secure and scalable path for institutional investors to channel funds into the crypto market.

The crypto reserve initiative has remained a major topic of discussion in the crypto community. Strategy pioneered the adoption of cryptos as reserve assets, and other companies like Metaplanet have also embraced the initiative. Interestingly, nation-states, particularly the United States, are also exploring ways to establish their own strategic crypto reserves.

However, unlike existing treasury holdings, Amber aims to leverage its crypto reserve to support blockchain projects, invest in high-conviction assets, and enhance institutional crypto adoption.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/505400.html

Previous:比特币/以太坊多次布局拉高空丹思路如期下跌

Related Reading

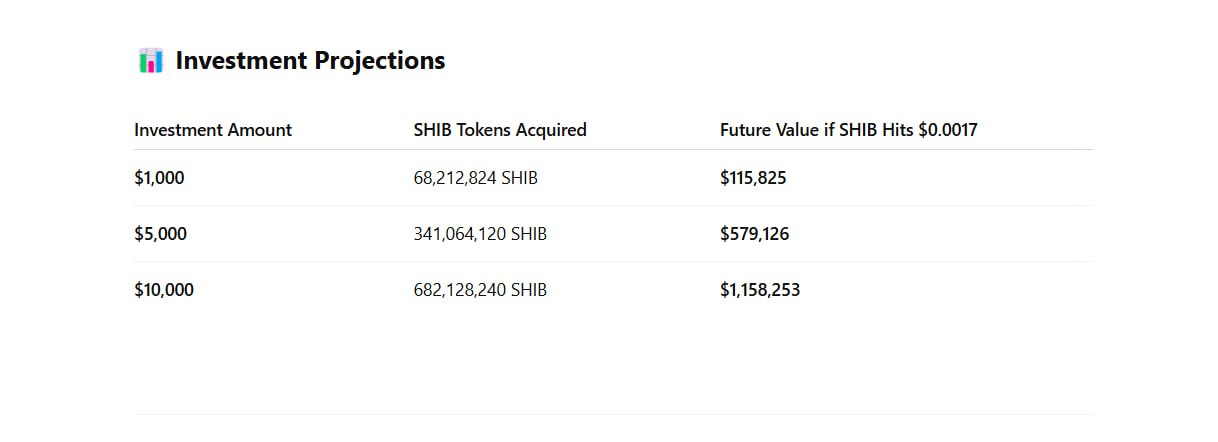

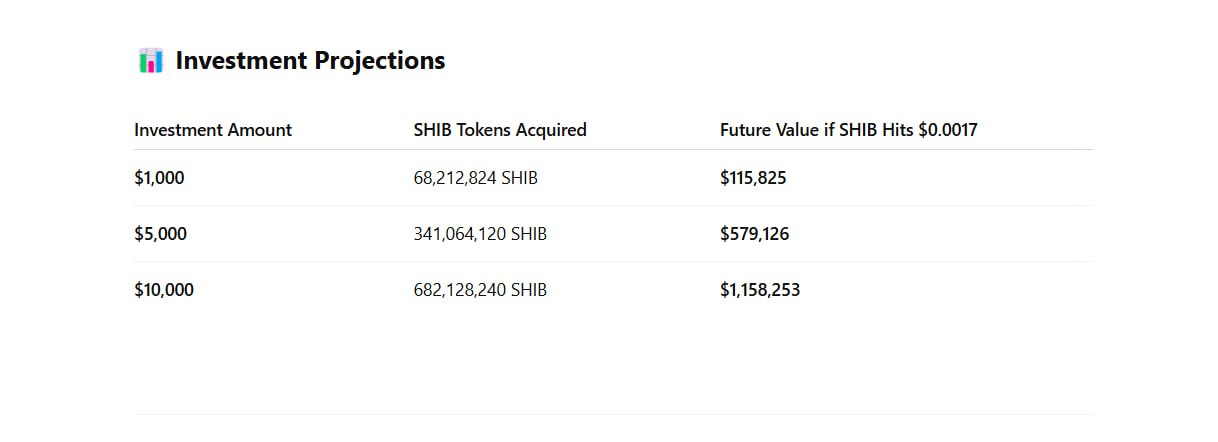

Here’s When $1K, $5K, and $10K in Shiba Inu Could Turn Into $115K, $580K, and $1M

Shiba Inu investors with $1K to $10K could grow into six figures if the token cancels more zeros and...

