Altcoins Takeover Incoming? These On-Chain Metrics Signal An Imminent Market Shift

The cryptocurrency market was impressive for most of the week, with Bitcoin and large-cap altcoins leading the charge. While BTC ran up to a new all-time high around $124,100, the other top cryptocurrencies, like Ethereum and Solana, flirted with their former record-high prices.

Most notably, the price of Ethereum continued its positive form, briefly touching the $4,800 level on Thursday, August 14. The latest on-chain data suggests that ETH and other altcoins might only be at the start of an extended rally, with the potential to outpace Bitcoin, the world’s largest cryptocurrency by market capitalization.

ERC20 Stablecoin Supply Hits New All-Time High Of Nearly $130 Billion

In a Quicktake post on the CryptoQuant platform, CryptoOnchain shared that the latest data signals that the market appears to be in the early phase of an altseason. This optimistic hypothesis is based on two primary on-chain metrics: the Stablecoin Liquidity and the Bitcoin Dominance (BTC.D) metric.

Firstly, CryptoOnchain revealed that the total supply of ERC20 stablecoins has witnessed a notable spike, recently reaching an all-time high of around $128.7 billion. Typically, a significant increase in stablecoin supply is often associated with elevated liquidity, allowing investors to take new positions in risk assets like altcoins.

CryptoOnchain added:

Alongside this, active addresses for stablecoins have broken past 250K for the first time in history, underscoring rising network activity and circulation levels typical before major market rotations.

The on-chain analyst also highlighted that the All Stablecoins (ERC20) Exchange Netflow on Binance has witnessed positive inflows in recent weeks, surpassing the $67 million mark multiple times. As CryptoOnchain noted, positive exchange netflows typically indicate increased purchasing power for investors.

Furthermore, as shown in the chart above, the BTC Dominance metric faced rejection from its Previous Cycle Bull Run Resistance zone. From a historical perspective, these rejections have coincided with capital rotating from Bitcoin into mid- and large-cap altcoins—an early hallmark sign of the altseason.

Ultimately, the combination of the increased stablecoin liquidity and Bitcoin Dominance technical rejection could mark the beginning of a breakout in the altcoin market. CryptoOnchain noted that a strong Ethereum breakout above its “This Cycle Bull Run Resistance” with a continuous downturn for BTC.D would be a key confirmation to look out for.

Altcoins Total Market Capitalization

As of this writing, the altcoin market is valued at around $1.57 trillion, reflecting an over 1% decline in the past 24 hours. According to data from TradingView, the total capitalization of altcoins has jumped by more than 5% in the past seven days.

Bitcoin Makes A Modest Pullback As Market Eyes Post Trump-Putin Meeting Reaction

According to CRYPTOWZRD’s recent update, Bitcoin ended the last session on a bearish note, but the b...

XRP Price Could Be Headed To New All-Time Highs Due To These Factors

Recent price action has shown that XRP is establishing the $3 price level as a base, and an analysis...

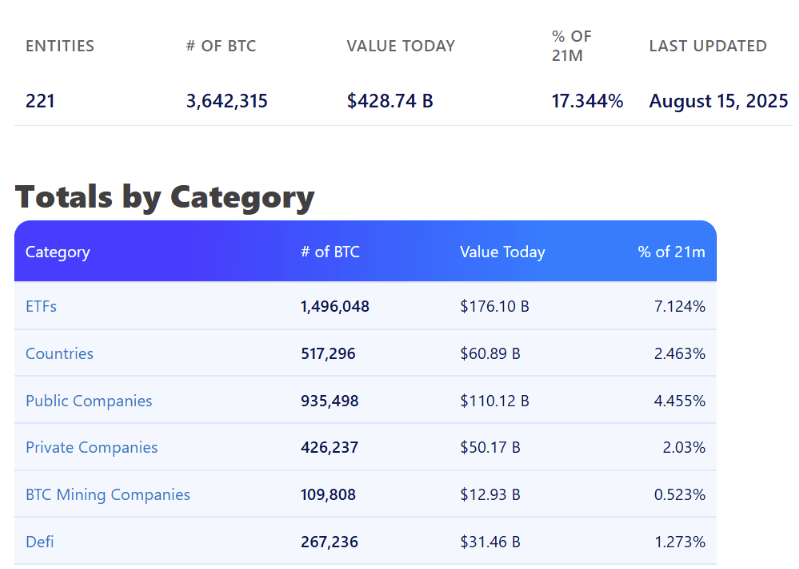

Institutional Bitcoin Holdings Near 20% Of Supply—Wall Street’s New Playground?

Bitcoin is undergoing a structural transformation, and institutional investors are steadily tighteni...