Bitcoin Price Consolidates Around $103,000-Here’s What May Happen if it Rises & Secures above $105,000

The post Bitcoin Price Consolidates Around $103,000-Here’s What May Happen if it Rises & Secures above $105,000 appeared first on Coinpedia Fintech News

The crypto markets are currently still, as most of the tokens, including Bitcoin, are consolidating within a narrow range. After the latest upswing, the ongoing sluggish behaviour can be seen as an accumulation of bullish strength, which could trigger a strong upswing hereafter. The consolidation usually breaks once the BTC price breaks above the local resistance that triggered a rejection in the near past.

The $105,800 range has triggered a pullback in the past few days. Does this suggest that breaking these levels may push the price straight to a new ATH, or could another consolidation follow just below the highs?

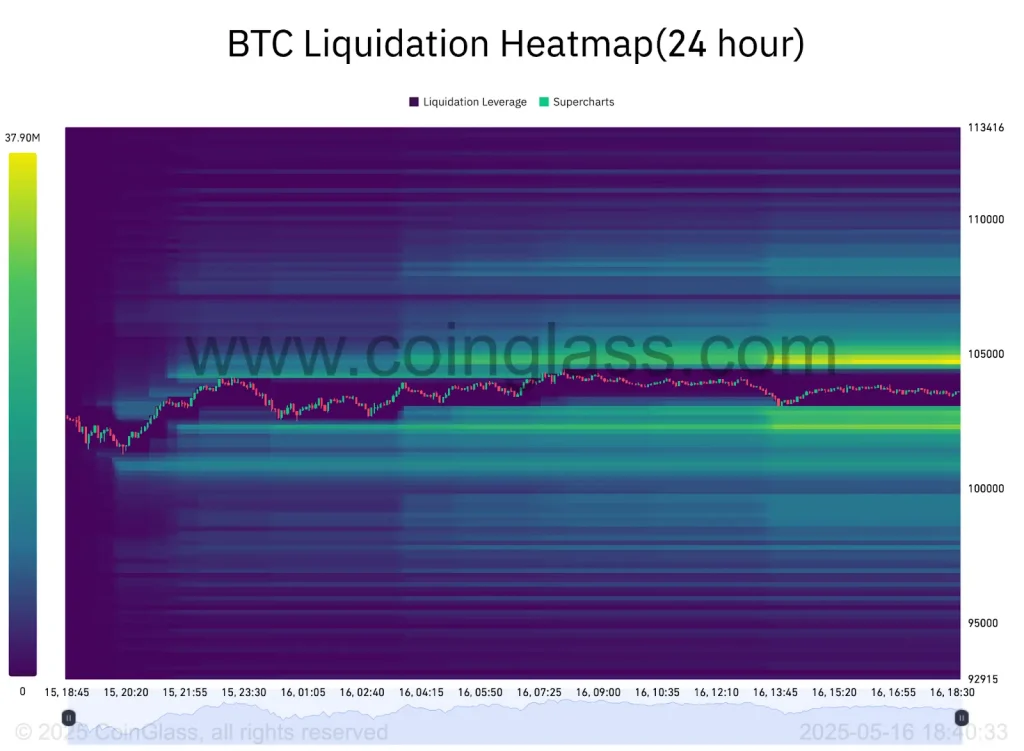

Many things have been developed in the past couple of years, specifically after the inclusion of institutions into the crypto space. Some of the data suggests a low interest and trading activity of the retail traders, while the institutions have taken over the crypto market. Big companies like Strategy and BlackRock have over 500K BTC with them, which could heavily impact the BTC price rally. Meanwhile, the price seems to have found the local resistance at $105,000 and breaking this may liquidate millions of shorts.

- Also Read :

- Altcoins Consolidate Within a Narrow Range—Has the Altseason Been Deferred to Q3 or Q4 2025?

- ,

Nearly $100M in shorts has been accumulated between $104,700 and $104,900, as per CoinGlass data. Shorts have begun to pile up close to $105,000, and breaking these levels is extremely crucial for the Bitcoin price rally. On the contrary, some of the longs are also accumulated below $102,500 and hence, breaking these levels may push the price lower while holding above the $100K psychological barrier.

Considering the current trade setup, the BTC price is consolidating within a range-bound while constantly trying to break the range. The short-term bearish flag has been pulled up, which makes a bearish move quite evident. However, the indicators have been failing to completely switch to bearish, and the bulls have prevented it each time. Hence, the upcoming weekend may have a huge impact, as a rise above $104,000 could easily elevate the levels above $105,000, while a failure could trigger a bearish action close to $100,000.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Yes, institutional players like BlackRock hold over 500K BTC, dominating market influence over retail traders.

As per Coinpedia’s BTC price prediction, the Bitcoin price could peak at $168k this year if the bullish sentiment sustains.

If BTC falls below $102.5K, it could test $100K support as long positions below may start unwinding.

Elon Musk Changes His X Handle to Kekius Maximus: KEKIUS Price Surges 108%

The post Elon Musk Changes His X Handle to Kekius Maximus: KEKIUS Price Surges 108% appeared first o...

Chainlink Inks Strategic Partnership With World Liberty Financial to Enhance Cross-chain Capabilities for USD1

The post Chainlink Inks Strategic Partnership With World Liberty Financial to Enhance Cross-chain Ca...

Bonk Meme and DeFi Development Corp Announces Strategic Partnership to Jointly Run a Solana (SOL) Validator

The post Bonk Meme and DeFi Development Corp Announces Strategic Partnership to Jointly Run a Solana...