Bitcoin Price Holds Above $115,000 — Here’s Why This Level Is Significant

After surging to a record high around $123,000 in the second week of July, the Bitcoin price action for the rest of the month has been largely choppy. However, the flagship cryptocurrency dropped to a level just above $115,000 on Friday, July 25. This abrupt decline came with the expected question in the market: Is the rally over?

Here’s How $115,000 Could Be Critical To BTC’s Price

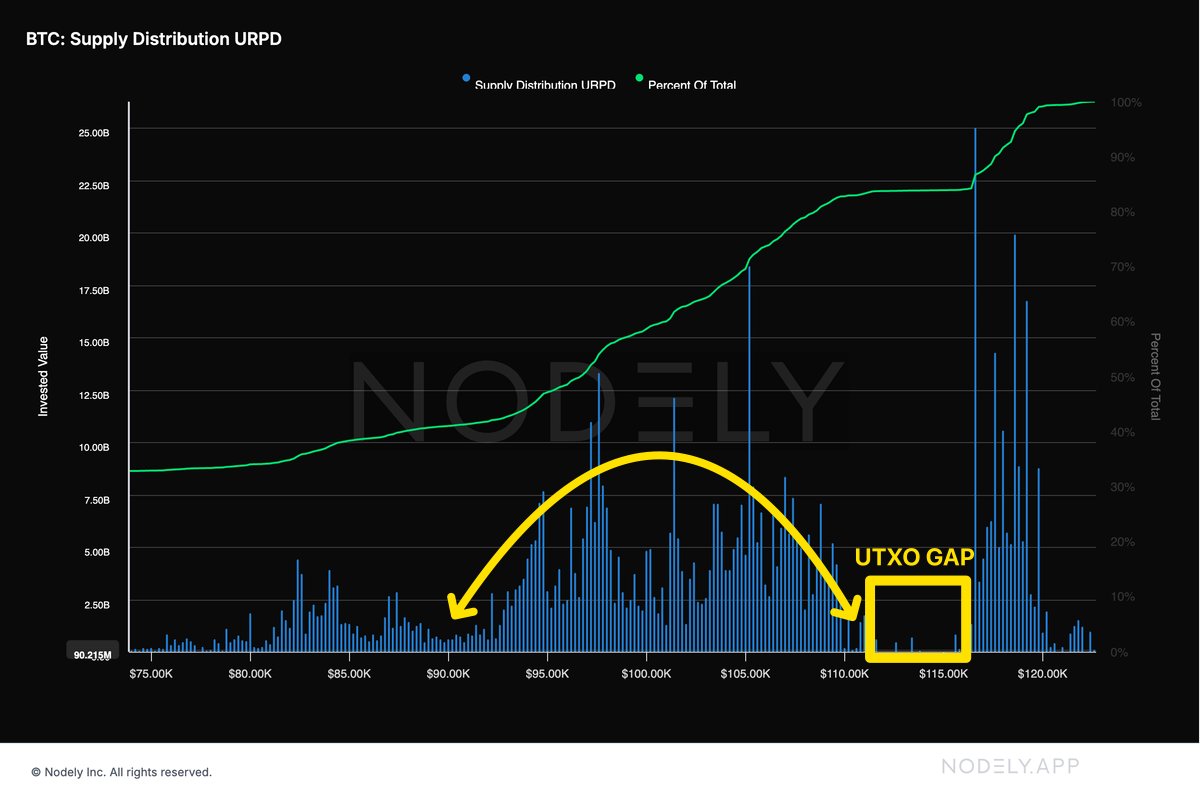

In a recent post on the social media platform X, crypto pundit Burak Tamaç highlighted the relevance of the region below the $115,000 level for the price of BTC. This on-chain observation, which is based on the BTC Supply Distribution URPD, showed how the Bitcoin price could play out in the near future.

The Supply Distribution URPD metric tracks the amount of Bitcoin supply last moved or transferred at particular price levels. This metric is specifically useful in identifying potential support (demand) and resistance (supply) zones.

Tamaç pointed out on X that there is a significant void in Bitcoin’s Unspent Transaction Output (UTXO) distribution just around the $110,000 and $115,000 bracket. What this means is that there have been relatively fewer significant transactions around this price region in the recent past.

