Moscow Exchange Launches Bitcoin Futures Tied to BlackRock ETF

Favorite

Share

Scan with WeChat

Share with Friends or Moments

The Moscow Exchange has launched trading of Bitcoin futures, marking a significant step in the growing acceptance of cryptocurrency in Russia.

These new products are tied to the performance of the BlackRock Bitcoin ETF (IBIT), which has recently experienced substantial growth.

While this

development

signals Russia’s continued embrace of crypto, the futures contracts are available only to qualified investors. This reflects the country’s cautious approach to regulating digital assets.

Moscow Exchange Rolls Out Bitcoin Futures

The Moscow Exchange's futures contracts will be linked to the value of the IBIT. They will be traded in US dollars per lot, with settlements processed in Russian rubles. The futures will be offered quarterly, with the first expiring in September 2025.

Notably, MOEX step aligns with recent developments in the Russian financial system. The government has made strides to allow more crypto-linked products within a controlled environment.

The Bank of Russia approved the issuance of derivative instruments and securities tied to the value of crypto for qualified investors in May 2025. However, the central bank remains cautious, advising against direct crypto investments for most financial organizations and their clients.

IBIT’s Positive Ascent

Russia’s growing interest in crypto comes amid broader shifts in global financial markets. The

success

of the BlackRock Bitcoin ETF underscores the increasing institutional adoption of crypto-based financial products.

This move comes just days after IBIT’s impressive rise to become one of the world’s top 25 exchange-traded funds by assets under management (AUM). According to Bloomberg ETF analyst Eric Balchunas, IBIT has accumulated $72.4 billion in AUM.

Despite the success of IBIT, the Bank of Russia maintains caution by limiting such offerings to qualified investors.

Sberbank Expands Bitcoin-Investment Products

Meanwhile, Russia’s largest bank, Sberbank, is planning to launch a new investment product tied to Bitcoin’s price movements. These

structured bonds

are currently available to a select group of qualified investors via the over-the-counter market.

Unlike typical crypto investments, the structured bonds provide exposure to Bitcoin without requiring a crypto wallet or dealing with unregulated foreign platforms. Instead, the entire transaction process is conducted in rubles within Russia’s financial and regulatory framework.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/509795.html

