Crypto Curiosity Meets Caution: Navigating Singapore's Digital Asset Journey Safely

The crypto conversation in Singapore has reached a tipping point. A 2025 Blockhead survey reveals that 26% of Singaporeans now invest in cryptocurrencies, but the remaining 74% aren't just uninterested; they're waiting for the right moment and the right platform. With Singapore positioning itself as Asia's digital asset hub, that moment is now. But success depends entirely on choosing platforms that prioritize security, regulatory compliance, and local integration.

This is where regulated platforms can help crypto-curious Singaporeans navigate the world of digital assets with greater confidence. Regulated platforms operating under local regulatory standards support secure and informed participation in crypto.

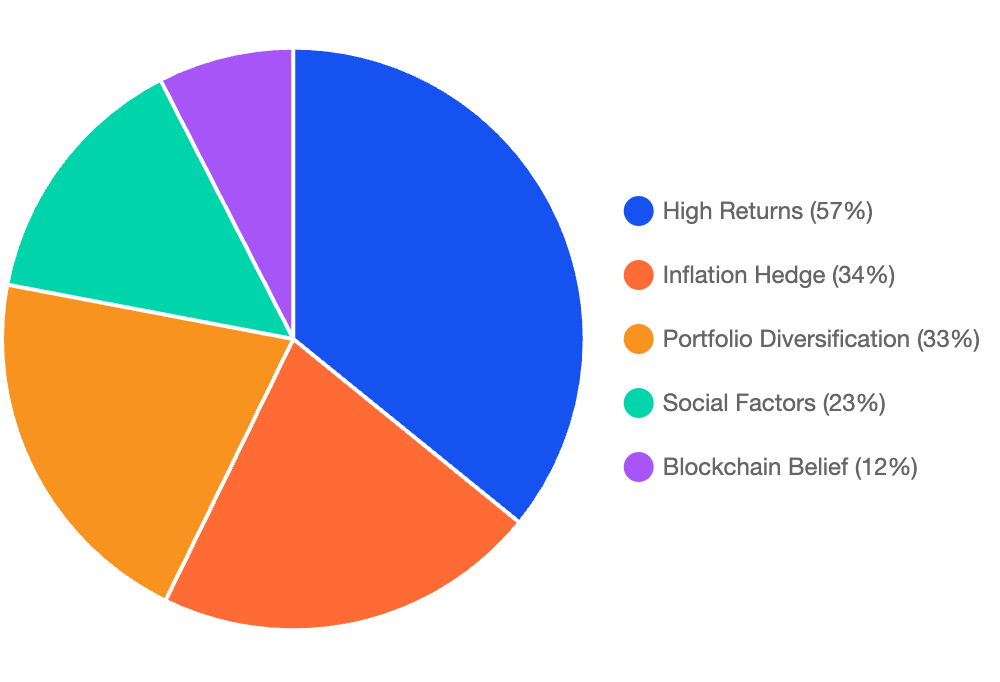

Understanding What Drives Singaporean Crypto Interest

The motivations behind Singapore's growing crypto adoption tell a clear story. Financial incentives dominate, but the reasons are more nuanced than simple speculation.

These findings reveal sophisticated investor thinking – Singaporeans aren't just chasing quick gains but seeking genuine portfolio enhancement and inflation protection.

Cryptocurrencies are a highly diversified asset class, offering a range of options from utility and governance tokens. Examples include BTC, the first decentralized cryptocurrency, often used as a store of value and referred to as "digital gold"; native tokens such as ETH and SOL, which power blockchain protocols; and AAVE and UNI, which support innovative decentralised finance (DeFi) applications.

Additionally, fiat-backed stablecoins that are regulated and pegged 1:1 to their underlying currency, such as USDC and XSGD, offer a way for users to get started with financial use cases with less volatility exposure.

Each type appeals to different investor profiles – whether seeking functional use, participation in token projects, speculative opportunities, or price stability. This diversity makes crypto a unique addition to modern investment portfolios, providing benefits beyond traditional assets.

