Dormant Ethereum ICO Wallet Awakens with $5.2M Transfer

- A long-dormant Ethereum ICO whale transferred 2,000 ETH valued at $5.2 million to the exchange Binance.

- Ethereum exchange reserves are declining, and netflows remain negative, indicating accumulation.

- The cup-and-handle pattern is emerging in the ETH chart, and a move above the resistance price of 2,950 may spark a price increase.

An Ethereum whale with a long inactivity period has transferred its 2,000 Ether worth more than 5.2 million dollars to Binance, as Onchain Lens data shows. The crypto wallet associated with the ICO of Ethereum kept the tokens for almost 10 years.

The transfer is an 8,367x return on the original purchase of only $622. A smaller transaction was reported previously on a similar address with only 0.002 ETH, indicating a phase-by-phase reactivation.

The whale movement brings an element of mystery to the current state of Ethereum as the asset sits at around the mark of $ 2,552, lacking any momentum. The weekly returns are pegged at 1.02 percent, and the 24-hour turnover has decreased by 17.4% to 13.02 billion. According to analysts, the market is still in a consolidation period, waiting to get clear signals.

Exchange Behavior Shows Supply Dry-Up

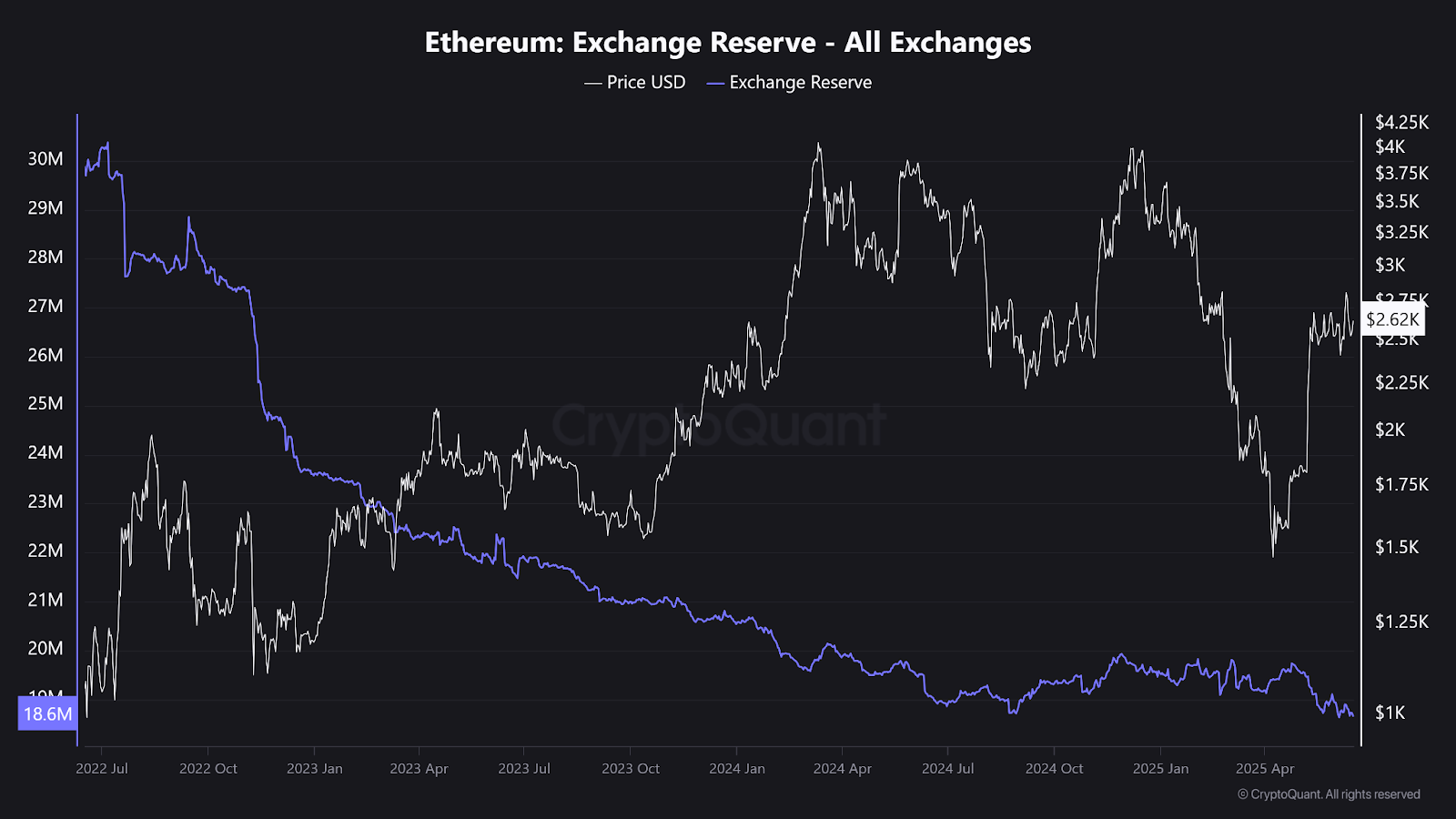

The on-chain indicators indicate that a constant Ethereum supply is leaving exchanges. According to CryptoQuant, the situation is even worse, with 18.6 million ETH currently in total exchange reserves as opposed to over 30 million in the middle of 2022. Such a steady decrease over two years marks a shifting interest in cold storage and staking over the exchange-based trading method.

