Crypto Founder Reveals What Will Drive Ethereum Price To $10,000

BitMEX co-founder and crypto investor, Arthur Hayes , has outlined the key catalysts that could drive the Ethereum price to a $10,000 all-time high by year-end. In a detailed market analysis, Hayes explains how expanding US credit policies, growing institutional interests, and a shift toward wartime economic strategies could create the ideal conditions for a major ETH price rally.

Ethereum Price Set To Hit $10,000 By Year End

On July 23, Hayes published an in-depth report on Substack, analyzing geopolitical trends and how they could create the ideal conditions for a major Ethereum price surge . The crypto founder has set a bold target of $10,000 for ETH by the end of 2025, attributing the future rally to macroeconomic shifts and increasing institutional appetite .

Hayes believes that as the US leans further into wartime economic policies under President Donald Trump’s reign, a wave of credit expansion could be unleashed—fueling “asset bubbles,” particularly in crypto. According to the BitMEX co-founder, Ethereum could benefit most from this environment.

While Bitcoin remains the crypto reserve asset , Hayes notes that ETH has been largely overlooked since Solana’s explosive rebound post-FTX . However, he asserts that the tides are turning, especially among Western institutional investors who are starting to favor Ethereum-based assets. The crypto founder pointed to growing confidence in Ethereum from financial influencers like Tom Lee and a renewed interest in DeFi ecosystems as early signs of a potential breakout.

Hayes’ venture capital firm, Maelstrom , is now also fully committed to ETH and the broader ERC-20 ecosystem. He has declared that the next ”Ether bull run” is imminent, forecasting a 176.3% rise from ETH’s current price of $3,619. Alongside his $10,000 Ethereum target, the crypto founder projected that Bitcoin could skyrocket to $250,000 before the end of the year.

ETH Rally Tied To US Economic And Wartime Developments

In his report, Hayes seemingly connects Ethereum’s upside potential to a broader macroeconomic narrative rooted in fiscal policy and geopolitical conflict. He argues that the US is shifting toward a form of state-sponsored capitalism or economic fascism designed to fuel wartime production.

According to the crypto founder, this strategy encourages banks to lend freely to companies without government-guaranteed profits. He noted that when the fiat supply increases without a corresponding rise in raw materials or labor, inflation becomes unavoidable. To manage this, he suggests the government may need to blow bubbles in non-essential assets like crypto, to absorb excess credit without destabilizing essentials like food or housing.

Furthermore, Hayes believes that just as Ethereum stands to benefit from this environment, stablecoins may play a key role in building it. As the crypto market cap grows, so does the amount stored in stablecoins, most of which are reinvested into US Treasury bills . For instance, if the market cap of crypto hits $100 trillion by 2026, the BitMEX co-founder predicts that stablecoins could indirectly fund trillions in government debt, ultimately making crypto an integral player in sustaining wartime fiscal policies.

Billionaire Mike Novogratz Says Ethereum Will Enter Price Discovery If It Takes Out This Level

Ethereum has been gaining ground in recent times, especially among institutional investors, as they ...

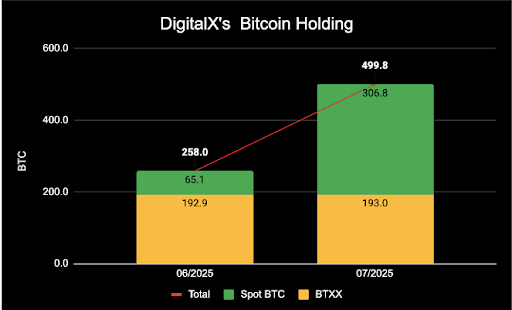

This Australian Investment Manager Just Added Bitcoin To Its Treasury, Here’s How Much BTC They’ve Bought

DigitalX Limited, an Australian digital Investment manager, has made headlines with a new Bitcoin (B...