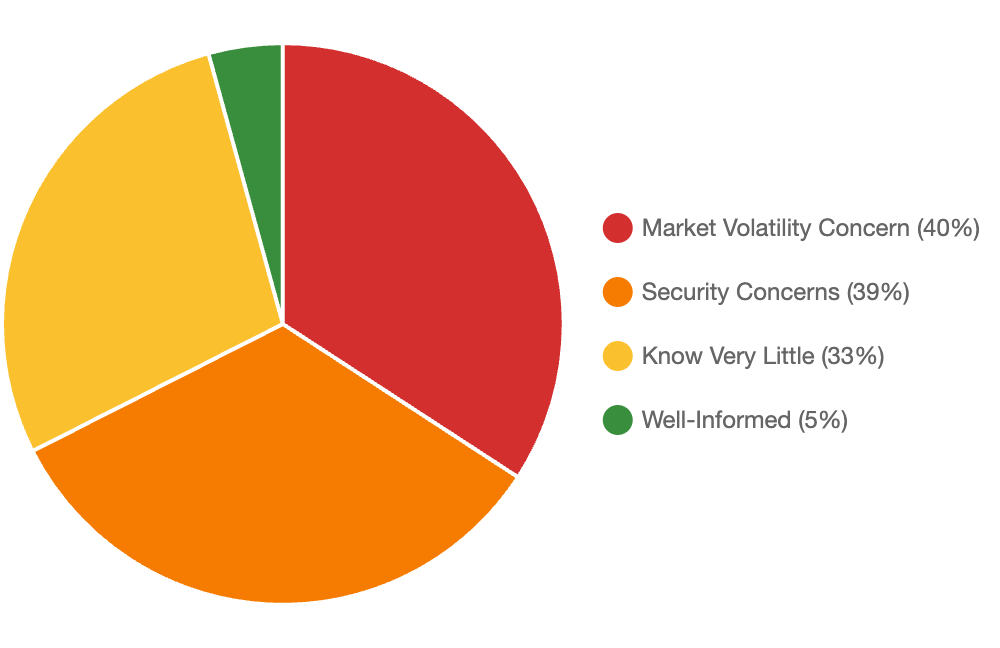

Decoding Singaporean Crypto Concerns

Despite growing interest, significant barriers prevent wider adoption. Understanding these concerns is crucial for platforms seeking to build trust in Singapore's discerning market.

The knowledge gap is substantial, but the security and volatility concerns are even more telling. These aren't abstract fears—they're rational responses to a complex market with real risks. "The potential is tempting, but I worry about scams," shared Sarah Tan, 30, a marketing executive. "How do I know who to trust or where it's safe?"

For Singaporeans entering the crypto space, trust is key. Global, regulated platforms are responding by prioritising transparency, robust security practices, and ongoing alignment with local regulations. This means regularly updating systems and processes to stay updated with Singapore’s evolving regulatory landscape. The goal is to help Singaporeans navigate the crypto landscape with greater confidence, while also providing a secure platform to access digital assets.

Recognizing Common Crypto Scams and Staying Protected

As crypto adoption grows, so does the risk of fraud. For new users, unfamiliarity with crypto tools and platforms may make them more susceptible to scams. Hence, staying vigilant and aware of such common scams is the first step to staying safe.

Here are some of the common scams and how to guard against them:

Phishing Attacks

Fake websites, emails, caller groups or mobile apps mimic real platforms to steal account passwords or recovery phrases.

How to protect: Always check URLs carefully, and avoid clicking any suspicious links in unsolicited messages. Enable multi-factor authentication for an extra layer of security.

Impersonation of Customer Support

Fraudsters pose as representatives from crypto providers or even local authorities, tricking users into giving access to their wallets or accounts.

How to protect: Official customer support teams will never ask for passwords or private keys. Never provide this private information to any parties, including family or friends. Always verify contact through official channels.

Fake Airdrops or Giveaways

Scammers impersonate influencers or crypto projects, promising free crypto if users send a small amount first.

How to protect: Legitimate and official projects or platforms would never ask you to send crypto to receive more. Ignore offers that are too good to be true.

Pump-and-Dump Schemes

This type of scams happen when a small group of people artificially boost the price of a crypto token by spreading hype on social media. Once the price of the token goes up, the insiders quickly sell their coins, causing the price to crash.

