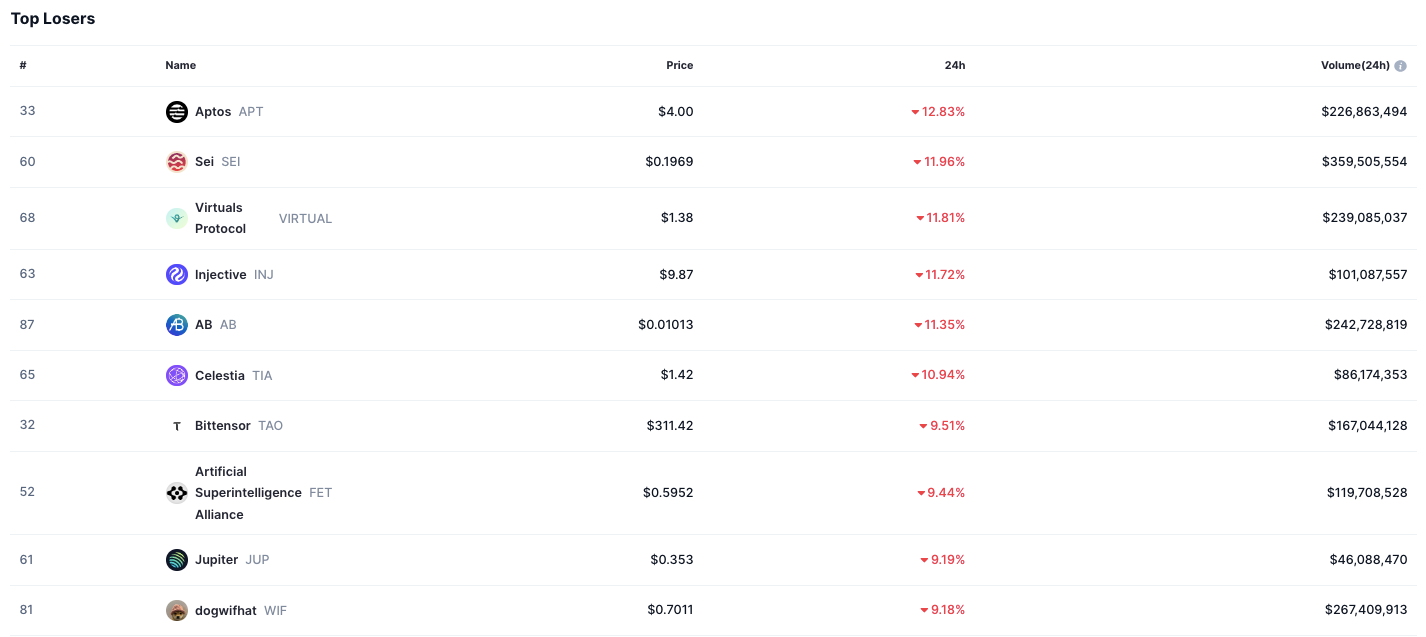

Crypto Market Sees Sharp Declines Amid Strong Trading Volumes

- Aptos leads losses with 12.83% drop amid strong $226.9M trading volume.

- Sei posts highest volume of $359.5M despite 11.96% price decline.

- Major liquidity persists as multiple tokens face double-digit price drops.

On June 22, 2025, the crypto market saw price declines across several digital assets, despite continued trading activity. Aptos (APT) led the downturn, falling 12.83% to $4.00. The token’s 24-hour trading volume stood at approximately $226.9 million, displaying active engagement even amid the price drop. This pattern of major liquidity paired with declining prices appeared throughout the market’s top losers.

Sei (SEI) registered an 11.96% loss, closing at $0.1969. Its 24-hour volume reached about $359.5 million, the highest among the tokens reporting losses, signaling considerable market participation. Virtuals Protocol (VIRTUAL) followed with an 11.81% decrease, trading at $1.38 alongside a volume of $239.1 million.

Injective (INJ) posted an 11.72% decline, priced at $9.87, with a 24-hour volume of $101.1 million. This adjustment adds to a broader trend affecting decentralized finance (DeFi) tokens. AB (AB) saw an 11.35% drop to $0.01013, while maintaining strong liquidity at $242.7 million in volume.

Additional Notable Tokens in Decline

Celestia (TIA) decreased 10.94%, settling at $1.42 with $86.2 million traded over the past day. Bittensor (TAO) recorded a 9.51% fall, trading at $311.42 with a volume of $167 million. Artificial Superintelligence Alliance (FET) declined 9.44% to $0.5952, accompanied by $119.7 million in volume.

Completing the top ten losers, Jupiter (JUP) fell 9.19%, closing at $0.353 with $46.1 million traded. Dogwifhat (WIF) dropped 9.18% to $0.7011, supported by $267.4 million in volume. The trading volume of Dogwifhat is among the potential higher liquidity rates in the midst of fading tokens.

These drops reflect ongoing instability in the crypto market as crypto assets experience price adjustments. Remarkably, some tokens maintained positive liquidity levels despite the negative price trends, which implies continued investor participation. Overall, the June 22 events suggest that the market is characterized by large trading activity at the peak of major sell-offs.

Top Crypto Gainers Today: GNS, OBOL, RBN, VGX, and Other Outperformers That Investors Are Targeting

Today's top gainers have come with different names, showing the dynamic within the market, active tr...

Binance Lists Humanity Protocol and Opens Futures and Alpha Trading

Binance to launch Humanity Protocol ($H) trading with futures, alpha access, and offering airdrop re...

PEPE Shows Signs of Life, HYPE Slides, and Web3 ai Sells Out 22.7B Tokens as AI Trading Buzz Grows

Check the PEPE price trend and Hyperliquid (HYPE) price drop. Web3 ai’s AI tools reshape trading. Se...