Stablecoins Ignite Record-Breaking May, Supply Jumps To $244B – Data

A surge of stablecoin transactions marked May as a standout month for the crypto sector. It moved beyond mere token swaps. Lots of people and services turned to dollar-pegged coins for moving value. Activity hit fresh highs, hinting that stablecoins are now the main channel for on-chain payments.

Spike In Wallet Activity

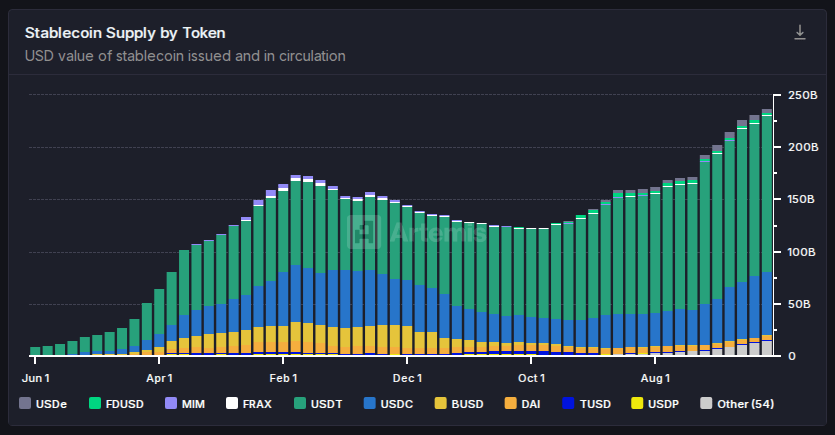

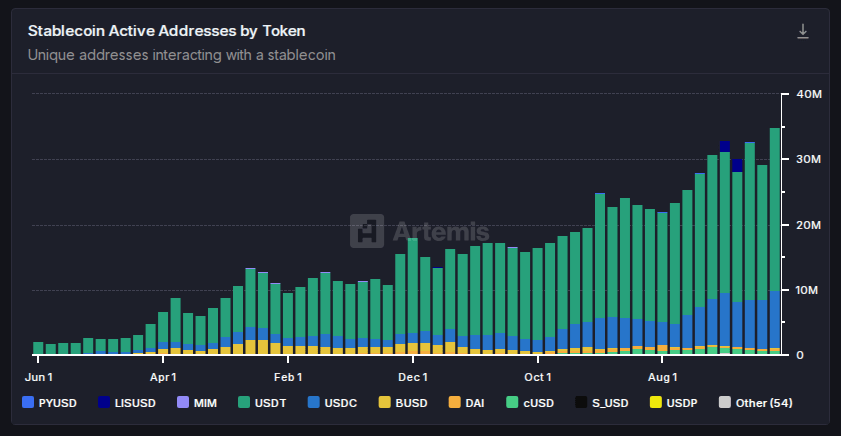

According to Artemis data , more than 33 million wallets sent or received stablecoins during May. That’s a big jump compared with earlier months. It shows more folks are leaning on these digital dollars than on native tokens.

Many traders, DeFi users, and everyday people tapped stablecoins to keep their funds tied to the US dollar. This wave of usage also came as the wider market showed signs of life, with prices slowly rising and confidence climbing.

Shift To Faster Networks

Based on reports, BNB Smart Chain counted over 10 million active wallets for stablecoin moves early in May. TRON came very close, with a little over 9 million wallets during that same stretch.

These two networks are cheap and quick. Folks want to dodge higher fees on older chains. By month’s end, both BNB Smart Chain and TRON could top those numbers again. That trend speaks to growing demand for fast, low-cost payments and DeFi deals. Ethereum simply can’t match these lower fees right now.

Stablecoin Supply Growth

Stablecoin Supply Growth

Stablecoins also saw more tokens enter circulation. The total supply grew to $244 billion, up nearly 3% in just one month. But not all coins minted equally. Tether’s USDT remained the heavyweight champion. It added nearly $4 billion to its total supply in May alone.

