Bitcoin on Course for Yet Another ATH?

Several technical, fundamental, and on-chain indicators suggest that Bitcoin is poised to resume its 2025 bull run despite its price having retreated on Monday.

Recent data from SoSoValue indicates that US-based spot Bitcoin ETFs are experiencing significant capital inflows, totaling $6.4 billion in net inflows over the past four weeks.

Net inflows to spot Bitcoin ETFs were steady for seven weeks in a row, totaling $11.4 billion, between the beginning of February 2024 and the middle of March 2024.

On March 14, 2024, the price of Bitcoin reached a record high of $73,800, a 73% rise over its previous low. Similarly, from October 2024 to December, Bitcoin experienced a 60% surge from $67,000 to $108,000, with cumulative weekly inflows reaching $17.6 billion.

As investor sentiment rises, these examples support the assumption that institutions are showing substantial demand for spot Bitcoin ETFs.

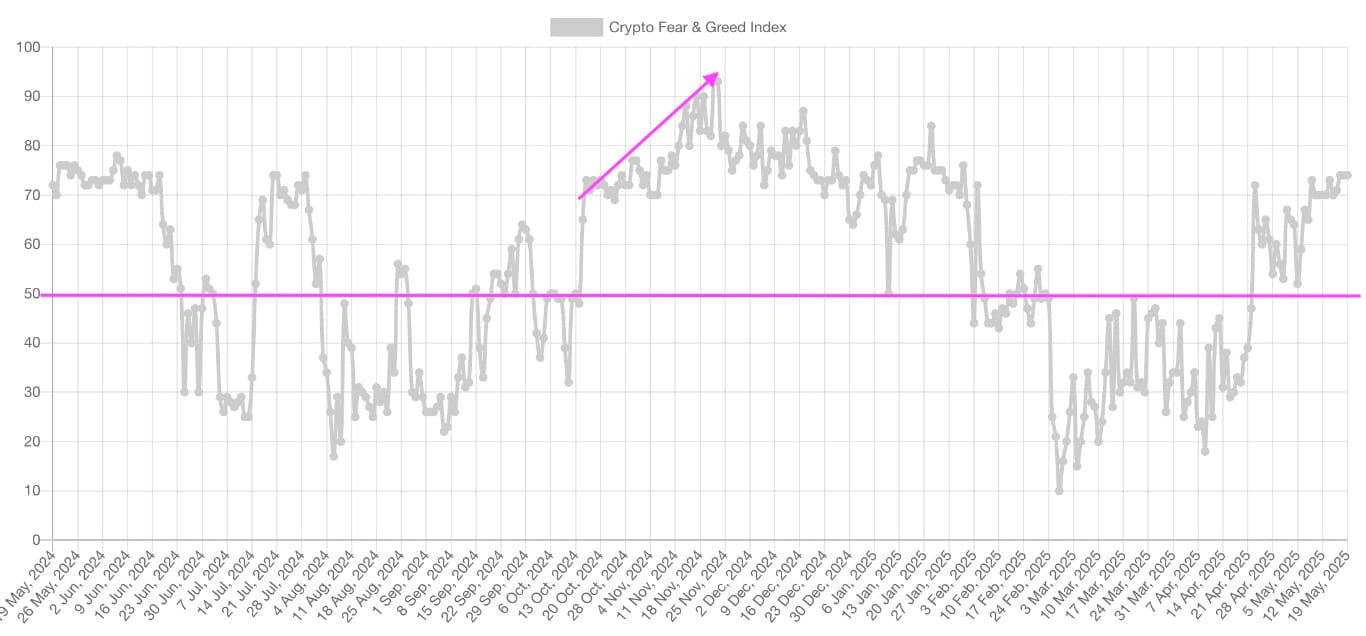

There has been a recent increase in optimistic attitudes within social media circles. With a score of 74, the Bitcoin Fear and Greed Index, which measures investor sentiment, indicates a prevailing sense of "greed" in the market.

Of particular note is that this index has now broken out over the 50 mark, remaining below the midpoint from February through April. This shows that market participants are optimistic about the cryptocurrency market as a whole.

