Bitcoin and Ethereum ETFs See Strong Inflows, Reflecting Growing Investor Interest

- Ethereum ETFs show stronger net inflows than Bitcoin, signaling investor shift.

- Bitcoin ETFs see mixed performance, with some funds experiencing outflows.

- Total Ethereum holdings across ETFs increase by 45,980 ETH in a week.

Cryptocurrency-focused Exchange-Traded Funds (ETFs) are seeing large inflows in both Bitcoin (BTC) and Ethereum (ETH), showing ongoing institutional and retail interest. The data shows that while Bitcoin ETFs continue to hold a large share of market holdings, Ethereum ETFs are seeing stronger net inflows, signaling a shift in investor sentiment toward the second-largest cryptocurrency.

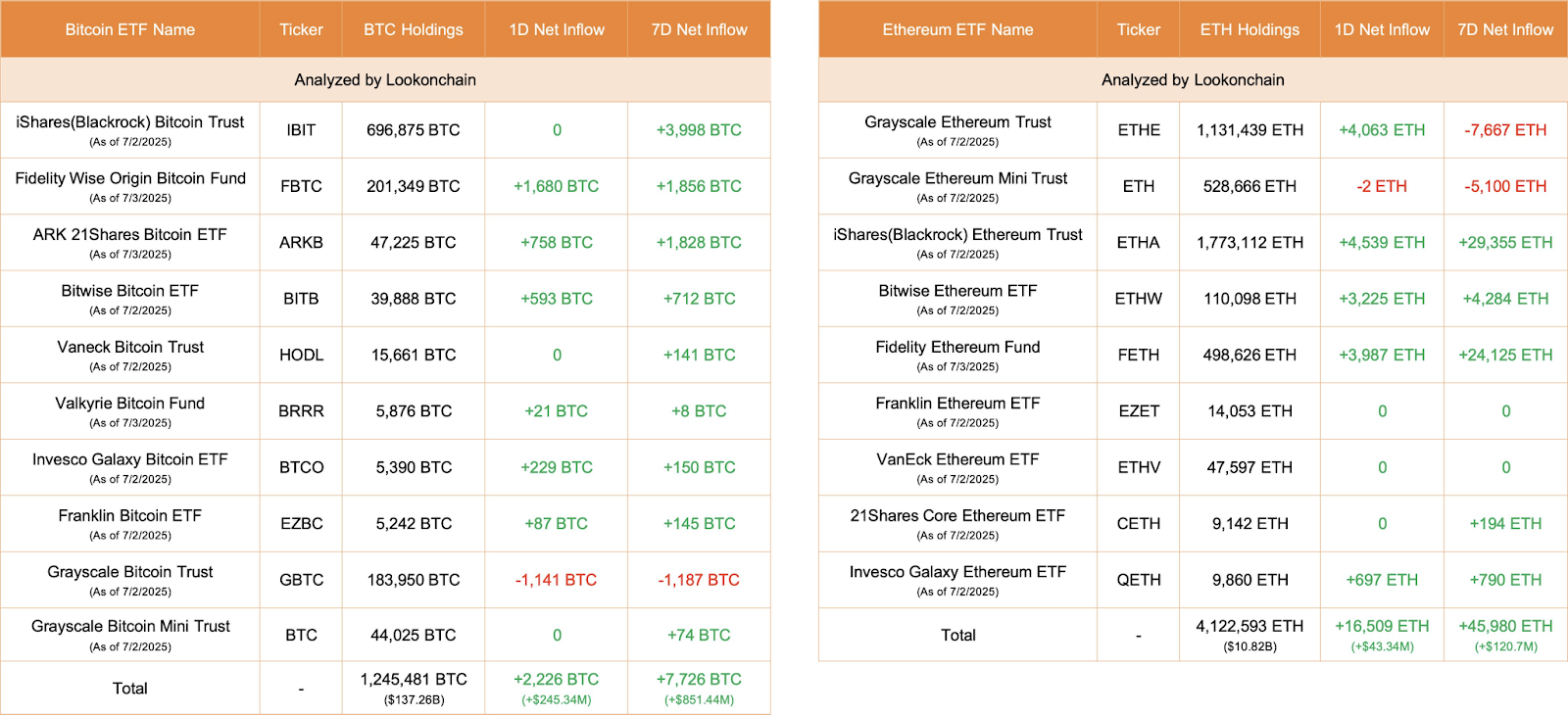

Bitcoin ETFs remain a core element of institutional interest in the crypto market. The iShares (BlackRock) Bitcoin Trust (IBIT) holds the largest amount of Bitcoin, with 696,875 BTC in its portfolio. Over the past week, this fund saw an inflow of 3,998 BTC, indicating continued demand.

The Fidelity Wise Origin Bitcoin Fund (FBTC) follows with 201,349 BTC and recorded a daily net inflow of 1,680 BTC. The ARK 21Shares Bitcoin ETF (ARKB) holds 47,225 BTC, adding 758 BTC in just one day. However, not all Bitcoin funds are seeing positive growth. The Grayscale Bitcoin Trust (GBTC), which holds 183,950 BTC, saw a decline in its holdings, with a net outflow of 1,141 BTC in the last 24 hours and 1,187 BTC over the past week.

Across all Bitcoin-focused ETFs, the total holdings have reached 1,245,481 BTC, showing a net weekly increase of 7,726 BTC. The overall net inflow for Bitcoin ETFs during this period is 2,226 BTC, which amounts to about $245.34 million. While Bitcoin maintains dominance in the ETF space, its performance is mixed, with some funds showing positive growth and others experiencing outflows.

Ethereum ETFs: Stronger Net Inflows and Growing Interest

Ethereum ETFs have shown greater growth in recent weeks. The Grayscale Ethereum Trust (ETHE), which holds 1,131,439 ETH, recorded an inflow of 4,063 ETH in the last 24 hours. However, it also experienced a net outflow of 7,667 ETH over the past week.

Conversely, the iShares (BlackRock) Ethereum Trust (ETHA) presently has 1,773,112 ETH, with a daily inflow of 4,539 ETH. This fund also recorded huge weekly growth of 29,355 ETH, indicating the continuation of investor interest. Bitwise Ethereum ETF (ETHW) has been experiencing a steady increase in inflow (4284 ETH in the last week), which is an indicator of positive investor sentiment.

The cumulative Ethereum holdings in all ETFs currently are 4,122,593 ETH, and the net growth during the week is 45,980 ETH. This adoption has marked Ethereum as having high growth regarding institutional adoption. Ethereum ETFs have registered heavier inflows compared to Bitcoin, an indication that Ethereum has generated more interest as a significant asset in the cryptocurrency ecosystem.

The rising investments in Bitcoin and Ethereum ETFs indicate the increasing institutional presence in the world of cryptocurrencies. Even though Bitcoin has a total holding of 1,245,481 BTC, Ethereum is recording a more intense momentum, as 45,980 ETH increased per week in its net move.

Mocaverse and Elympics Team Up to Bring Verifiable Identity to Web3 Gaming

This Mocaverse and Elympics partnership aims to incorporate AIR Kit of Mocaverse into Elympics to of...

Terminus and BIXOS Partner to Transform Real-World Assets with Web3

Terminus and BIXOS partner to tokenize real-world assets (RWAs) as boosting global access, transpare...

AscendEx x Dechat: A Big Strategic Move Towards Secure, Decentralized Communication

Recently, the major crypto exchange AscendEx made a formal announcement of its partnership with Dech...