XRP Could Hit $35 If It Captures A Quarter Of Remittance Market By 2029

XRP slipped to around $2.22 on July 7, marking a quiet session for the token. That price sits well below what many crypto backers think it should be.

They point to XRP’s speed, its ability to handle thousands of transfers every second, and a growing list of real‑world partnerships as reasons it’s undervalued.

XRP Eyes A Slice Of Remittance Market

According to recent projections, the global remittance industry will swell from $783 billion in 2024 to $833 billion in 2025, growing at about 6.4% a year. That same pace is expected to push the total to roughly $1.06 trillion by 2029.

Based on reports, if XRP captures 25% of that market and investors value its network at twice its annual volume—similar to big payments firms—the token’s market cap would hit $534 billion. With about 60 billion XRP in circulation, each coin would be worth $8.90.

Ripple Expands Global Ties

Ripple has been busy lining up deals in places that move lots of money overseas. Brazil, Mexico, the UAE, Saudi Arabia, Vietnam, and the Philippines are all on the list.

In these markets, people sending cash home often face high fees and slow transfers. XRP’s consensus system lets banks and money‑transfer firms settle payments in seconds, not days. That speed could help push adoption even higher.

Legal Clarity Boosts Confidence

Legal Clarity Boosts Confidence

Based on court rulings, the US now treats XRP sales to retail buyers as not being securities. That change opens the door for more banks and payment companies to jump in without fear of a legal sting. It also gives some larger investors more confidence to hold XRP long term.

Purely on network‑value math, XRP at $8.89 would already be a four‑fold jump from $2.22. But crypto markets often bid up tokens beyond those simple models. If growing adoption brings a 4× “demand premium,” XRP could climb all the way to $35.56 by 2029.

That scenario assumes Ripple’s partnerships scale up, regulatory risks stay low, and investors see XRP as a must‑have tool for cross‑border payments.

Key Risks And VariablesNothing is guaranteed. Market sentiment can swing. Token emissions from escrow or new supply changes could hurt the price. And if banks take longer than expected to roll out XRP‑based services, demand could lag.

On the flip side, more use cases—like tokenized assets or on‑demand liquidity—could boost real‑world volume and push the price even higher.

Featured image from Meta, chart from TradingView

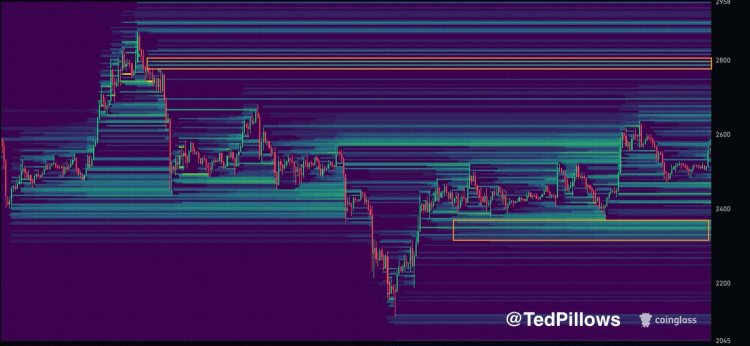

Ethereum Range Tightens – Liquidity Looms At $2,800 And $2,350

Ethereum is approaching a pivotal moment as it pushes to reclaim the $2,600 level, aiming to break f...

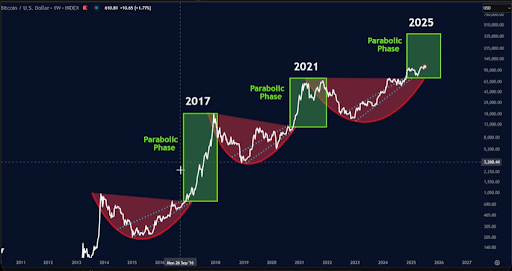

Bitcoin To Repeat Parabolic Phase From 2017 And 2021? Here’s The Target

Bitcoin is currently on the path to holding a strong footing above $109,000 after reclaiming the $10...

Ethereum Breaks Higher With Conviction: No Signs Of A Breakdown Yet

Bankr, in a recent update, pointed out that Ethereum is maintaining its upward momentum, backed by s...