If this market mood trend continues, it could indicate the start of a bull run in prices, similar to what has occurred in the past.

Interestingly, this degree of greedy market attitude was previously seen in November 2024, just before Bitcoin's rally to its all-time high price of $108,000 on December 16, 2024.

The current trend indicates that Bitcoin's price is likely to continue rising toward new all-time highs.

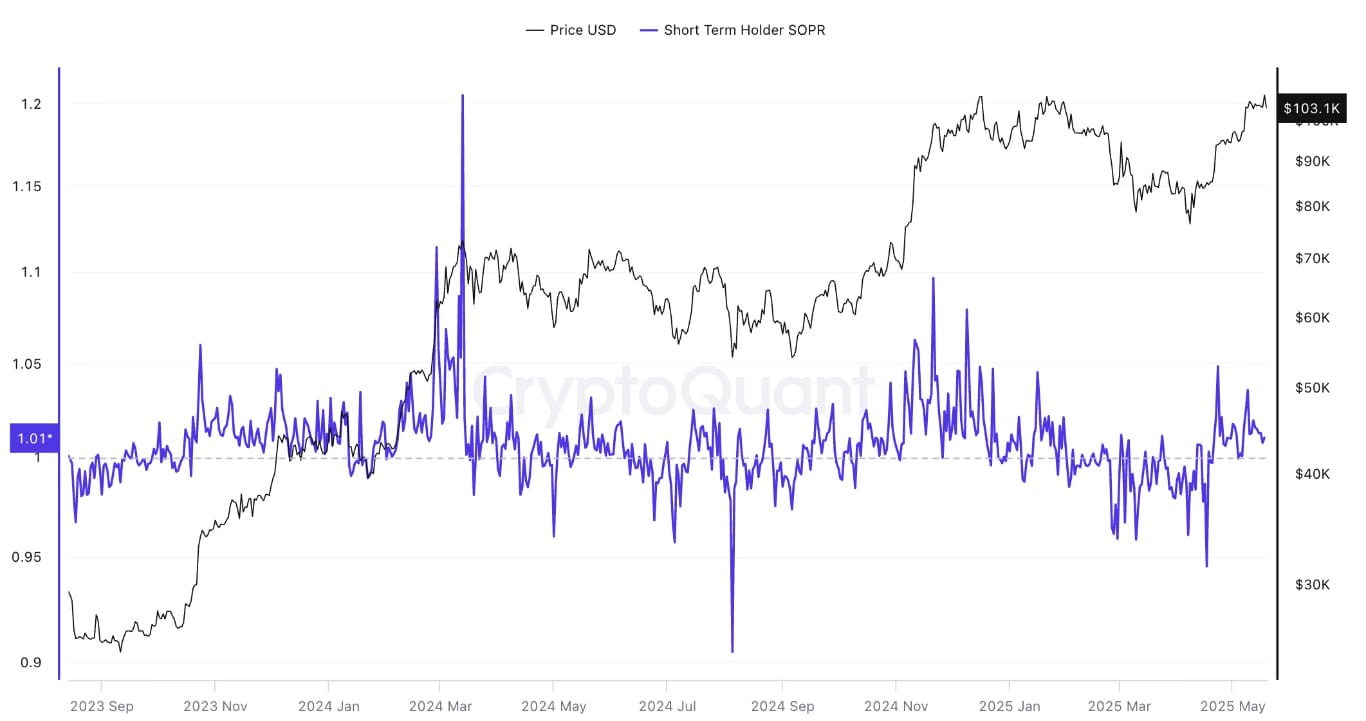

According to data from CryptoQuant, profit-taking has not significantly increased, despite the recent climb above $107,000, which saw over 97% of the Bitcoin supply turn a profit.

While short-term holders (STHs) are generating a profit again, CryptoQuant's short-term holder (STH) Spent Output Profit Ratio (SOPR) shows that they aren't actively booking profits. STHs can see their profit or loss relative to when they initially owned Bitcoin using the SOPR metric.