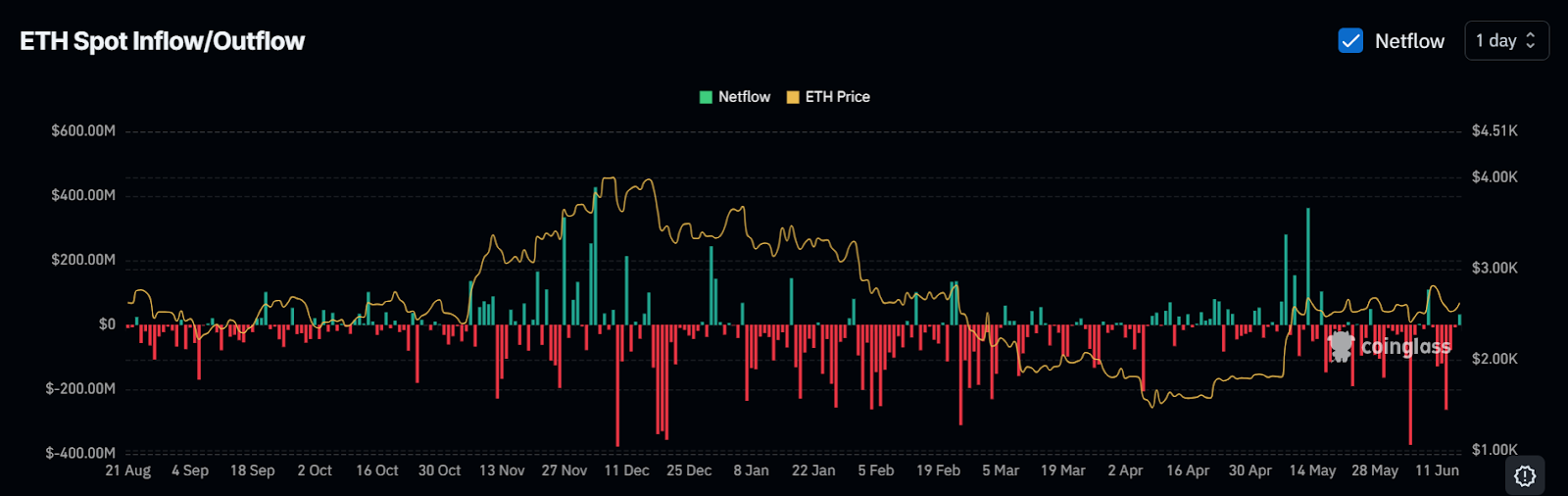

Netflows also support this transition. Coinglass daily inflow/outflow values reflect bossy conduct in netflows, recording an extensive period of negative netflows. The June outflow peaked significantly at the beginning of June, with several peaks of more than $200 million. In the meantime, inflows are few, signifying investors’ reluctance to deposit ETH on exchanges, not knowing which way to jump.

Accumulation tendency is also supported by exchange outflow volume. There was a significant amount of spiking in April and June 2025, with a single-day outflow of more than 2 million ETH with prices falling below 2,000. These moves tend to be accompanied by the smart money buying the dip as opposed to panicked selling.

