Bitcoin vs. Big Tech Amidst Market Turmoil

The rally in risk assets since the conclusion of a 12-day conflict has made for utterly bizarre volatility in the week ahead.

A housing regulator in the United States recently ordered financial institutions to include Bitcoin in their mortgage reserve holdings, which is an important turning point in the cryptocurrency's development.

Furthermore, the activity of Bitcoin treasury companies is accelerating during all of this.

On a broader scale, risk-on momentum has been increasing, as the Nasdaq 100 and the S&P 500 both reached fresh all-time highs.

A 3.5-day week in US markets due to Independence Day on Friday will offer plenty to judge.

Could Bitcoin Be the Next Big Thing?

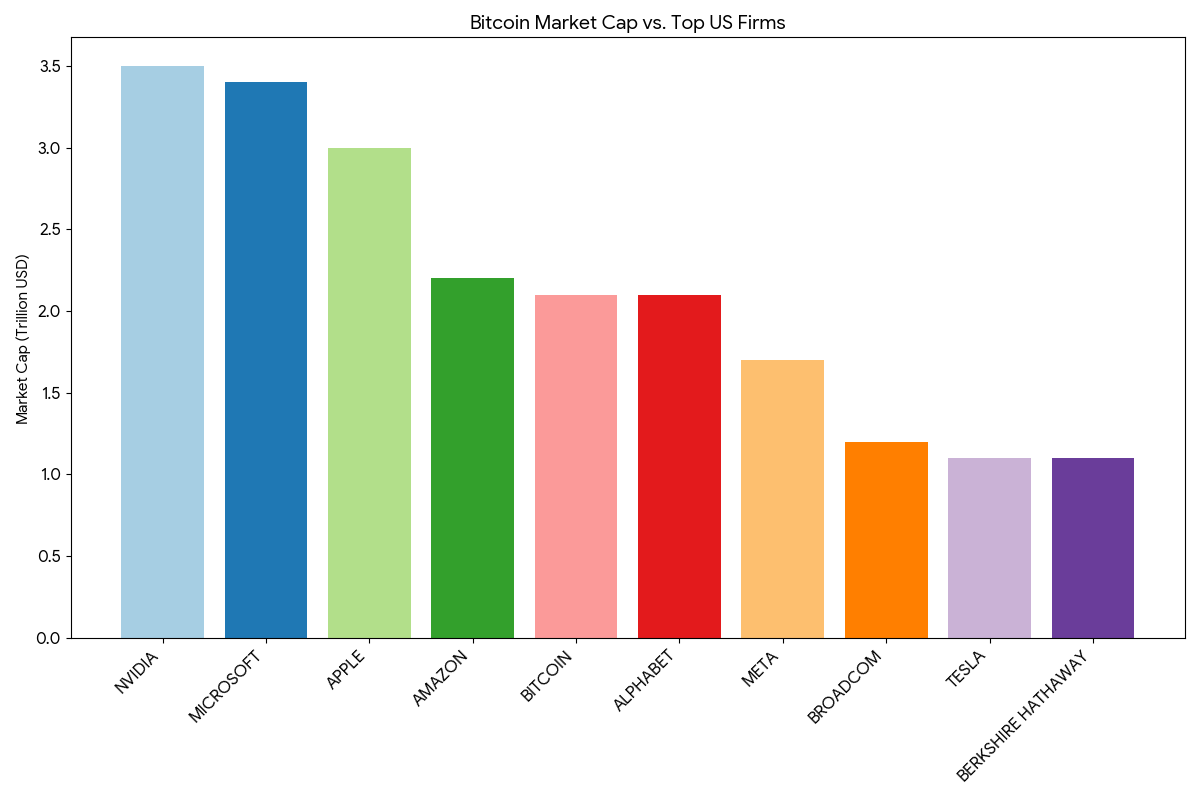

First, let's look at how Bitcoin is doing compared to big US firms. Thanks to Bitcoin's recent surge, the OG token's market valuation has reached an astounding $2.1 trillion, surpassing even the most illustrious corporations in the world.

But how does that translate to the bigger picture of the economy?

For one, US President Donald Trump himself spoke of Bitcoin as an economic tool. According to Trump, the United States is employing Bitcoin as a tool for economic warfare. "Takes pressure off the dollar" is more accurately described as a debt strategy than crypto excitement.

The government's goal in devaluing the currency is to increase the $33 trillion in debt. Crypto isn't a side project anymore but a mainstream instrument.

In the shadows, this is taking place: Grid buildouts are being financed by nation-states using Bitcoin as collateral. Bitcoin has been reclassified by capital markets as HQLA, or High-Quality Liquid Assets.

The US officially adopted the "digital gold" narrative as policy just recently. To those who persist in believing that "Bitcoin is poison," the battle is an older one.