For short-term investments, a score above one means that most coins have been profitable, while a value below one means that most have been losing money. The present value of 1.01% shows that STHs are still profitable and not overheated.

Bitcoin has more upward potential before hitting this level, as an SOPR of 1.01% was deemed overheated during the two months of sideways price action since March, when the price was trapped in a range between $80,000 and $98,000.

The OG token could experience a significant parabolic surge if its price surpasses the record high and the SOPR value for short-term holders continues to rise.

Technical analysis indicates that Bitcoin's price action has formed a bull flag pattern on the weekly timeframe, suggesting that this leading cryptocurrency is likely to experience a significant price surge.

A bull flag is a bullish technical chart pattern that suggests a potential upward price continuation after a significant rally. This pattern emerges when prices stabilize within a descending channel or range, resembling a flag, following a significant upward movement known as the flagpole.

The observed trend suggests that purchasers are pausing to reassess before continuing the upward trajectory. When the price surpasses the flag's upper trendline, usually with heightened volume, it clarifies the ongoing trend.

On April 22, the price surpassed the upper trendline at $86,800, confirming the bullish flag pattern. Bitcoin has the potential to increase significantly, matching the height of the previous uptrend.

The projected upper target for BTC's price is $180,000. This would represent a 74% rise from the existing price levels.

Furthermore, Bitcoin's weekly relative strength index stands at a favorable 62. This indicates that the current market conditions continue to support potential growth, thereby increasing BTC's likelihood of achieving its bull flag target.