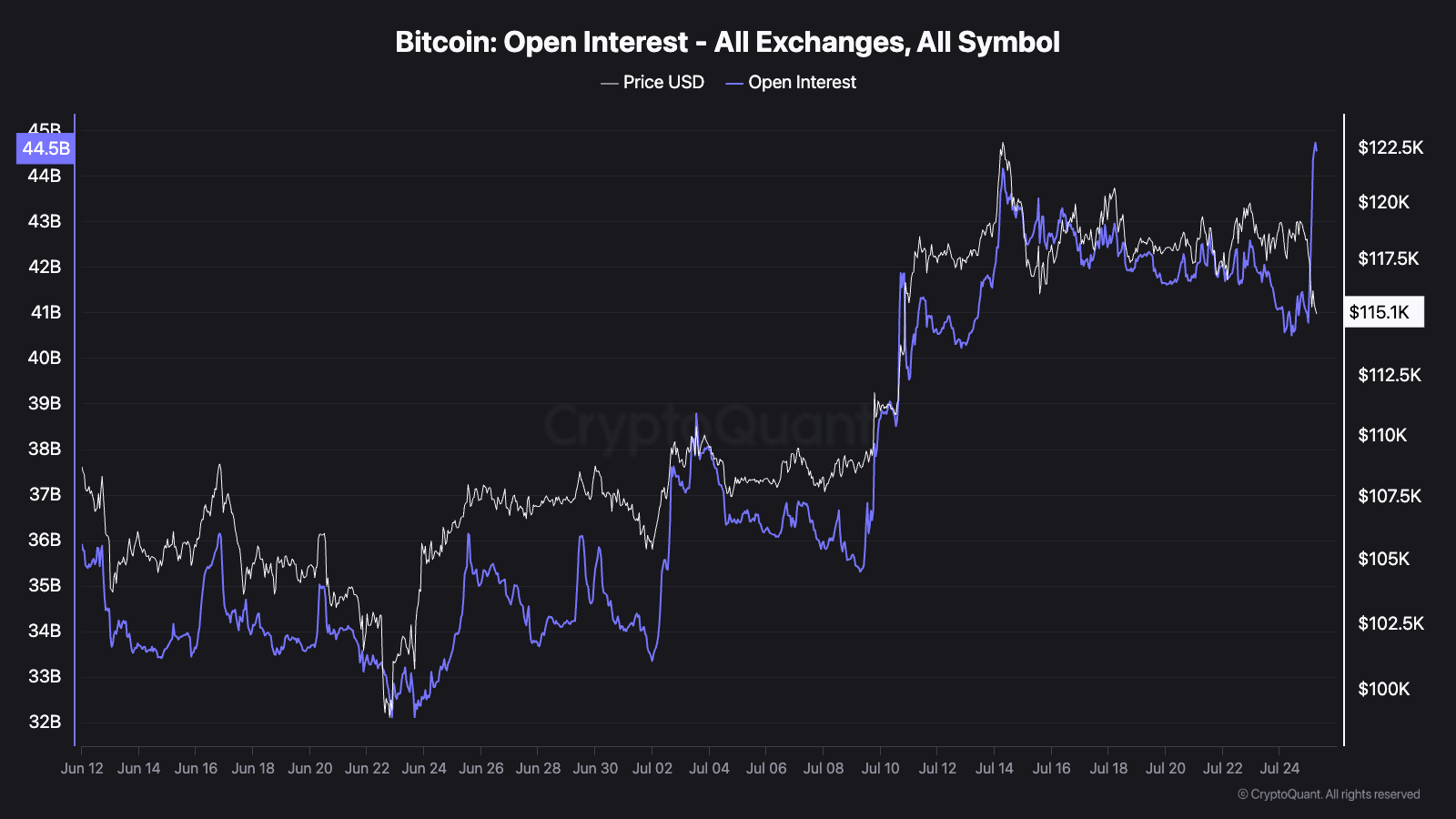

Bitcoin Open Interest Sets New Record As Price Plunges To $115,000

Data shows the Bitcoin Open Interest shot up to a new all-time high (ATH) even as the cryptocurrency...