Capital markets are very logical. They've gone now. How quickly you adjust is now more important than if.

A comparison with major tech companies and large US firms demonstrates that Bitcoin is currently on par with some of the world's most renowned corporations.

Let's put that comparison in context.

Compared to Berkshire Hathaway, Meta, and Tesla, Bitcoin's market value is higher. It's on par, if not better than Google's parent company, Alphabet. Even if it isn't yet as good as Apple, Microsoft, and Nvidia, it is catching up quickly.

The comparison highlights the profound influence of Bitcoin and the integration of crypto into the modern financial system. The $2.1 trillion asset class that began as a 2009 experiment in peer-to-peer cash is now competing with corporate behemoths.

Bitcoin vs. Traditional Assets

In contrast to businesses whose worth is proportional to sales, inventory, and customer satisfaction, the value of Bitcoin is based on:

- Utility decentralization and scarcity

- Adoption curves and market speculation

- Institutional demand and macroeconomic hedging

- Geopolitical worries and narratives about store-of-value

Bitcoin has gone from being on the periphery to center stage, thanks to rising institutional investment, integration into payment systems, and expanding worldwide use, particularly in nations where currencies are volatile.

Next Steps?

The market value of Bitcoin might eventually exceed that of Microsoft or Apple if its current trend continues. You can't deny this, whether you're orange-pilled or not:

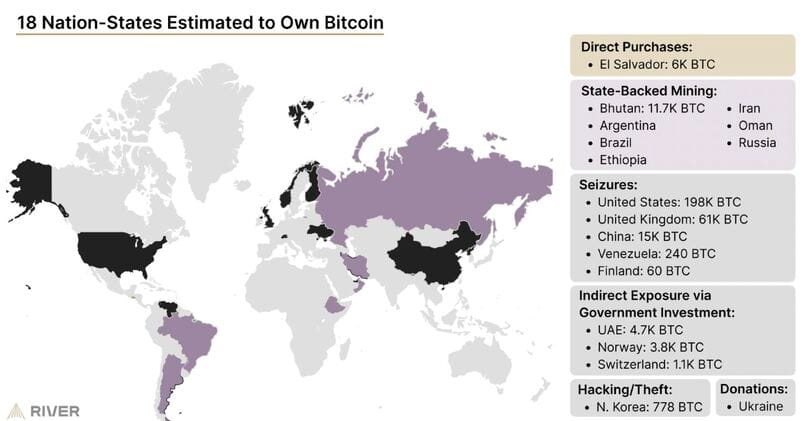

Bitcoin is justifiably turning into the most valuable asset in the world. It is now believed that 18 different nations have Bitcoin in their treasuries.

The European Union and developing countries, despite the latter's greater widespread use of Bitcoin, are conspicuously lacking.

That clearly shows a growing acknowledgement of Bitcoin as a mainstream asset.

Strategic Bitcoin Move Amidst Market Turmoil

Amid market uncertainty, Strategy—the biggest public Bitcoin investor in the world—made a daring move by purchasing 245 Bitcoin, valued at $26 million, on 23 June .

Despite short-term volatility caused by geopolitical anxieties, Strategy is confident in Bitcoin's long-term potential. This acquisition was made during a period when Bitcoin's price dropped significantly, from $108,900 to below $99,000. A week later, it

announced

it purchased 4,980 BTC for $531.9 million, marking eleven weeks of consecutive BTC acquisition

With these acquisition, Strategy has further demonstrated its passionate commitment to incorporating Bitcoin into its investment approach. The decision by Strategy highlights the increasing number of institutional investors including Bitcoin in their portfolios, taking advantage of market falls to potentially profit in the long run when financial markets encounter worldwide upheavals.

Given Bitcoin's growing legitimacy as an asset class, institutional investors influence on the cryptocurrency markets going forward is likely to build momentum.

Elsewhere

Blockcast

Ripple's Journey: From Payments to Financial Solutions

This week, host Takatoshi Shibayama interviews Eric van Miltenberg , SVP of Strategic Initiatives at Ripple, discussing the APEX 2025 conference, Ripple's evolution from a payment-focused company to a broader financial solutions provider, and the future of the crypto industry.

They explore the similarities between the internet boom and the current blockchain landscape, the importance of regulatory clarity, and the potential of tokenization in various sectors. Eric shares insights on Ripple's strategic acquisitions and the company's commitment to addressing real-world problems through innovative technology.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Whale Accumulation Continues - Why We Are Bullish Despite Short-Term Dip Expectations

Your daily access to the backroom....

Swyftx Acquires US-Focused Caleb & Brown in Largest ANZ Crypto Deal

Australian exchange targets wealthy American investors with $100M+ acquisition....

Malaysia Proposes Streamlined Digital Asset Exchange Rules

Securities Commission seeks public input on framework changes following RM13.9 billion trading surge...