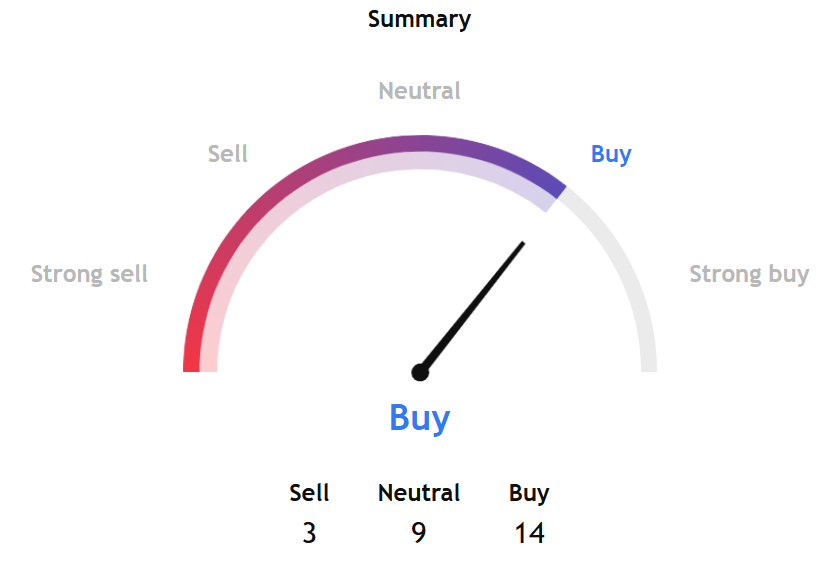

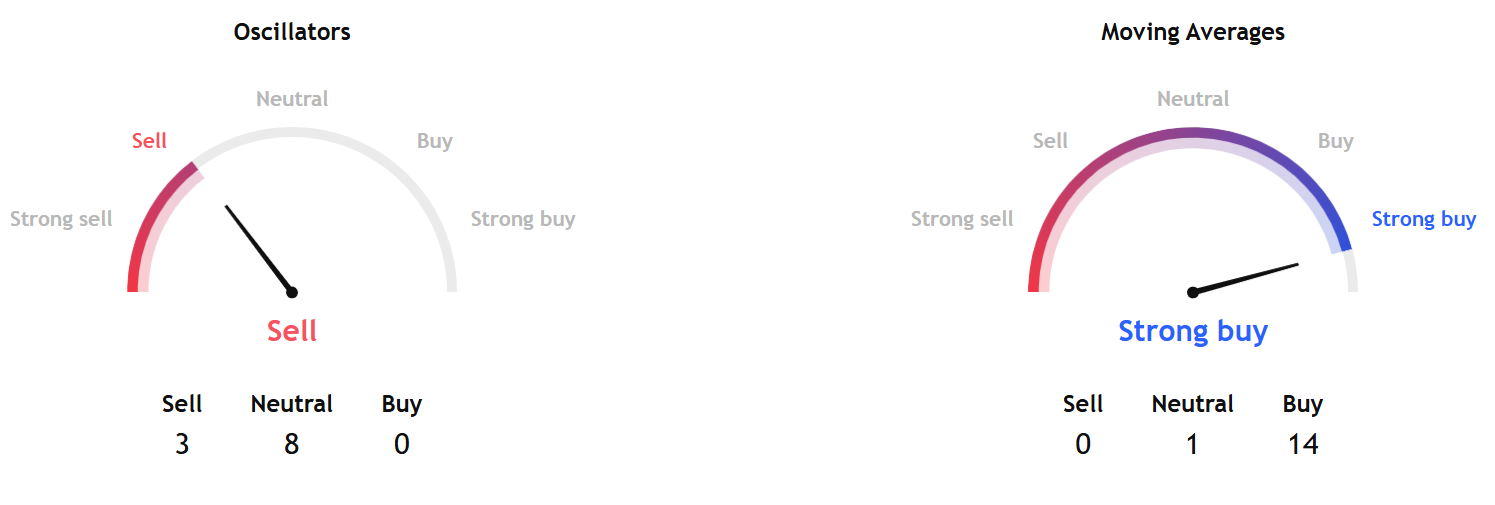

TradingView's technical analysis indicates a strong buy signal, supported by the moving averages.

Most oscillators showed neutral, while momentum (10) and MACD levels (12 & 26), and the Williams Percent Range (14) indicated a sell signal.

All moving average indicators suggested a buy action, except for the Ichimoku Base Line (9, 26, 52, 26), which indicated a neutral signal.

Global market moves also supported crypto bets. On Friday night, Moody's downgraded the US debt, which caused some turmoil at the start of the trading week.

The 'Sell America' trade returned, resulting in the dollar and stocks becoming losers, while longer-dated Treasury yields briefly surged past 5%. These trades are expected to boost alternatives like cryptos, with haven bets favoring digital assets.

Elsewhere

Singapore & the Future of Crypto (11 June)

Join us for a compelling fireside chat on 11 June with Jeremy Tan , entrepreneur and independent GE2025 candidate, as he sits down with Saad Ahmed, Head of APAC at Gemini, to explore what Bitcoin really is, why it matters, and how it could help shape the future of Singapore — and its people.

Whether you're new to Bitcoin, curious about crypto, or eager to understand where the future of money is headed, this is your chance to gain clear, honest insights. No jargon. No hype. Just practical knowledge for everyday Singaporeans.

The event is free to attend, though seats are limited and subject to confirmation. If not approved, you’ll still receive a livestream link to attend online. Apply early to secure your spot!

Blockcast

Singapore's Bitcoin Candidate Jeremy Tan on Disrupting Politics & Finance

This week we have a special guest, Jeremy Tan , the independent candidate for Mountbatten SMC who garnered a surprising 36% of the vote in Singapore's general election by centering his campaign on, among other things, Bitcoin adoption. Jeremy discusses his motivations for bringing Bitcoin into the political arena, highlighting the need for Singapore to consider it as a hedge against US dollar instability, and addresses the Monetary Authority of Singapore's (MAS) cautious stance on crypto, suggesting a disconnect between the official narrative and behind-the-scenes activity.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

From Wall Street to Governments: Why Bitcoin's Next ATH Is Within Reach

Your daily access to the backroom....

Vivek Ramaswamy's Strive Targets Mt. Gox Bitcoin Claims

Strive's pivot to becoming a Bitcoin treasury company reflects a broader industry trend with compani...

DeFi Technologies Enters RWA Market With Regulated Stablecoin, Following Nasdaq Listing

DeFi Technologies' entry into this segment with a regulated, bank-issued product underscores the ong...