Ethereum (ETH) Price Analysis: Breakout to $3,000 or Breakdown to $2,200?

The post Ethereum (ETH) Price Analysis: Breakout to $3,000 or Breakdown to $2,200? appeared first on Coinpedia Fintech News

Ethereum price has been range-bound near the $2,650 level after a strong 45% monthly rally. As of press time, ETH is trading at $2,631, down 3.79% in the past 24 hours, suggesting short-term selling pressure. But beneath the surface lies a classic technical setup that could decide the next big move to its resistance around $2,700–$2,800.

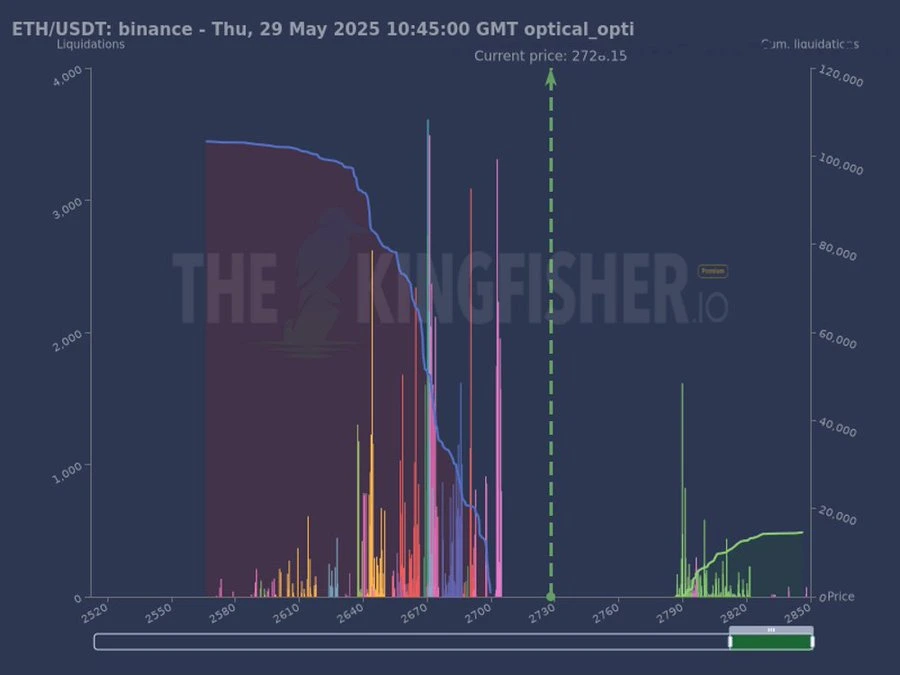

Liquidation Cluster: A Trouble or an Opportunity?

According to a post analyst, “The Kingfisher” , there’s a significant concentration of long liquidations between $2,600 and $2,700. This creates a liquidity “magnet” meaning, if ETH dips into this zone, we could see a domino effect of liquidations. With price currently near $2,631, ETH is closer to is crucial zone.

The thesis highlights that the short liquidations above are comparatively light. This asymmetry suggests a steeper downside risk, especially if market sentiment flips bearish. A slip could trigger a flush toward $2,510, or even $2,319 if panic sets in.

Ethereum (ETH) Price Analysis:

Ethereum’s 1-D chart shows an ascending triangle, a bullish continuation pattern, with resistance holding near $2,800. A strong daily close above $2,800 would confirm the triangle breakout. In that case, ETH could rise above the $3,000 psychological resistance to surge toward $3,100–$3,300, backed by short squeezes and breakout momentum.

Conversely, If ETH fails to break out and drops below $2,510, it would invalidate the bullish pattern. A further breakdown below $2,320 would open the gates to $2,200, where the next major support lies.

Read our Ethereum (ETH) Price Prediction 2025, 2026-2030 for long-term targets!

FAQs

Ethereum price today is at $2,631.27 with a daily change of -3.79%.

Key levels include $2,800 for a bullish breakout, $2,510 for a bearish bias, and $2,319 for confirmation of a steeper correction.

If you’re a long-term investor, accumulation on dips within the $2,400–$2,500 range may offer value. Short-term traders should wait for a breakout above $2,800 or a breakdown below $2,510 for clearer signals.

Pi Network Leverages Gaming with FruityPi App to Boost Engagement and Utility

The post Pi Network Leverages Gaming with FruityPi App to Boost Engagement and Utility appeared firs...

Why You Should Consider $FEPE Before Tier-1 Listings: The Early Token You Can’t Miss

The post Why You Should Consider $FEPE Before Tier-1 Listings: The Early Token You Can’t Miss appear...

Tap, Pay, and Go: SpacePay’s NFC Integration Brings Crypto Payments to Any Smartphone

The post Tap, Pay, and Go: SpacePay’s NFC Integration Brings Crypto Payments to Any Smartphone appea...