USDC Emerges As Top Pick In Booming Crypto Payroll Trend—Survey

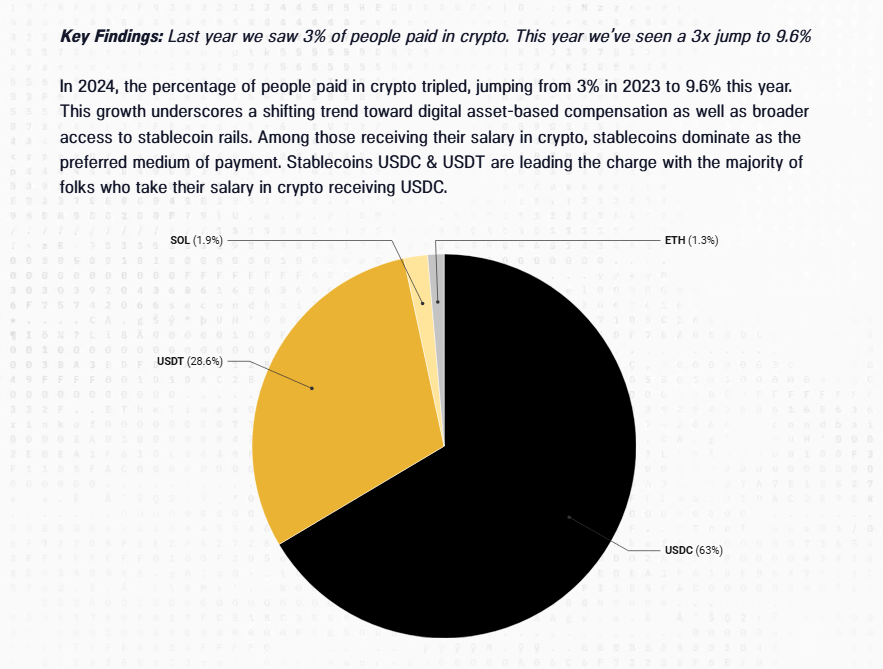

A growing number of workers are now getting paid in crypto. In 2023, just 3% of those surveyed said part of their salary arrived as digital tokens. By 2024, that share jumped to 9.6%.

This shift comes as blockchain firms and DAOs explore new ways to handle cross-border pay. Reports have disclosed that purely fiat payments fell from 95% to 85% over the same period.

Our mission is to support the long-term success of both our portfolio companies and the broader crypto ecosystem.

One major gap we’ve consistently seen? Reliable, transparent compensation data for crypto teams.

That’s why we created our annual Crypto Compensation Survey – a…

— Pantera Capital (@PanteraCapital) August 6, 2025

Rise In Crypto Payroll

According to Pantera Capital’s 2024 Blockchain Compensation Survey , USDC leads the pack. It now makes up over 60% of all crypto wages.

USDT trails with 28%. Smaller slices go to Solana at 1.9% and Ethereum at 1.3%. These numbers point to stablecoins becoming a regular tool for payroll. That’s a big change from just a year ago.

Many companies are drawn by faster settlement times and lower fees. And workers in regions with shaky banking systems see real benefit.

Reports have disclosed that Asia-based teams and contractors are among the biggest drivers of this trend. They often rely on stablecoins to avoid high transfer costs or strict local rules.

A handful of firms now let staff split pay between cash and crypto. This hybrid model gives people the freedom to hold tokens or spend fiat. It also helps those who want to dollar-cost average into crypto markets.

Pantera’s data shows these arrangements are on the rise, though full-crypto pay remains rare.

Stablecoin Salaries Soar

Circle’s decision to publish monthly reserve reports has strengthened trust in USDC . The company even secured access to US Treasuries for its backing.

That transparency helps explain why more payroll departments pick USDC over other coins. Tax teams also get clearer data when they see monthly reserve disclosures.

Behind the scenes, better payroll platforms and accounting tools have made on-chain payments simpler. Real-time rails now link digital wallets to corporate treasuries. And more firms are building internal processes to track taxable events.

Based on reports from industry insiders, this is only the beginning. As more crypto-native companies formalize their operations, they’ll need reliable ways to pay people.

And wider acceptance by regulators could give traditional firms the confidence to join in.

Featured image from Young Platform, chart from TradingView

Франция запускает майнинг биткоина на ядерной энергии

Франция переходит на новый этап внедрения криптовалют, поскольку партия крайнего правого крыла Rasse...

Omni Network (OMNI) Maintains Momentum a Week After Upbit Listing, Price Up 276%

Omni Network (OMNI) continues to ride a powerful bullish wave one week after its debut on South Kore...

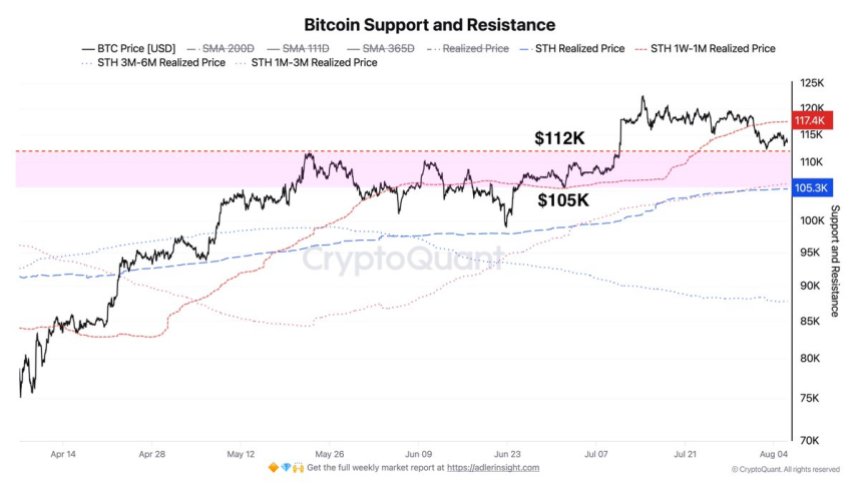

Bitcoin STH Realized Price Signals Fragile Support: Correction Risk Intensifies

Bitcoin is entering a critical phase after losing the crucial $115,000 support level, with selling p...