How to protect: Be careful about aggressive promotions of any crypto assets on social platforms such as Discord, Telegram and X. Always research a token’s fundamentals before investing.

Recognizing these scams help users stay protected while building confidence in the crypto space. Regulated platforms further enhance protection with institutional-grade security systems and reliable customer support, bringing users a peace of mind through oversight and accountability.

How to Choose a Regulated Crypto Platform

With many crypto platforms available, selecting a regulated and trustworthy one is crucial. Here are key factors to consider:

Regulation and Licensing

Choose platforms licensed by the Monetary Authority of Singapore (MAS) with Standard Payment Institution (SPI) or Major Payment Institution (MPI) licenses. Check MAS’ Financial Institutions Directory for verification. Regulated platforms must disclose asset safeguarding practices, providing transparency and accountability. Avoid unregulated platforms, especially those on MAS' Investor Alert List , which expose you to higher risks and limited protection.

Robust Security Features

Look for multi-factor authentication (MFA), cold storage of digital assets, encryption, regular security audits.

- Transparency of Operations Platforms should clearly disclose asset storage methods, security protocols, financial statements, and auditing processes.

- Positive Reputation Research reviews and expert opinions on Google reviews, crypto forums, and industry reports to assess service quality and reliability.

Taking Charge of Your Crypto Security

While regulated crypto platforms implement strong security measures, protecting your crypto assets also depends on the steps you take as a user. Here are four essential steps to help you stay secure:

- Enable multi-factor authentication (MFA): This adds an important extra layer of protection beyond just a password.

- Use strong, unique passwords: Avoid reusing passwords across different sites to reduce risk if one is compromised.

- Keep your private keys and seed phrases offline: Never share or store them digitally where they can be vulnerable to hacking.

- Keep your software and apps updated: All your software and apps are constantly updated and improving. Make sure you are using their last version. This is a great way to protect you and your devices.

Security forms the foundation, but ease of use drives adoption. Platforms available in Singapore often offer convenient, localised payment methods, allowing users to make SGD deposits and withdrawals with PayNow or FAST transfers. Combined with faster and secure verification via Singpass, Singaporeans can now access crypto more seamlessly.

With the availability of these local features, crypto is now more accessible to Singaporeans – a major improvement compared to just a few years ago where direct access using SGD was limited or unavailable.

Choosing Confidence in Singapore's Crypto Future

Singapore’s comprehensive crypto regulations and efficient financial infrastructure attracts world-leading crypto platforms to the local market. This regulatory success creates a competitive environment where innovation thrives under consumer protection, and the reason why global crypto players have chosen Singapore as their regional hub.

The growth of crypto adoption in Singapore also reflects the nation's broader approach to financial innovation—embracing technological advancement while maintaining rigorous standards for consumer protection. The 26% adoption rate from the Blockhead survey represents just the beginning of a transformation that will reshape how Singaporeans interact with digital assets.

But sustainable growth requires platforms that prioritize security, regulatory compliance, and user experience.

Hey there! Just a quick note to let you know that this article is brought to you by Coinbase. Crypto creates economic freedom by ensuring that people can participate fairly in the economy, and Coinbase (Nasdaq: COIN) is on a mission to increase economic freedom for more than 1 billion people. We’re updating the century-old financial system by providing a trusted platform that makes it easy for people and institutions to engage with crypto assets, including trading, staking, safekeeping, spending, and fast, free global transfers. We also provide critical infrastructure for onchain activity and support builders who share our vision that onchain is the new online. And together with the crypto community, we advocate for responsible rules to make the benefits of crypto available around the world. Coinbase has a Major Payment Institution licence to provide digital payment token and cross-border money transfer services in Singapore.

SharpLink Adds $295M in Ethereum, Taps BlackRock Veteran as Co-CEO

Gaming company expands treasury to 438,017 ETH while appointing former BlackRock digital assets chie...

Galaxy Digital Executes $9 Billion Bitcoin Sale

Early Bitcoin investor liquidates 80,000+ BTC in historic transaction facilitated by digital asset f...

Blockcast 71 | How Nook is Simplifying DeFi Lending & Making Crypto Accessible to the Masses

Three former engineers at Coinbase left the company earlier this year to launch Nook, which raised $...