Broader Markets Refuse to Budge to Trump Tantrums

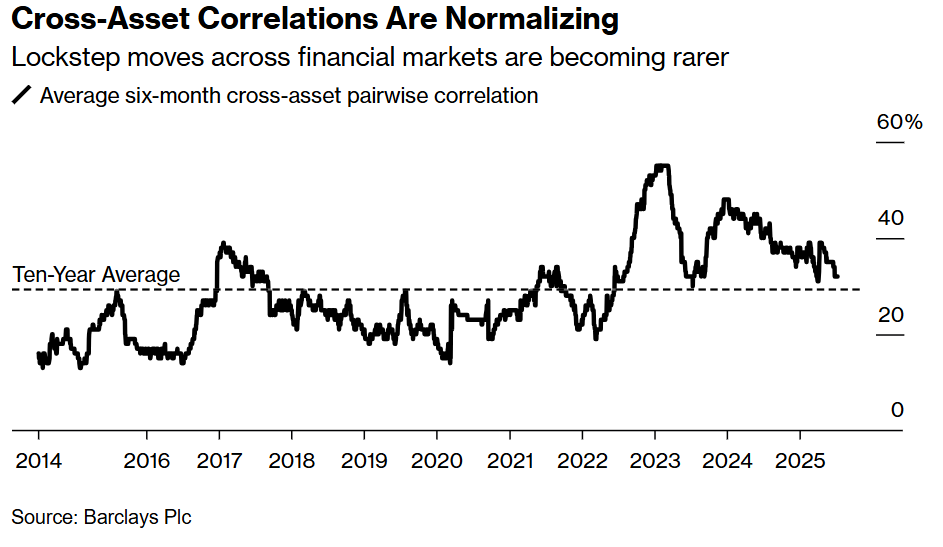

One perspective to consider of why the markets are not buckling under Trump's economic broadsides is through the analysis of cross-asset correlations: the extent to which equities, bonds, credit, and commodities exhibit synchronized movements.

The correlation that has characterized market dynamics over the last three years, driven by inflation and Federal Reserve policy dominating the news cycle, has now reverted to its 10-year average. Notably, the cryptocurrency market is demonstrating robust performance amidst this evolution, highlighting its growing maturity and distinct characteristics.

The latest crypto market data underscores this trend:

- Bitcoin Spot ETFs: Saw a $131 million outflow, bringing an end to a 12-day inflow streak. Despite this, Bitcoin remains a key player, currently trading at $117,254, down 1% in 24 hours but up 0.08% in the past 7 days. Bitcoin recently crossed the $120,000 mark and reached a new all-time high of approximately $123,150 on July 14, 2025, buoyed by strong institutional demand and regulatory clarity.

- Ethereum Spot ETFs: Continue to attract significant momentum with a substantial $297 million inflow, extending its streak to 12 consecutive days of inflows. Ethereum is currently changing hands at $3,686, down 2.33% in 24 hours but remarkably up 24.41% in the past week. Ethereum's all-time high was $4,891.70 on November 16, 2021.

- Solana (SOL): Is trading at $196.97, showing strong 24-hour performance with a 5% increase and a 22.99% gain over the past 7 days. Solana's all-time high reached $293.31.

- The global crypto market cap stands at $3.88 trillion, reflecting a 1.13% decrease in the last 24 hours, yet having recently touched a record $4 trillion.

This shift in cross-asset correlations means that high-yield bonds are no longer mirroring short-term Treasuries, and equities are decoupling from interest rate movements. Equities are no longer moving in tandem with interest rates. Gold, often seen as a safe-haven asset, has reasserted its role as a valuable diversifier, demonstrating a clear separation from Treasuries and credit markets, surging towards $3,400/oz and now up an impressive +27% year-to-date.

As we embark on a robust corporate earnings season, the outlook appears promising. That represents a well-balanced economy, where no single factor holds overwhelming influence.

As inflation fears subside, the traditional links between assets are weakening, allowing investors to focus on tangible fundamentals rather than just policy maneuvers. This represents a more balanced economy where no single factor holds overwhelming influence.

Normalizing Cross-Asset Correlations?

In essence, stock performance is driven by earnings rather than overarching economic worries. The risk premiums associated with corporate debt are indicative of the underlying balance sheets rather than solely influenced by central bank communications. Consequently, the markets are not governed by fear; rather, they are demonstrating a coherent internal rationale.

