Is Bitcoin Overtaking US Treasuries? Analyzing the Shift in Investor Behavior

The post Is Bitcoin Overtaking US Treasuries? Analyzing the Shift in Investor Behavior appeared first on Coinpedia Fintech News

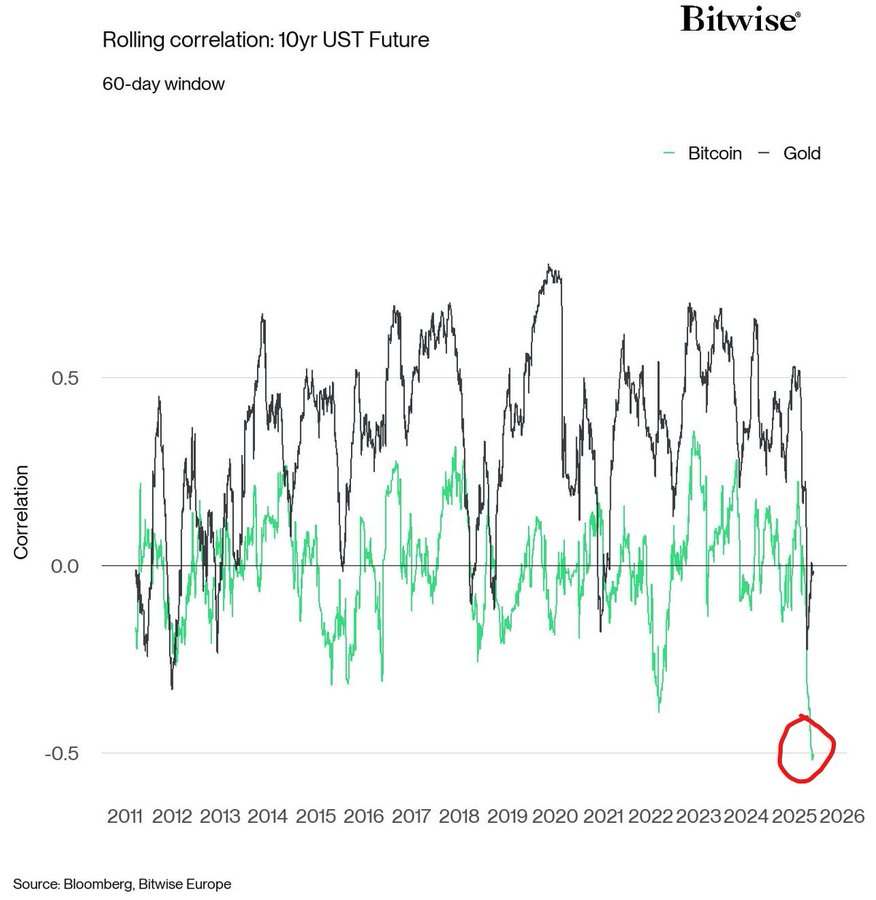

Andre Dragosch, Head of Research at Bitwise in Europe, has pointed out that Bitcoin’s 60-day correlation with US 10-Year Treasury Futures has fallen to its lowest level ever.

This historical decoupling could signal a growing shift in investor behaviour, possibly indicating increased interest in Bitcoin over traditional bonds.

Curious? Dive in!

Bitcoin’s Correlation with US 10-Year Treasury Futures Explained

Correlation shows how two assets move in relation to each other. A higher correlation means they move together, while a low or negative correlation implies they move in opposite directions.

Highlighting a chart titled “Rolling Correlation: 10-Year UST Futures”, Dragosch has revealed that the 60-day correlation between Bitcoin and the US 10-Year Treasury Futures has plummeted to its lowest level ever recorded.

The revelation has triggered a serious discussion on ‘are traditional investors selling US Treasuries to buy Bitcoin?’

US 10-Year Treasury Yield: A Simple Analysis

At the start of April, the US 10-Year Bond Yield was 4.213%. Though at a point on April 4, it slipped as low as 3.859%, between April 7 and 11, it climbed steeply by 15.44%. On April 11, it hit the month’s peak of 4.590%. After hitting the peak, the market witnessed two minor corrections that month: a 4.48% correction b/w April 14 and 16 and a 4.34% correction b/w April 24 and 29.

In the early half of this month, the US 10-Year Bond Yield saw a steady rise. Between May 1 and 21, it surged by 9.99%. At one point on May 22, it reached a peak of 4.629%. Currently, the yield sits at 4.420% – at least 4.49% below the peak of the month.

Bitcoin Price Action: An Overview

At the beginning of April, the Bitcoin price was $82,497.20. Although between April 1 and 8, the price dropped by 10.27%, between April 9 and 30, it almost steadily grew by 23.34%.

In the early half of this month, the Bitcoin market also witnessed a steep increase. Between May 1 and 22 alone, the market jumped by 18.63%, from $94,123.24 to a peak of $11,653.95.

Since May 23, the market has dropped by over 5.16%.

A Final Note

During May, both US 10-Year Treasury Yield and Bitcoin price saw significant increases, indicating a risk-on environment where both traditional safe assets and riskier assets were bought.

However, Bitcoin’s initial April drop while yields also fluctuated, then its subsequent strong recovery coinciding with rising yields, hints at some capital rotation into Bitcoin as bond attractiveness waned.

The subsequent minor corrections in both assets at the end of April and May suggest some profit-taking or shifting market sentiment.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

It signals Bitcoin is moving independently, hinting investors may prefer crypto over traditional bonds.

Factors include increased institutional adoption, economic uncertainty, and Bitcoin’s emerging role as a hedge against traditional assets.

Analysts suggest that Bitcoin is increasingly viewed as a store of value, especially during periods of economic instability.

Crypto Billionaire Justin Sun Set for Space Flight? Blue Origin’s Tweet Sparks Buzz

The post Crypto Billionaire Justin Sun Set for Space Flight? Blue Origin’s Tweet Sparks Buzz appeare...

IRS vs. Coinbase: Supreme Court Asked to Reject Crypto Privacy Challenge

The post IRS vs. Coinbase: Supreme Court Asked to Reject Crypto Privacy Challenge appeared first on ...

Will Cardano (ADA) and Ripple (XRP) 2017 Successes Be Repeated by This New Altcoin in 2025?

The post Will Cardano (ADA) and Ripple (XRP) 2017 Successes Be Repeated by This New Altcoin in 2025?...

ATTENTION: This is probably the most important macro chart for

ATTENTION: This is probably the most important macro chart for

(@Andre_Dragosch)

(@Andre_Dragosch)