Bitcoin Setting Up For ‘Large Move’ Amid $103,000 Retest – Key Levels To Watch

Amid the tension in the Iran-Israel conflict, the cryptocurrency market experienced another daily pullback. Bitcoin (BTC), which had just recovered from Friday’s drop, erased its recent gains and recorded a 4.5% dip to the $103,000 mark in the past 24 hours. However, some analysts believe that the flagship crypto is preparing for a big move in the coming weeks.

Bitcoin Could See Massive Move Soon

On Monday, Bitcoin attempted to break its post-November range high but failed to hold the $108,000-$109,000 area as support for the fourth time in a month, falling back into its larger range.

Market watcher Daan Crypto Trades noted that this resistance level remains a key area to watch, adding that “without a clean break above, it’s not the time to get excited just yet.”

Nonetheless, the trader considers that the BTC is “setting up for a large move” as the cryptocurrency continues to hold its monthly range between $100,000 and $110,000.

He asserted that this range will break “at some point in June,” as well as the current weekly high and low, which have “a very low probability of being held” in the coming days.

Daan added that a break from these levels is highly possible in the next 1-2 weeks, likely leading to a big move in the direction of the break.

Analyst Sjuul from AltCryptoGems highlighted the crypto market’s performance and investors’ concerns amid the war-related headlines, noting that Bitcoin reacted in a similar pattern during past geopolitical and crypto-related events.

According to the analyst, global events’ uncertainty has led to mass liquidation and on-chain panic multiple times since 2020, leading to 30%-50% crashes. However, the market has recovered from these events after significant accumulation.

Here’s the pattern: Big event (Black Swan). Panic headlines. Sharp BTC dump. Retail Panic sells. Smart money buys. Time passes. Bitcoin hits new highs.

Based on this, Sjuul forecasted a strong Bitcoin pump and a new all-time high (ATH) once the current war tensions are over.

BTC Holds Key Support Amid Pullback

Meanwhile, analyst Rekt Capital emphasized that Bitcoin has been retesting its old range high as support for the past six weeks and showing stability around the $104,400 level during this period.

According to the analyst, as long as BTC’s price Weekly Closes above this level, the candle wicks below it are “just noise” and it is positioned to transition into its Second Price Discovery Uptrend.

He also pointed out that the cryptocurrency has only seen a less than 10% dip during the recent pullbacks. Moreover, these drop depths have also been diminishing, with the first rejection producing a 7.72% drop and the second dip being 5.79% deep, while the current rejection has seen a 4.5% retrace so far.

Rekt Capital considers the strongest support to be between the $102,000-$104,000 area, and the final level to break is the range high resistance of $108,890.

“As long as this resistance isn’t rejecting price too much, then maybe it’s getting weaker over time,” he affirmed, concluding that a weekly close above this level would be “a very strong sign for a reclaim of this resistance into new support to springboard price higher.”

As of this writing, Bitcoin is trading at $105,085, a 1.1% jump in the past hour.

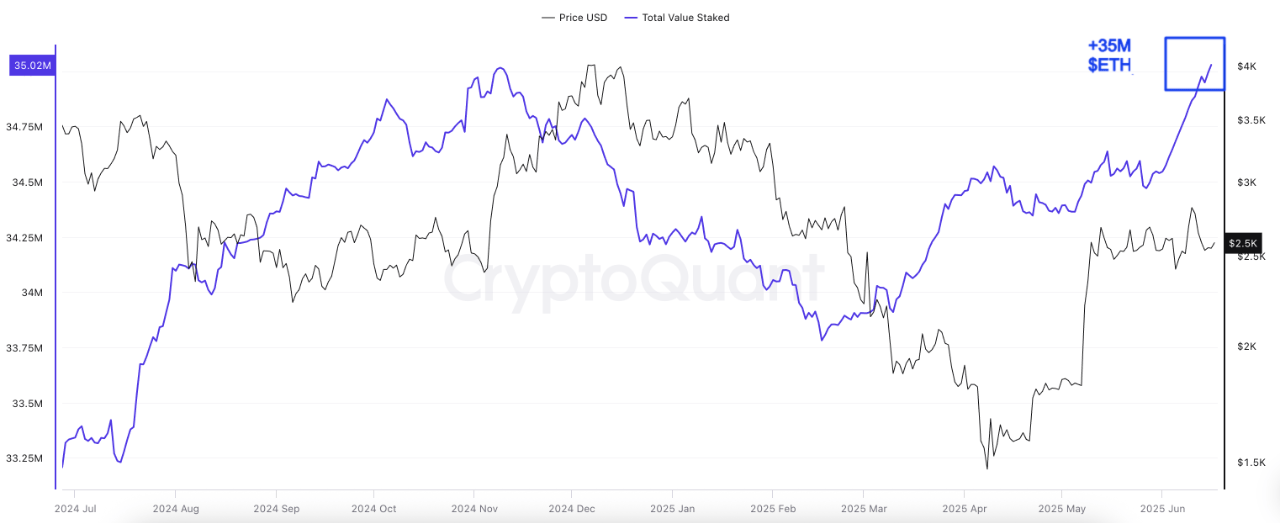

Ethereum Staking Hits 35M ETH: Is a Major Price Explosion on the Horizon?

