Bitcoin Technical Indicators Flash Mixed Signals at Key Support

A quick glance at the data calendar highlights the risks associated with risk assets, as investors closely monitor the impact of Trump's trade wars on the real economy.

Besides the macro headlines screaming risk-off and the history suggesting staying off risk assets, cryptos will put the Federal Reserve in wait-and-watch mode later in June.

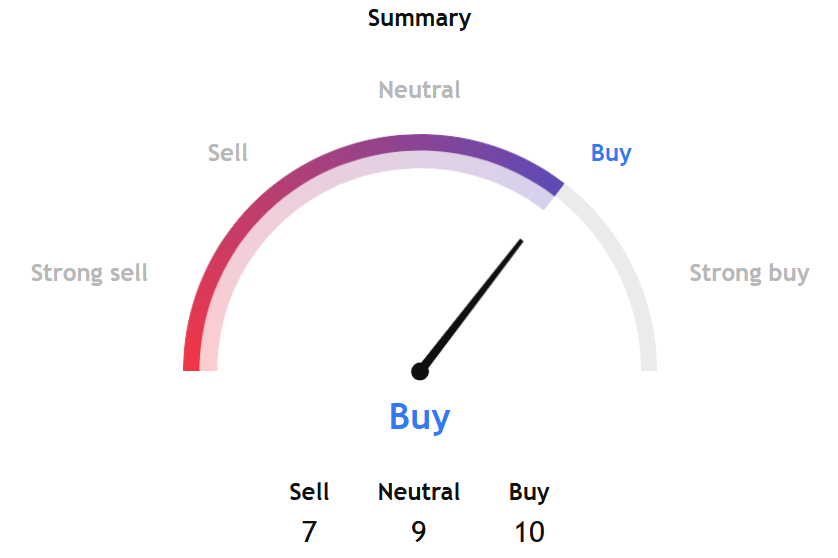

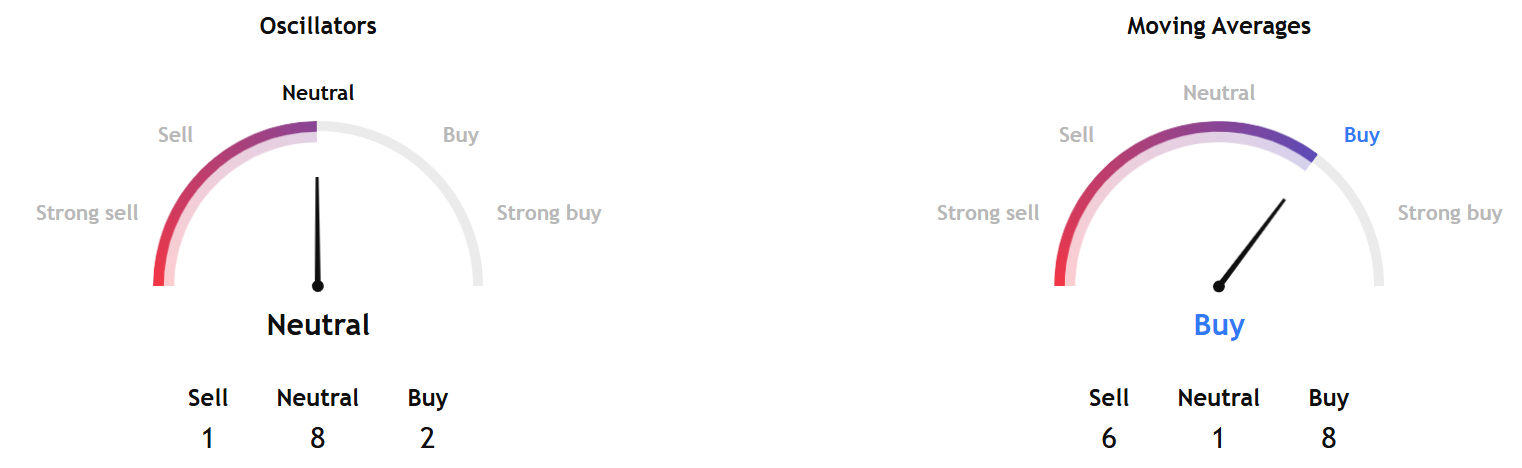

While TradingView's technical analysis charts point to a buy signal, the indicators pointing to sell increased compared to last week.

The oscillator indicators pointed to a neutral signal while moving averages indicators showed buy.

More indicators in the moving averages analysis pointed to a sell signal, underscoring the risk for cryptos this month.

"We're seeing a notable increase in sell signals across our technical framework," noted BRN analyst Valentin Fournier. "The mixed signals suggest the market is at a critical inflection point."