However, this UTXO gap sits above a price region ($90,000 to $110,000) thick with significant investor activity. Considering the level of activity within this zone, there is an increased likelihood of the premier cryptocurrency finding a support cushion just within the UTXO gap.

In this context, the support is to be above the $110,000 price level. As mentioned earlier, after Bitcoin reached a new all-time-high price, the premier cryptocurrency entered a consolidatory phase, where it has moved mostly sideways in the second half of July. During this period of indecisive price action, it can be observed that the Bitcoin price has not gone below the $115,000 price.

What this means is that the $110,000 and $115,000 zone is likely where a new UTXO support has been established. If Bitcoin prevails above this price level, we can expect to see continued bullish momentum . On the flip side, if the $110,000 — 115,000 support zone fails, the flagship cryptocurrency might experience a severe sell-off.

Bitcoin Price At A Glance

As of this writing, Bitcoin is valued at about $118,050, reflecting an almost 2% jump in the past 24 hours.

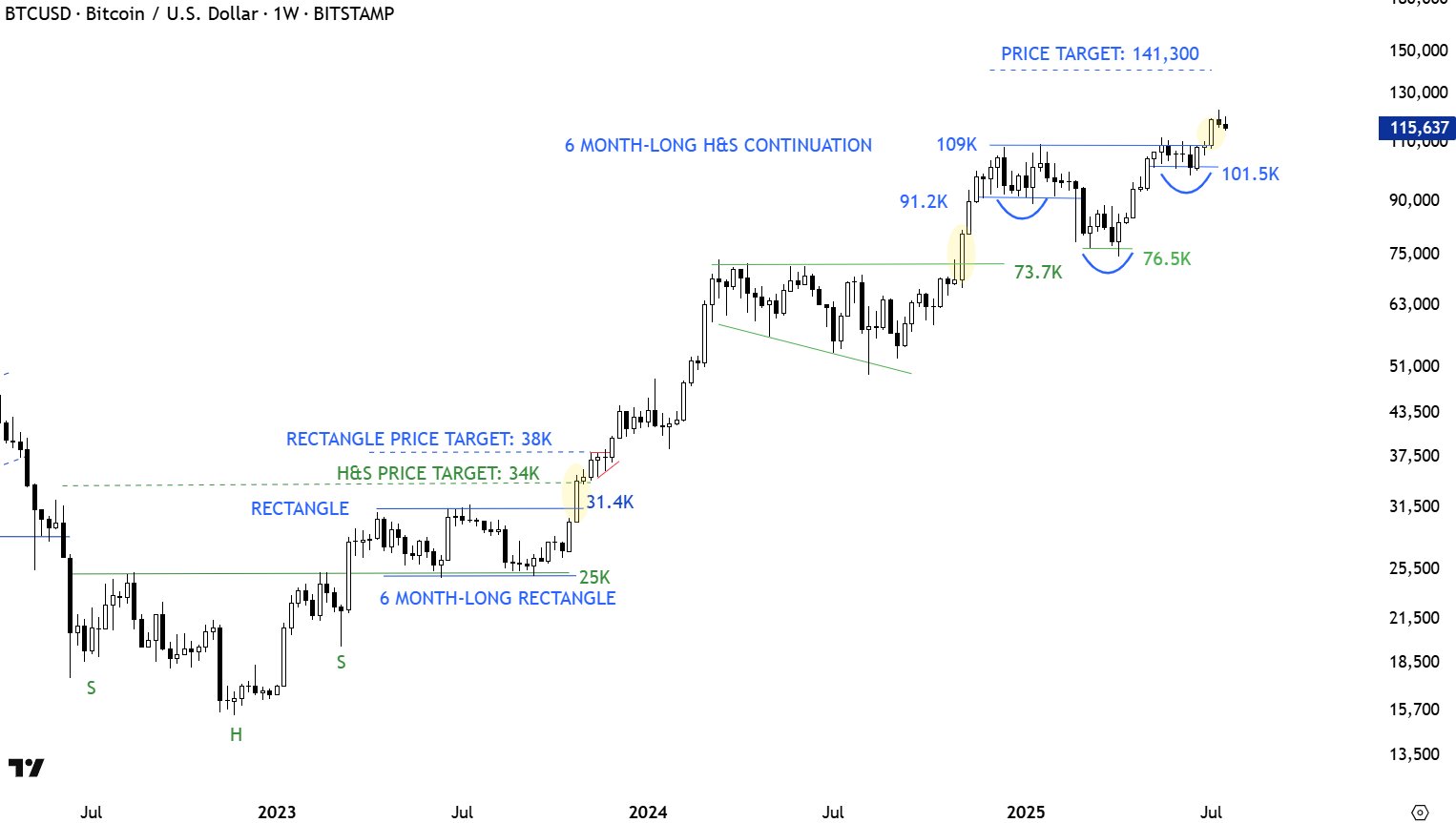

Bitcoin Price Could Still Tumble Down To $109,000 — This Chart Pattern Suggests So

The Bitcoin price has been quite indecisive in its action over the past week, jumping between the $1...

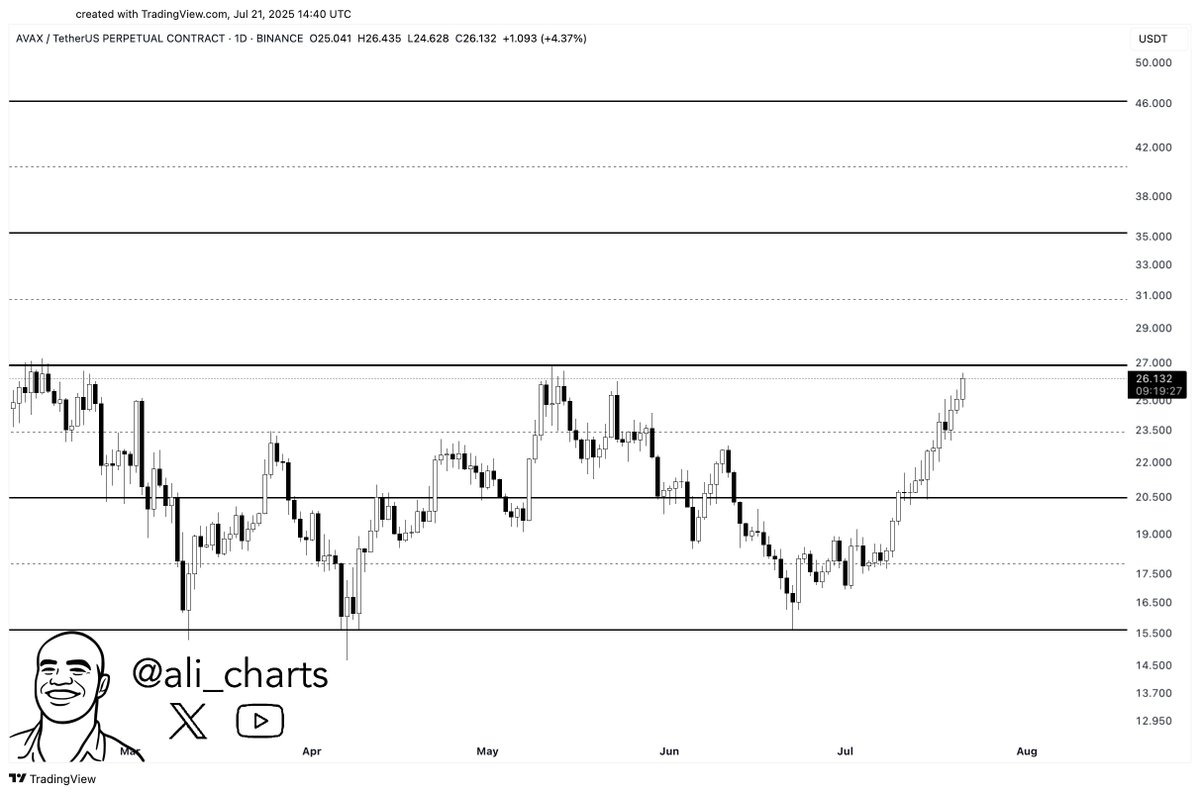

AVAX Ready For Range Breakout – Bulls Eye $36 Price Target

Avalanche (AVAX) prices are up 6.59% in the past 24 hours amidst a general crypto price rebound. The...

Ripple CEO Sounds Alarm: If You’re An XRP Investor, You Should See This

Ripple’s Chief Executive Officer (CEO), Brad Garlinghouse, has issued a serious warning to XRP inves...