Most of that new USDT landed on TRON . Today, TRON holds nearly $78 billion in USDT, while Ethereum carries $73 billion. In sum, USDT’s overall supply now tops $153 billion and added tokens almost every day. USDC moved in the opposite direction. Its supply dipped slightly, thanks to outflows on Solana. Still, USDC keeps about $60 billion circulating across all its chains.

Payments And Bridges Overtake CardsStablecoins didn’t just grow in supply and usage. They carried huge volumes of payments. Over the past 30 days, those coins moved over $2 trillion worth of value. That level beats what many debit and credit cards handled in the same span.

For example, Visa’s volumes were lower than what stablecoins saw. Plus, USDC’s cross-chain moves spiked. The CCTP bridge saw $7.7 billion flow through it, up 83% month-on-month. That rush of bridging means more people are shuttling dollars between networks for trades, lending, or simple transfers.

Featured image from ETF Stream, chart from TradingView

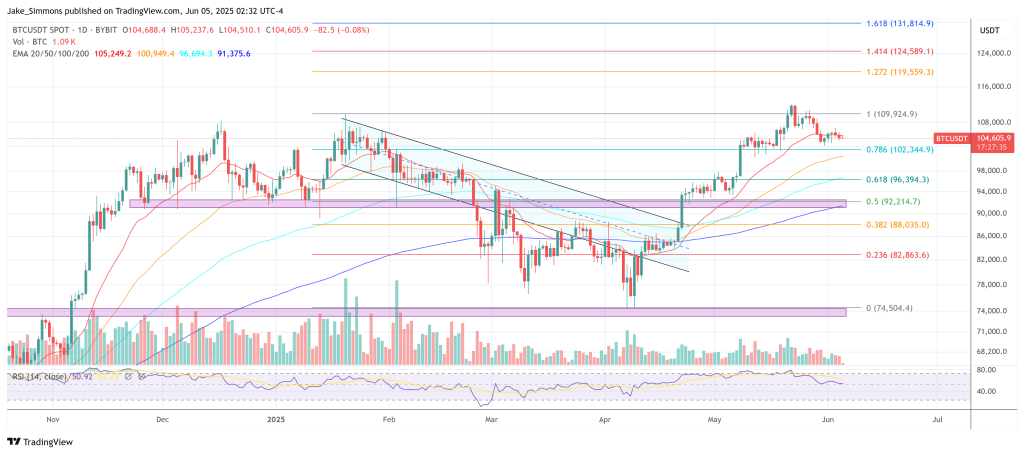

The Last Bitcoin Cycle? Swan Says History’s Turning

Bitcoin is drifting just above $105,000 on June 5, its lowest realized volatility in almost two year...

Solana Turns to Wall Street Investors, Pushing Meme Coins like Snorter to New Highs

Solana’s out to rebuild a digital empire, and it’s doing it from an office building in Lower Manhatt...

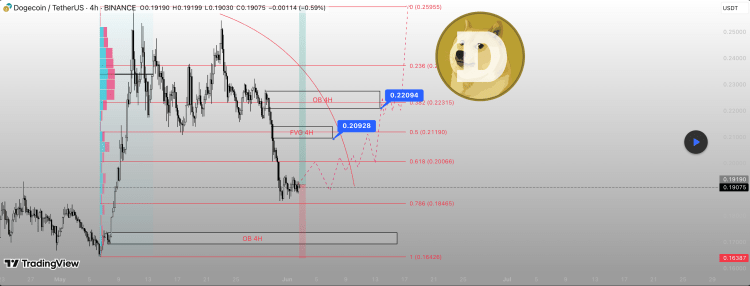

Dogecoin Price Crash Below $0.2: 4H Order Block Shows Exactly What’s Happening

Following the Bitcoin price sweep down below the $104,000 level over the weekend, the Dogecoin price...