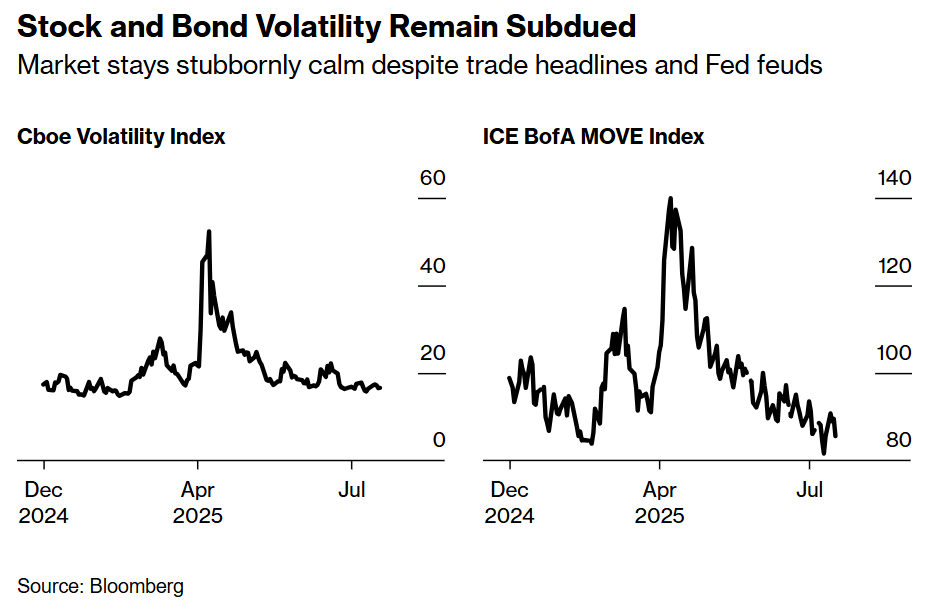

Last week exemplified this newfound stability. Despite President Donald Trump's criticisms of Fed Chair Jerome Powell and differing opinions among central bankers regarding interest rates, markets remained largely unfazed. The S&P 500 rose 0.6%, marking a notable 17-day period without fluctuations exceeding 1 percentage point in either direction. Even a long-duration Treasury ETF saw only a modest decline of 0.6%. In the crypto space, Bitcoin remained near its all-time highs, showcasing its own resilience.

Subdued responses have brought a gauge of asset co-movement monitored by Barclays back to levels reminiscent of those before the Fed initiated its rate-hiking strategy three years ago.

The metric, emphasizing the relationships between government bonds, credit, stocks, and commodities, reached an unprecedented 55 percent in March 2023, during a period when inflation-driven synchronized movements were adversely affecting investors across various asset classes.

Currently, it stands at 32%, which is approximately the average observed over the last ten years.

Markets navigated a critical juncture in April following the president's change in direction.

There is a perception among stakeholders that he lacks the confidence to engage with the stock market and is hesitant to implement policies that may be unfavorable in a volatile market environment.

Based on the headlines, this might be an unusual moment for stability to emerge.

Market fluctuations have been frequent, characterized by sudden tariff threats, currency fluctuations, and political tensions surrounding the Federal Reserve.

The shift lies not in the noise itself, but in the manner in which markets integrate it.

Since the lows in April, the S&P 500 has experienced a remarkable 26% increase, while Bitcoin has impressively surged by over 50%, demonstrating strong independent trajectories. This persistent surge in high-risk assets, even in the face of tariff concerns and economic uncertainty, has contributed to the decoupling of asset correlations, including those within the broader financial landscape and with digital assets.

However, in such seemingly serene and logical markets, any genuine disruption could have a more significant impact. It remains premature to consider bonds a universal hedging solution. A multitude of overarching concerns – including inflation, excessive government spending, climate issues, demographic changes, and deglobalization – still threaten to disrupt sentiment. The outlook for structural upward pressures on inflation levels and volatility suggests that cross-asset correlations may remain elevated for the foreseeable future, even if the current trend is normalizing.

Nevertheless, the current reset in correlation has assuaged concerns for those managing diverse portfolios and restored confidence in the benefits of diversification. This year, the traditional 60/40 portfolio has seen a 6% increase, while the Cambria Global Asset Allocation ETF, encompassing a mix of stocks, bonds, real estate, and commodities, has risen by 9%. Given the anticipated moderation in inflation and robust economic performance, the prevailing conditions offer minimal room for unexpected developments.

