Bitcoin Hash Ribbons Indicating Prime Buying Opportunity, Analyst Says

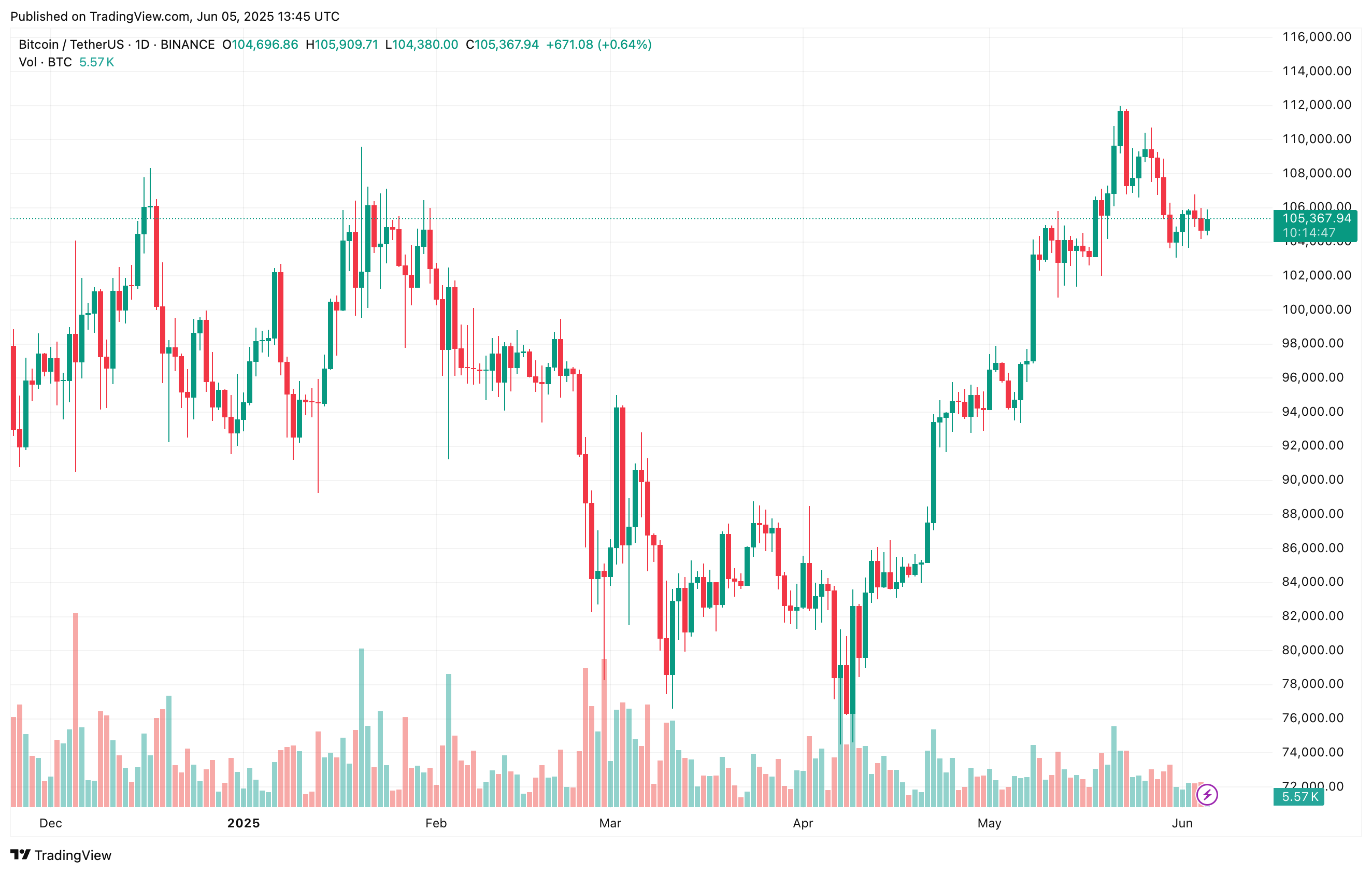

Bitcoin (BTC) remains range-bound in the mid-$100,000s, showing no clear directional bias. However, the Hash Ribbons indicator is now flashing a fresh buy signal, suggesting that the top cryptocurrency may be gearing up for its next upward move.