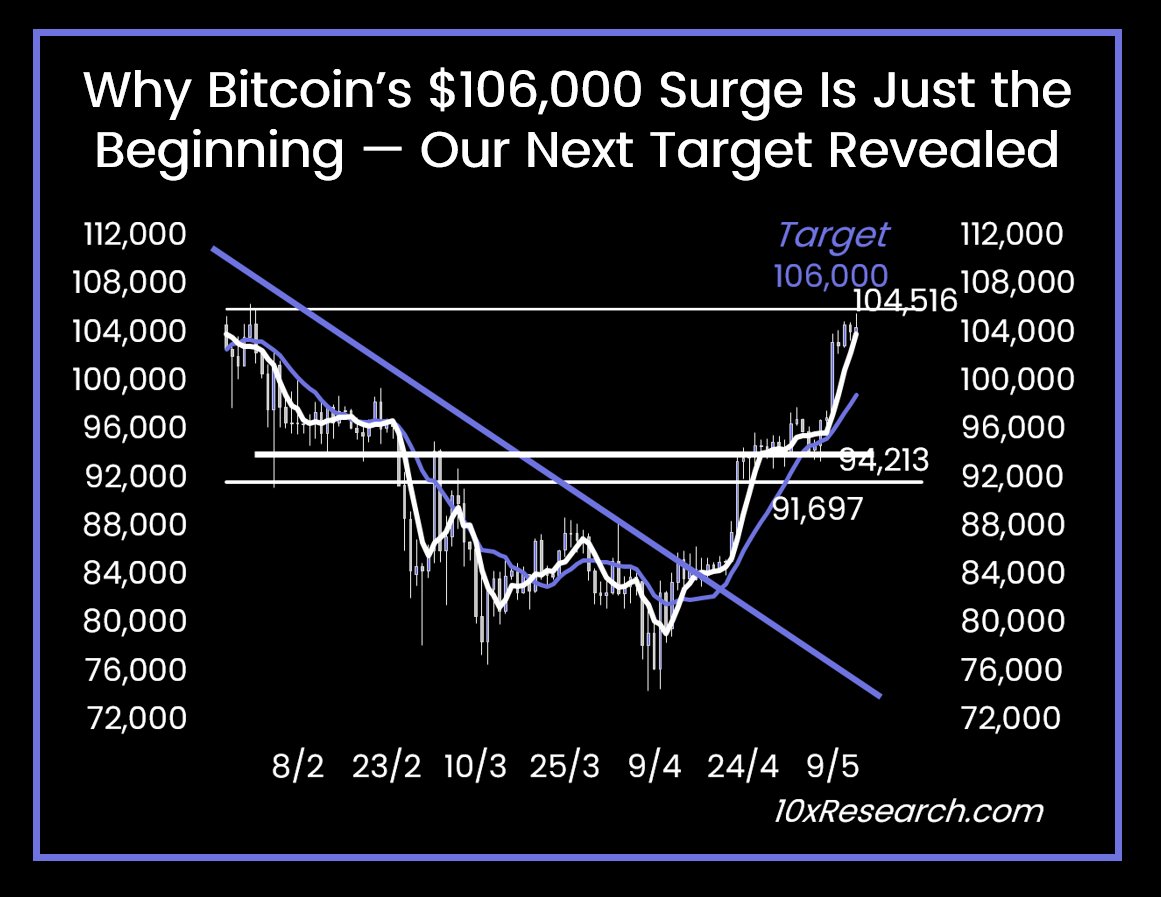

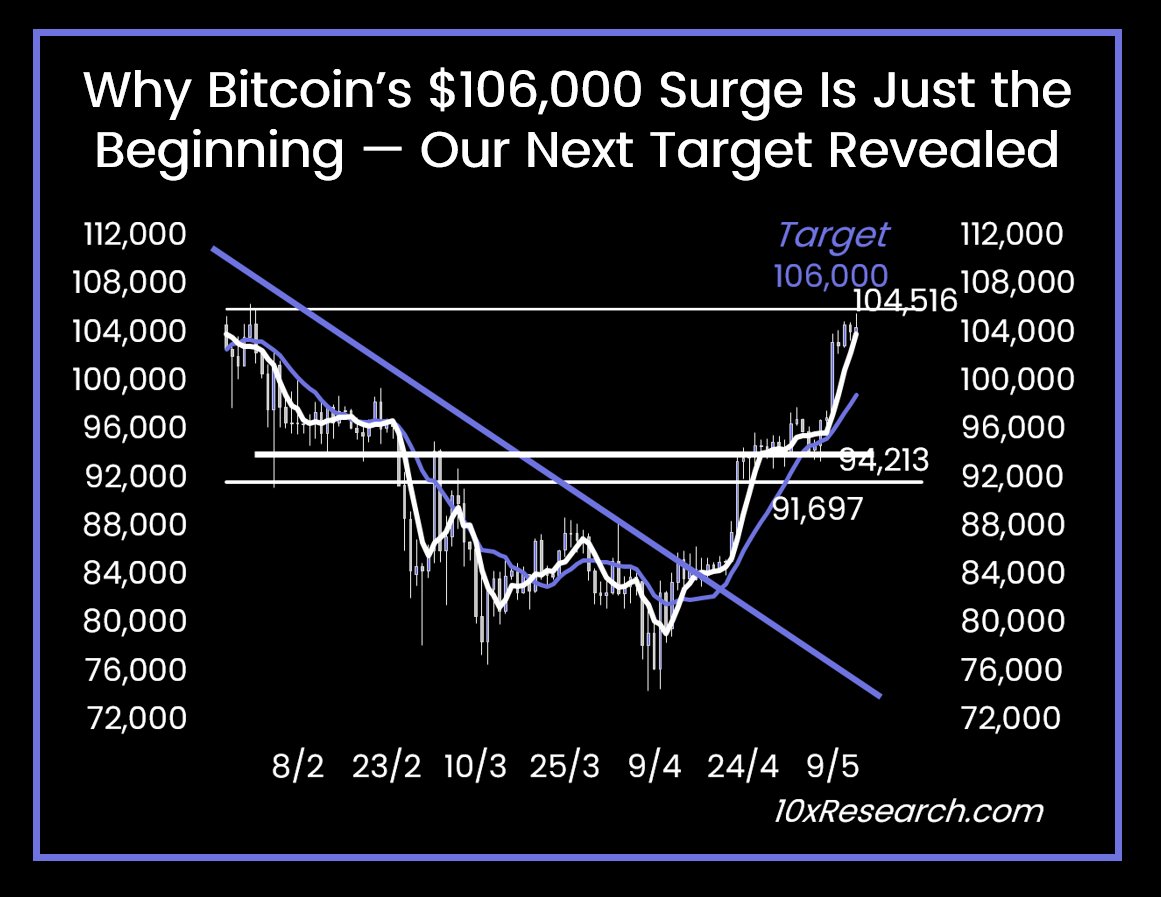

10x Research Updates Its Bitcoin Target, Predicts Further Upside as BTC Hits $106K

Bitcoin has moved closer to the $106,000 mark, prompting fresh attention from analysts at institutio...

Bitcoin Leads as Crypto Inflows Hit $882M in Fourth Straight Week of Growth

Digital asset investment products continued their positive momentum, recording a fourth straight wee...