Ethereum (ETH) has experienced a notable pullback after a brief period of upward momentum earlier th...

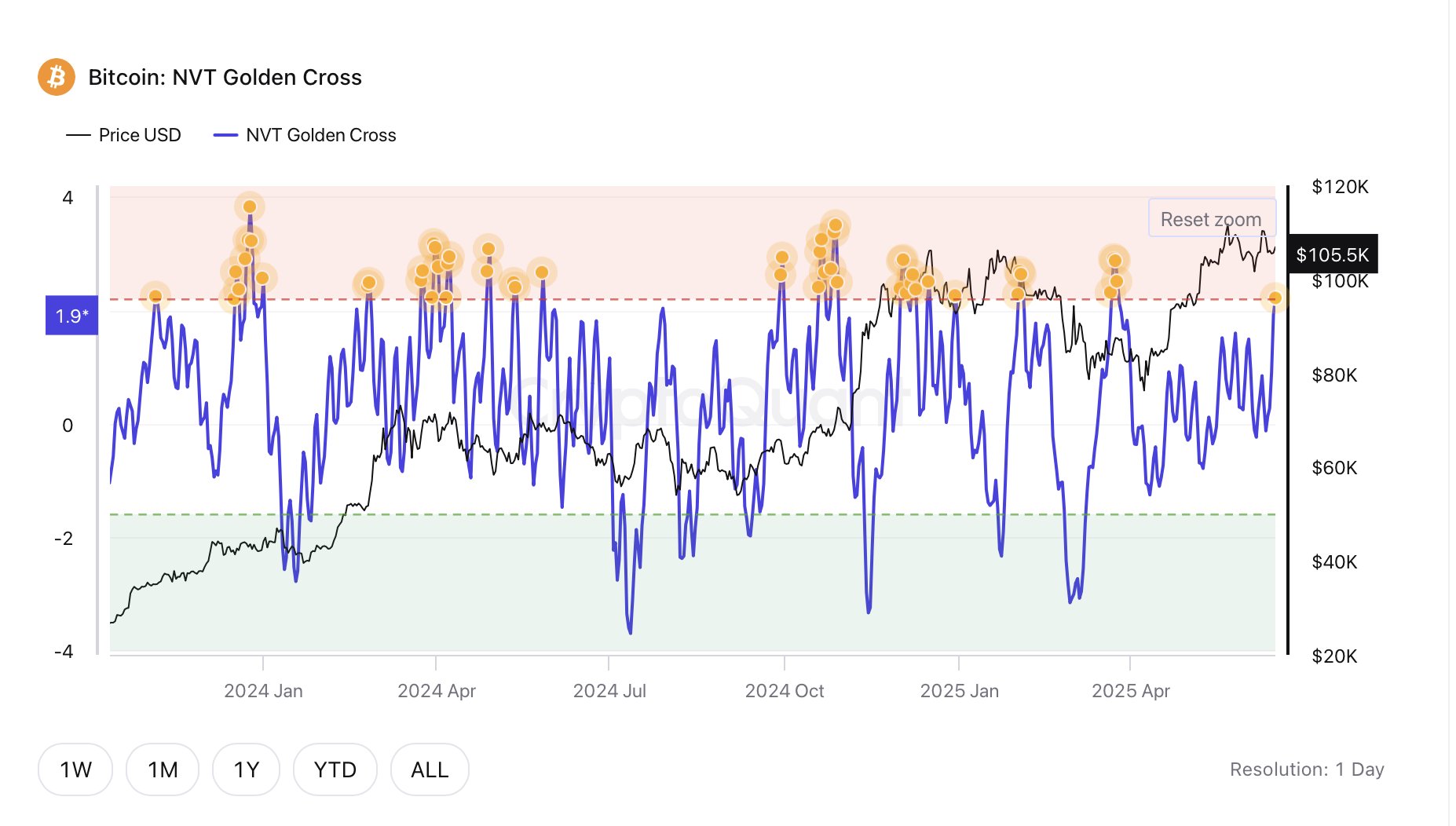

Bitcoin NVT Enters Reversal Zone: BTC Dangerously Overvalued?

On-chain data shows the Bitcoin Network Value to Transactions (NVT) Golden Cross has surged into a z...

Bitcoin Holds Below $110K as IBCI Suggests Market in Transition Phase

Bitcoin continues to trade in a range just below its recent all-time high, maintaining a relatively ...