Bitcoin Hash Ribbons Flash Buy Signal

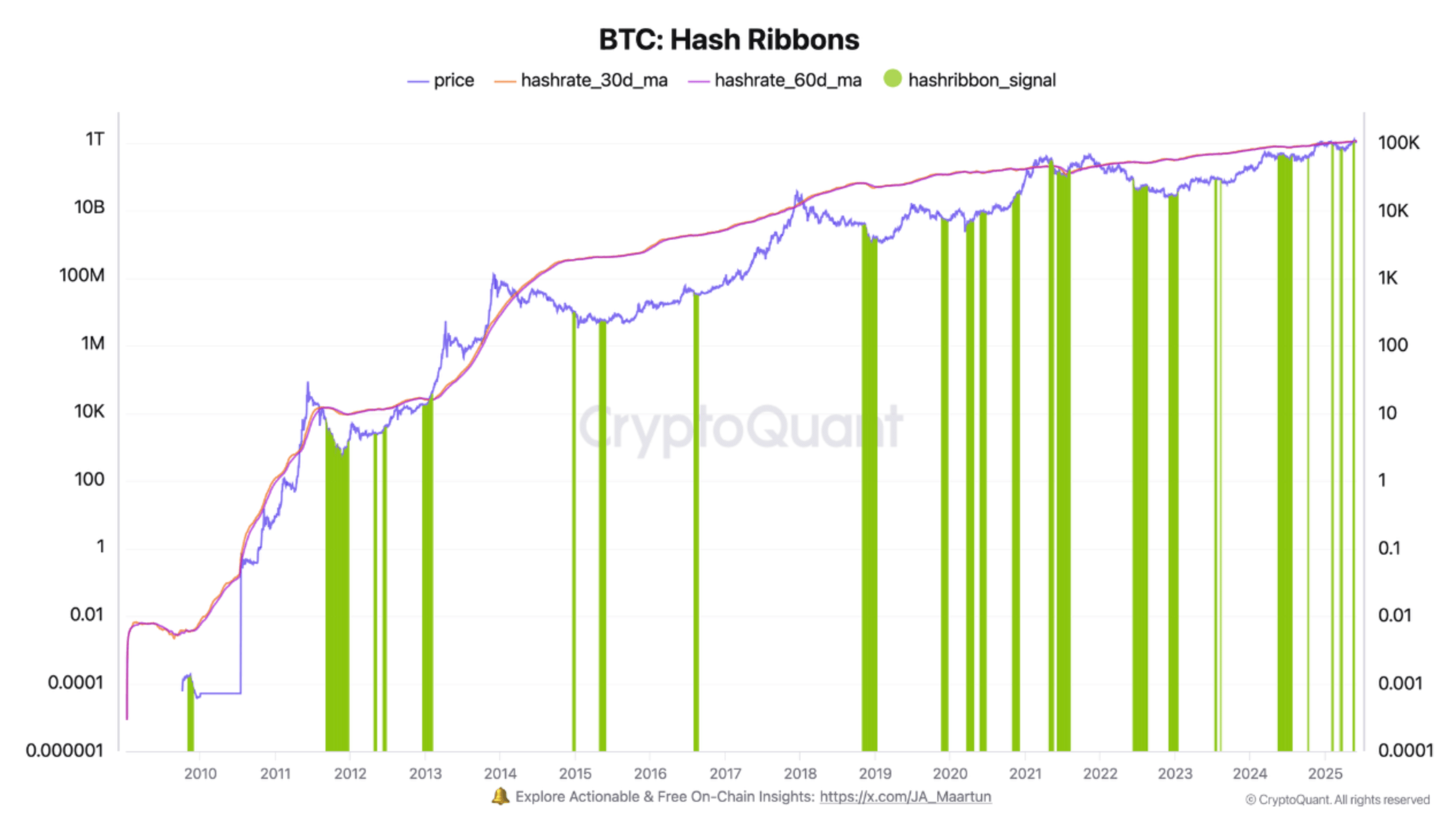

According to a recent CryptoQuant Quicktake post by contributor Darkfost, Bitcoin’s Hash Ribbons are signalling a potential prime buying opportunity for the leading digital asset. This signal coincides with Bitcoin’s hashrate reaching new all-time highs (ATH).

For the uninitiated, Bitcoin Hash Ribbons is an on-chain indicator that analyzes miner stress by comparing the 30-day and 60-day moving averages of Bitcoin’s hashrate. When the short-term average crosses above the long-term average after a period of decline, it signals that miner capitulation is ending – often marking a strong long-term buying opportunity.

Such signals can emerge when mining becomes unprofitable for certain miners, forcing them to sell their BTC holdings to stay afloat. These sell-offs may temporarily pressure the price, but historically they have created attractive long-term buying opportunities.

In their analysis, Darkfost notes that while the current signal is bullish from a long-term perspective, it could lead to a short-term pullback in BTC price. However, he emphasizes that any dip should be viewed as a chance to accumulate.

Darkfost also pointed out that the Hash Ribbons indicator has historically been reliable, with the exception of 2021 during the China mining ban. They shared the following chart illustrating how the indicator is currently showing a strong buy signal.

Is BTC Headed For A Crash?

While the Hash Ribbons suggest a favorable long-term setup, some analysts warn that the short-term correction could be deeper than expected. For instance, crypto analyst Xanrox used the Fibonacci levels to forecast that BTC may tumble as low as $98,000.

Similarly, analyst Jelle noted that Bitcoin may face “one last speed bump” before launching a major rally to $140,000. Meanwhile, more pessimistic voices continue to warn of a dramatic crash , with some speculating that BTC could fall below $10,000 – a view seen as increasingly unlikely by most market participants.

Despite the varying predictions, fresh on-chain data points to a healthy BTC market in the near to medium term. For instance, CryptoQuant contributor Amr Taha recently highlighted that the derivatives market has undergone a reset, with funding rates stabilizing around neutral levels.

Similarly, Fundstrat’s Head of Research, Tom Lee foresees BTC surging to as high as $250,000 by the end of the year. At press time, BTC trades at $105,367, up 0.5% in the past 24 hours.

Bitcoin Could Break The Dollar — $250K Prediction Still In Play, Billionaire Says

Tim Draper, a Silicon Valley venture capitalist, has doubled down on his call for Bitcoin to hit $25...

Bullish Signs For Ethereum: Metrics Pointing To Upcoming Breakout

The Ethereum (ETH) price experienced a significant decline on Thursday, falling over 7% and approach...

Bitcoin Cycle Top Is In—$270,000 Delayed Until 2026, Says Analyst

Bitcoin’s majestic 2024-25 ascent may have stalled at the very moment many traders expected an early...