Whale Pulls 947,557 UNI Tokens from Binance, Sparking Bullish Sentiment in UniSwap Market

UniSwap (UNI) is witnessing a significant change in market dynamics, fueled by whale activity and major on-chain indicators. Today, crypto analyst Onchain Lens spotted a whale who withdrew 947,557 UNI tokens worth $5.61 million from Binance.

Whale turns bullish on UniSwap

This withdrawal action shows that the whale appears to be a long-term buyer who is positioning himself in the UniSwap market for potential future price growth.

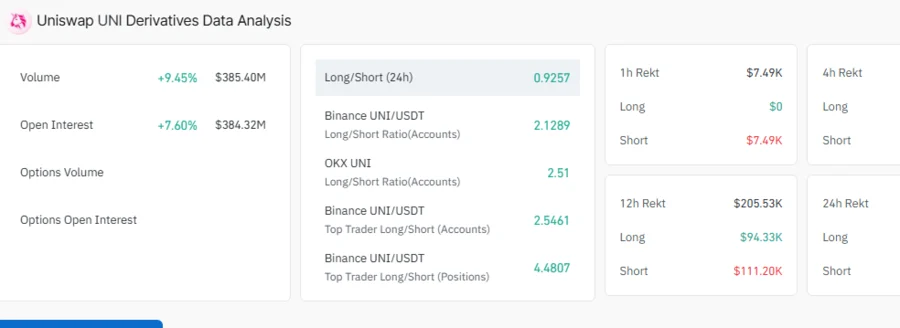

On the second note, this investor’s activity suggests that whales and savvy traders are buying UNI tokens, attracted by the asset’s potential. Today, the token’s transaction volume rose by 9.45% from yesterday (as per Coinglass data), suggesting a recent increase in market activity. This is an indicator of an increased number of buyers withdrawing UNI tokens from exchanges, transferring them to private wallets for holding purposes.

A sustained withdraw activity often ignites positive impacts on crypto prices like UNI. This typically happens this way because such activity tends to decrease the supply of tokens on exchanges and therefore activates a potential increase of an asset’s price.

Key indicators pushing UniSwap forward

Several on-chain indicators show that UNI is poised to see an uptrend. First, UniSwap is a strong platform whose growth is supported by multiple protocols, including Unichain , operating within its ecosystem. Just to mention a few, UniSwap is the largest player in the decentralized exchange sector. Despite strong competition from other DEXs, it still retains its strong market share.

Over the past 30 days, it processed transactions valued at more than $64 billion, outperforming its competitors, including PancakeSwap, Raydium, and Meteora, which processed transactions worth $51.1 billion, $26 billion, and $17.8 billion, respectively. This growth is possibly because UniSwap operates in multiple blockchains, including Avalanche, Base, Arbitrum, Polygon, and Ethereum.

Secondly, the whale’s withdrawal from Binance has attracted substantial attention in the UniSwap community. Whale actions like this often impact liquidity and can trigger potential upward movement. At press time today, the asset’s price is standing at $6.24, up 6.5% over the past 24 hours. This jump indicates that the market is preparing to experience upswing in the coming days.

On the third point, while the whale withdrawal highlights rising market participation, Open Interest further confirms this bullishness. As per metrics from Coinglass, UniSwap’s Open Interest (IO) has increased by 7.60% today, suggesting increasing interest among traders in the derivatives market. This shows that an increased number of futures traders are placing long premiums, optimistic about a potential future price hike.

In another crucial indicator, UniSwap is currently trading in a double-bottom pattern. This is a bullish reversal pattern showing that the current downward movement is ending and an upside might emerge. This suggests that the asset is likely to break the resistance levels of $6.613 and $6.739 soon.

Sonic SVM Strengthens $SONIC Scarcity with 24-Month Buy-and-Lock Model

Sonic SVM has unveiled a major enhancement to its tokenomics with an innovative SONIC token value ac...

Sahara AI Launches SIWA Testnet to Empower Decentralized AI Builders

Sahara AI opens SIWA testnet and launches DSP Beta on May 27, offering users a way to register AI da...

How Blockchain Is Changing the Way We Think About Digital Transactions

Blockchain is transforming digital transactions by enabling faster, secure, and more transparent sys...