Israel, Iran Ceasefire Ignites Crypto Surge As Bitcoin Tops $106,000—Details

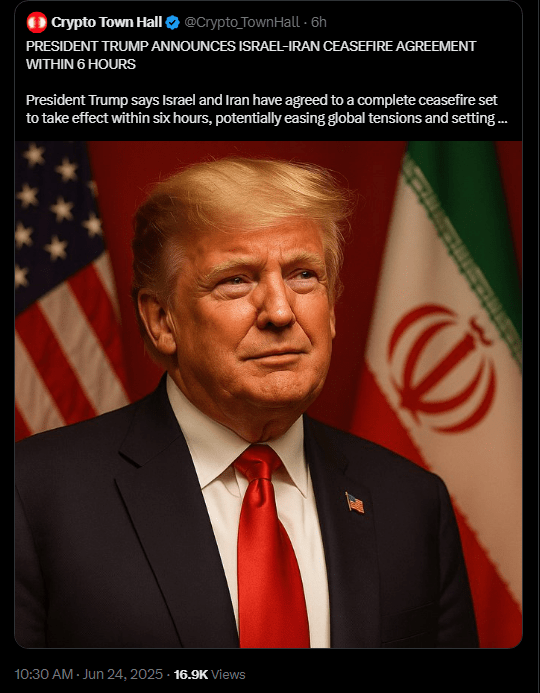

An unexpected peace in the Middle East created waves in the crypto market on 24th June, 2025. Iran and Israel agreed to cease hostilities , and US President Donald Trump termed it a “Complete and Total CEASEFIRE .”

The traders had waited days with their hearts in their mouths as missiles soared and oil anxiety mounted. Then peace talks took hold, and digital-asset markets responded almost as quickly as the news broke.

BREAKING:

TRUMP ANNOUNCES CEASEFIRE BETWEEN IRAN AND ISRAEL.

BULLISH FOR MARKETS!

pic.twitter.com/M9PZM9UsB8

— Crypto Rover (@rovercrc) June 24, 2025

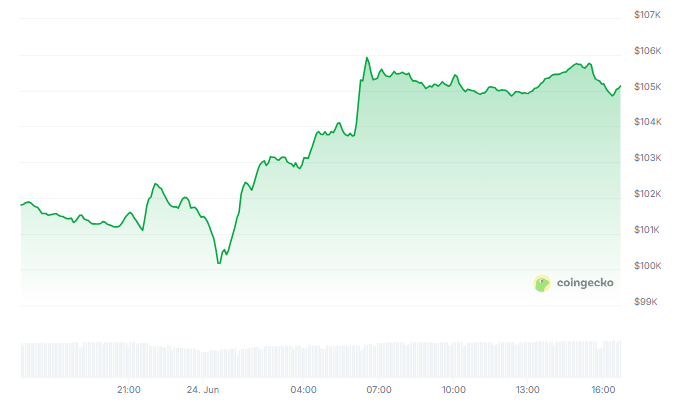

Bitcoin Breaks Through Key Level

According to reports, Bitcoin leapt more than 5% within minutes of the ceasefire announcement. It shot past $106,000 before settling just above $105,000.

That’s a sharp rebound after prices dipped below $99,000 at the height of the conflict. Investors who had been on the sidelines scrambled back in, driving trading volumes higher on exchanges worldwide.

Ethereum And Altcoins Move Up

Based on data from market trackers, Ethereum climbed over $2,400 in the hours following the news. A handful of smaller tokens also had a big day. Sei jumped 32%, while Dogwifhat surged 20%. Aptos wasn’t far behind, gaining about 10%. When the top coins gain traction, it often pushes smaller projects higher too, and today was no exception.

IRAN CONFIRMS CEASEFIRE AGREEMENT WITH ISRAEL

Iran has officially confirmed it has agreed to a ceasefire with Israel, signaling a critical de-escalation in one of the world’s most volatile conflicts. Markets may react swiftly to the easing geopolitical risk. https://t.co/1HKhmbqEGr pic.twitter.com/868bWekGte

— Crypto Town Hall (@Crypto_TownHall) June 24, 2025

The global cryptocurrency market cap reached $3.21 trillion, with a 4.40% increase in one session. Prior to the ceasefire, investors moved money into gold and the US dollar in case oil supplies were impaired.