InvestTech's overall algorithmic analysis suggests maintaining positions, indicating low liquidity risk and medium volatility risk.

The short-term view based on InvestTech's analysis shows that Bitcoin's breaking off the floor of the short-term rising trend channel indicates a weaker initial growth rate very shortly.

Support at the point of $104,000 is being tested by the cryptocurrency.

While this may elicit a favorable response, a decline below $104,000 indicates a bearish indication. When the RSI diverges negatively from the price, there is a potential for a downward reaction.

However, regarding technical analysis, the OG token is positive in the short term.

In the medium term, InvestTech shows Bitcoin has broken out of its medium- to long-term upward trend channel. This can indicate either a more gradual increase in speed or the onset of a more horizontal trend. The cryptocurrency has slightly declined below the support level of $106,000.

An established break predicts a further decrease. Similar to the short term, there is potential for a downward reaction when the relative strength index (RSI) shows negative divergence from the price.

ETF Flows Reveal Institutional Rotation

Fournier noted a clear divergence in institutional demand that adds context to the technical picture.

Bitcoin and Ethereum continue to show a clear divergence in ETF flows. Bitcoin ETFs saw another $270M in outflows yesterday, bringing the 3-day total to over $1.2B in redemptions. In contrast, Ethereum recorded $78M in inflows, marking a 12-day streak totaling $634M—the strongest accumulation trend since ETF approval.

"This flow divergence highlights growing institutional interest in ETH while suggesting sustained profit-taking on BTC," the analyst explained. "The rotation tells us institutions are becoming more selective within crypto allocations."

Corporate activity remains uneven but noteworthy. While Michael Saylor's Strategy purchases have slowed ($70M last week), others are stepping in:

- MetaPlanet added $117M in BTC

- Twenty One Capital appears to be modeling MicroStrategy's playbook, as $2.7B in BTC was moved by Tether and Bitfinex to initiate its own treasury strategy

This reinforces the narrative of a race among corporates and even state-linked entities to accumulate BTC, despite short-term profit taking.

Options Market Signals Defensive Positioning

SoSoValue shows the Daily Total Net Open Interest (Delta) at -364.76 million. The Delta shows the difference between the daily movements of open contracts for Calls and Puts.

That data suggests the number of open Put contracts has risen, which means that market makers will have to sell assets to cover their bets, leading to the sale of more ETFs.

This metric is useful for learning about market dynamics and the strategies used by market makers to mitigate risk.

"We had anticipated last weekend's dip and the setup continues to improve," observes our senior analyst. "With clear signs of rotational flows into altcoins, momentum appears to be shifting."

Recent performance metrics support this view:

- Total market cap: +1.4%

- BTC: $105,366 (+0.45%)

- ETH: $2,608 (+4.6%)

- SOL: $159.3 (+2.7%)

"Market momentum remains fragile, but we're seeing altcoins drive the latest rebound as the market regains footing," adds Fournier.

ETF flow data will be interesting to watch this week to understand investors' bets for cryptos in June.

Elsewhere

Singapore & the Future of Crypto (11 June)

Join us for a compelling fireside chat on 11 June with Jeremy Tan , entrepreneur and independent GE2025 candidate, as he sits down with Saad Ahmed, Head of APAC at Gemini, to explore what Bitcoin really is, why it matters, and how it could help shape the future of Singapore — and its people.

Whether you're new to Bitcoin, curious about crypto, or eager to understand where the future of money is headed, this is your chance to gain clear, honest insights. No jargon. No hype. Just practical knowledge for everyday Singaporeans.

The event is free to attend, though seats are limited and subject to confirmation. If not approved, you’ll still receive a livestream link to attend online. Apply early to secure your spot!

Blockcast

Licensed to Shill II: M&A Mania, Token Launchpads, the Rise of Bitcoin Corporates

In this episode of Licensed to Shill, Blockcast dives headfirst into the industry's accelerating maturity, turbocharged by eye-popping M&A deals and the convergence of TradFi and crypto. Your host Takatoshi Shibayama is joined by Lisa J.Y. Tan (Economics Design), Nikhil Joshi (Emurgo), and Valentin Fournier (BRN) for a no-holds-barred analysis of the industry's most compelling narratives.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Lee Jae-myung Wins South Korean Presidency, Promises Crypto Revolution

The victory positions Lee to deliver on sweeping cryptocurrency reforms promised during a campaign w...

Ethereum Foundation Unveils Conservative Treasury Strategy Amid Major R&D Restructuring

The combined announcements represent perhaps the most significant organizational evolution in the Et...

USDC Issuer Circle Supercharges IPO to $1B as BlackRock Backs Stablecoin Play

Circle's upsized $1B offering values the USDC stablecoin company at $7.2 billion, positioning it to ...