Active Addresses Flat but Stable

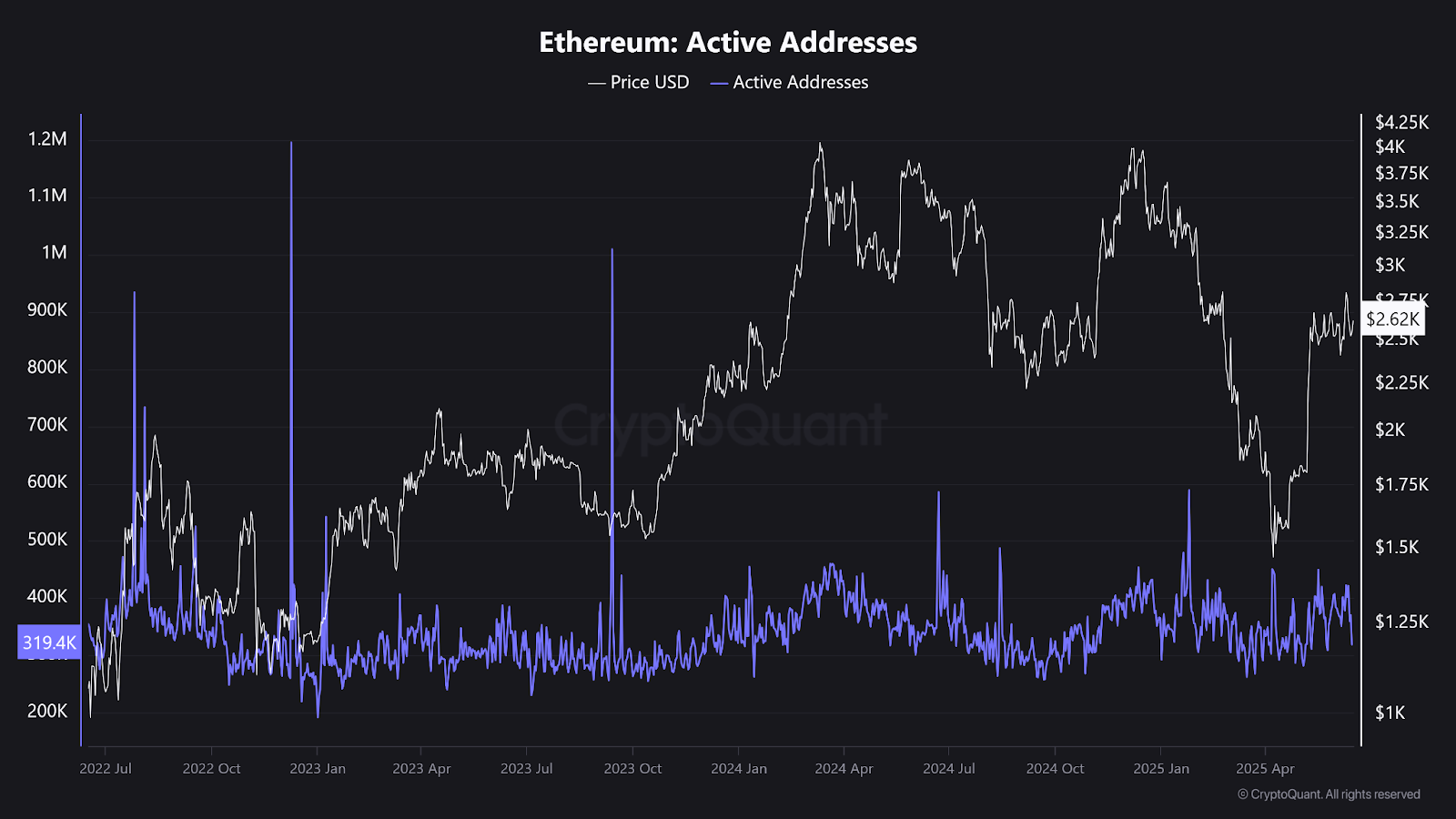

The active address count in Ethereum is stable despite fluctuating prices. The number is estimated to be between 400K and 600K, a consistent number of users. Although some days occasionally spike more than 1 million addresses, one can see steady on-chain transactions without speculative surges on most days.

This consistency in usage is an indication of a maturing network. The retail punting does not seem excessive, although the core participation of Ethereum is strong. It is likely a scenario where market participants wait to see the bigger picture of macro conditions and technical displays before taking bold steps.

Cup-and-Handle Pattern Suggests Breakout Potential

A cup-and-handle is developing on Ethereum’s weekly chart, and technical analysts are closely monitoring such a formation. The price declined between mid-2024 and the beginning of 2025 to create the cup at $2,000. In Q1 2025, a rounded handle started to form, and the price eased to approximately $2,530. Historically, such patterns promise accumulation before a breakout.

On the other hand, for Ethereum to break above its $2,950 resistance level, the expected target would be approximately $4,204 by the end of the year. That estimate corresponds to the depth of the pattern and what has happened in the market before.

Crypto Holds Firm as Geopolitical Turmoil Shakes Global Markets

Crypto investor Kyle Chassé notes Bitcoin and altcoins are surging while stocks fall as Bitcoin stay...

BNB Price Prediction 2025 Signals a $700 Breakout While Qubetics Builds Momentum

BNB eyes a $700 breakout amid ETF buzz and token burns, while Qubetics gains traction in RWA tokenis...

Major Crypto Token Unlocks This Week: ARB, VANA, ZK, APE, SAROS, and More Set to Drive Market Liquidity

The data highlighted major upcoming token unlocks in which multiple crypto assets including Arbitrum...

(@VipRoseTr)

(@VipRoseTr)