Earnings to Drive Markets

The June-quarter earnings season has commenced with impressive momentum, driven by consumer strength that is bolstering robust corporate profits.

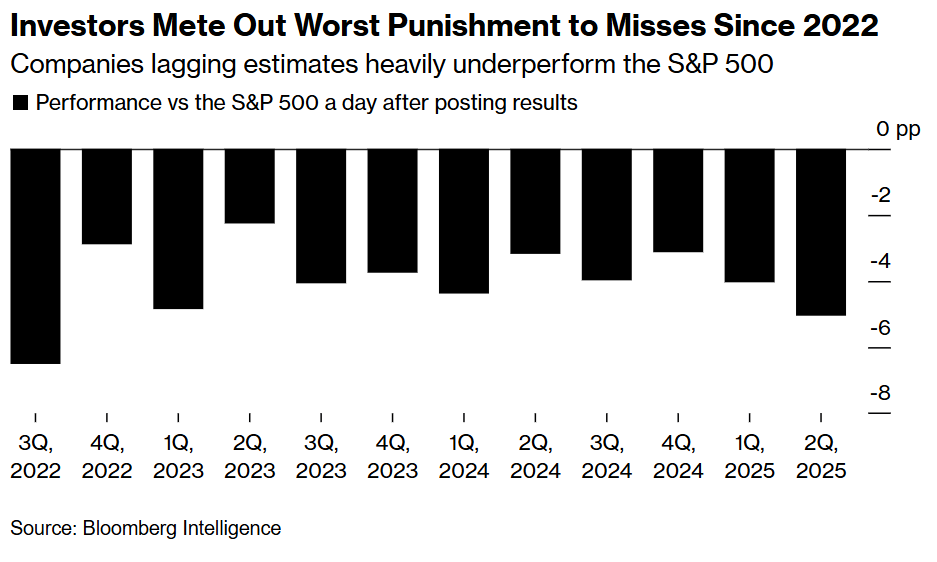

The response in the stock market has been relatively subdued, which suggests that a significant portion of the positive developments may already be reflected in the prices, leading to a backlash against any disappointments.

Data from Bloomberg Intelligence indicates that the market is currently reacting more severely to earnings results that miss expectations than it has in almost three years. In this environment, only a select few companies are being rewarded for surpassing both profit and revenue expectations this year.

The S&P 500 Index closed near its all-time high on Friday, achieving seven new records in just 15 sessions. The Wall Street benchmark currently trades at 22 times anticipated profits over the next 12 months, nearing the level reached in February before the implementation of global tariffs in April.

Given the persistent uncertainties—particularly regarding tariffs, economic growth, inflation, and the Federal Reserve’s strategy for rate cuts—the insights from corporate earnings will be crucial in shaping investor confidence moving forward.

For the cryptocurrency market, the Fed's actions, especially potential rate cuts, remain a significant focus, with many market participants betting on a direct correlation between such moves and a boost to Bitcoin and the broader crypto ecosystem.

Elsewhere

Blockcast

Future-Proofing Crypto: Quranium's Quantum Revolution

This week, host Takatoshi Shibayama speaks to Kapil Dhiman, co-founder and CEO of Quranium , a quantum-proof blockchain founded in 2024 that combines AI-native architecture, EVM compatibility and quantum security. They discuss Kapil's journey from a CPA to an entrepreneur in the blockchain space, the significance of quantum computing, and the dual nature of technology – its potential benefits and risks. Kapil emphasized the urgency of preparing for a quantum future, the importance of security in digital assets, and the roadmap for Quranium's innovations in creating a secure environment for cryptocurrency.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Eric van Miltenburg (Ripple), Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Corporate Buying and Trump’s Genius Act Provide Long-Term Tailwinds But We're Preparing for a Short-Term Dip

Your daily access to the backroom....

Polymarket Acquires CFTC-Licensed Exchange for $112 Million to Re-Enter U.S. Market

World's largest prediction market buys QCEX to enable regulated trading platform for American users ...

BitGo Files Confidentially for IPO as Crypto Companies Rush to Go Public

Custody giant joins wave of crypto IPO filings amid regulatory clarity and sector growth, following ...