Previous:比特币以太坊凌晨最新行情走向分析:6/5

Related Reading

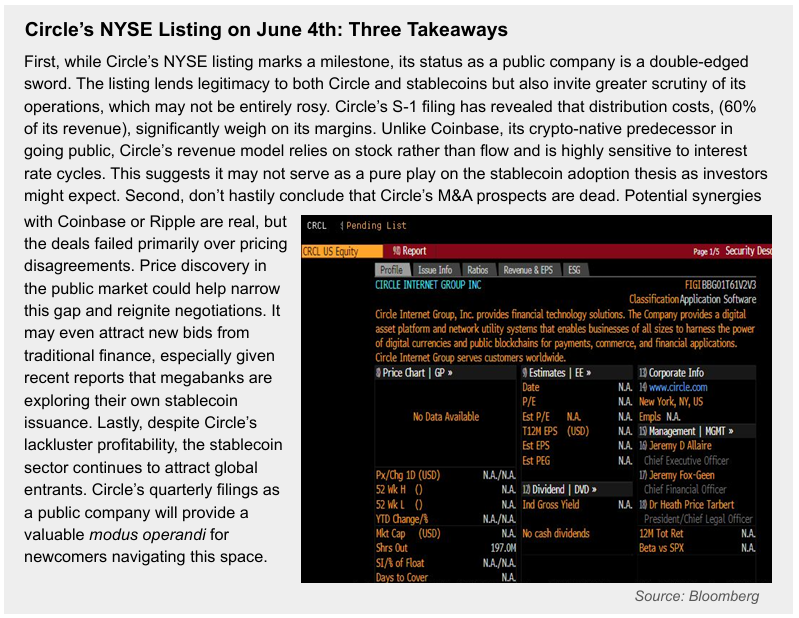

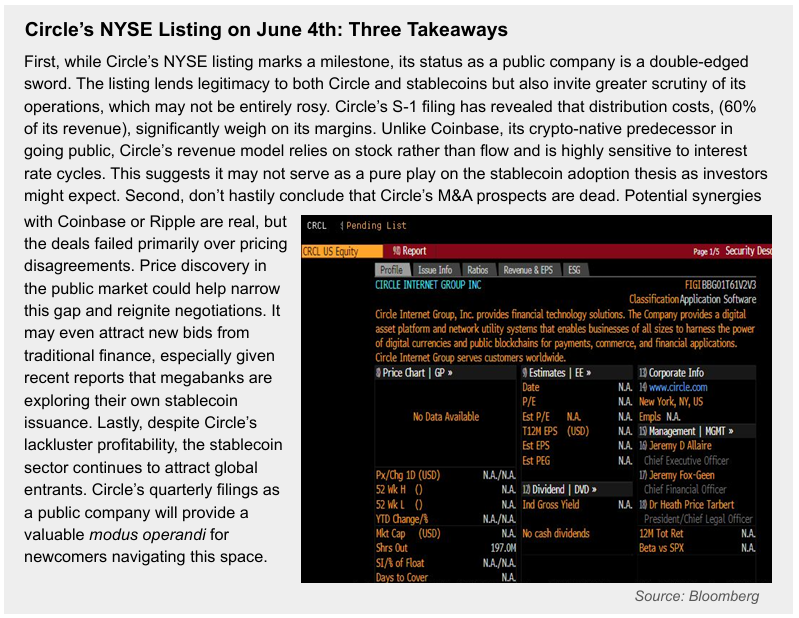

Here’s Why Circle’s Strong IPO Doesn’t Eliminate a Possible Ripple Deal

New research indicates that despite Circle's strong entry into the stock market, there is still pote...

Trump Media Registers $12 Billion in New Securities Amid Bitcoin Acquisition Plans

Trump Media and Technology Group, the parent company of Truth Social, has filed to register up to $1...

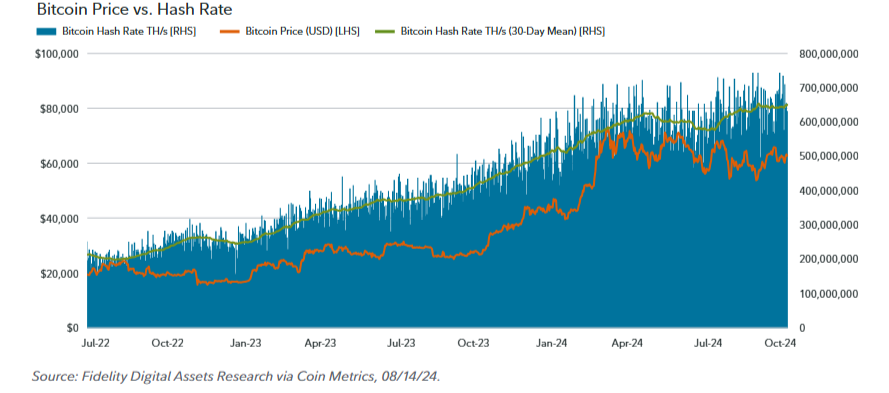

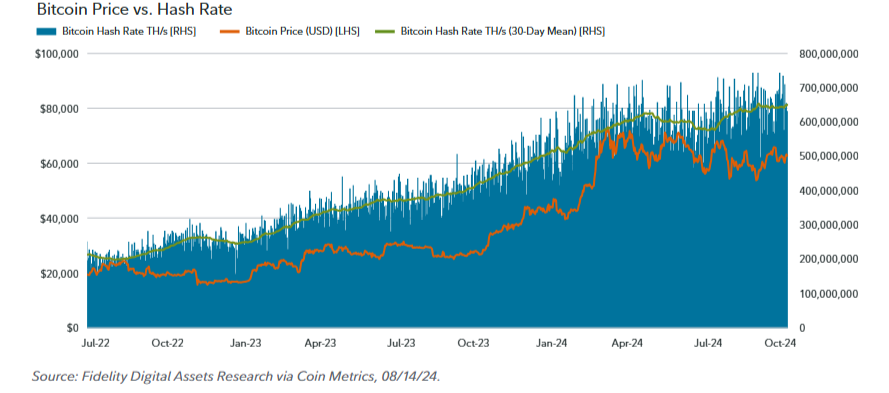

Bitcoin Potential as a Store of Value Sets It Apart from Other Digital Assets: Fidelity

Prominent asset manager Fidelity has highlighted Bitcoin unique features and functionalities in comp...