“CONGRATULATIONS TO EVERYONE! It has been fully agreed by and between Israel and Iran that there will be a Complete and Total CEASEFIRE (in approximately 6 hours from now, when Israel and Iran have wound down and completed their in progress, final missions!), for 12 hours, at… pic.twitter.com/Tdj8bPUd0w

— U.S. State Dept – Near Eastern Affairs (@StateDept_NEA) June 23, 2025

As reports of peace circulated, those same investors funneled cash back into digital assets and equities. You could almost feel the relief in the tickers flashing green across trading screens.

Experts Cautious On Future

Experts Cautious On Future

Edul Patel, CEO of Mudrex, told reporters that the market had picked up “bullish momentum” after the ceasefire. He noted that some altcoins rallied as much as 13% in one day.

Market analysts pointed out how traders “bought the dip” when Bitcoin briefly tumbled under $99,000, helping it finish the day near $105,000.

Even so, they warn the calm may not be for long. A flare-up in the region or hints of a rate hike from the US Federal Reserve could send prices swinging again.

Traders are celebrating today’s gains, but there’s a sense of caution in chat rooms and trading floors. Peace is welcome, but stability in crypto often depends on more than a single announcement.

For now, though, the market is riding high—and investors are hoping that this ceasefire really does stick.

Featured image from Imagen, chart from TradingView

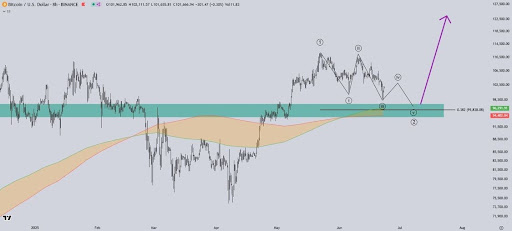

Bitcoin Elliott Wave Count Predicts Further Crash To $94,000, But What Next?

Bitcoin (BTC) has been facing significant volatility and downward pressure lately. However, analysts...

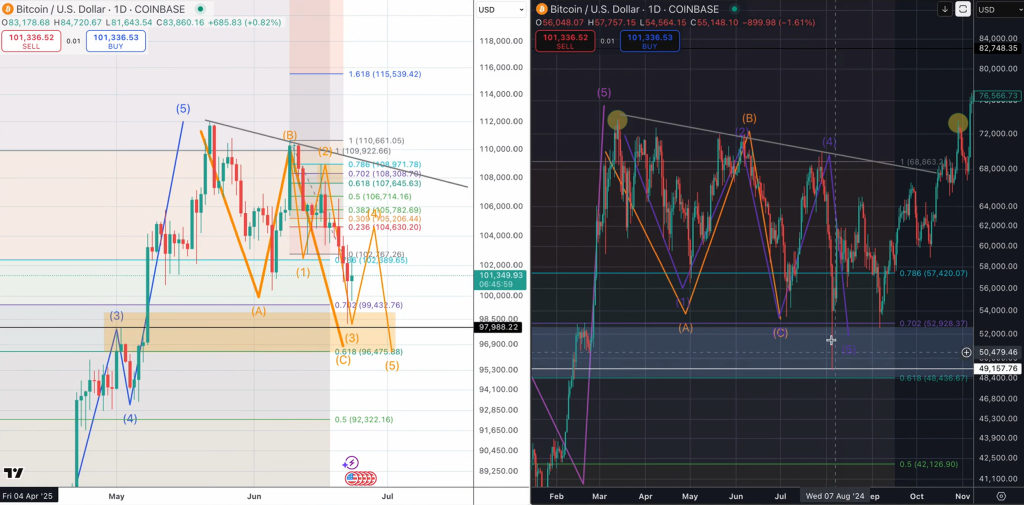

Bitcoin Repeats Its 2021 Pattern—Analyst Warns Final Crash Still Ahead

Bitcoin rallied above $105,000 in mid-morning European trading on Tuesday, clawing back losses susta...

Dogecoin About To Explode? ‘Don’t Send It Too Hard,’ Analyst Warns

The news that Iran and Israel have agreed to a ceasefire brokered by US President Donald Trump may h...