Bitcoin Faces Strong Chance Of $150K Rally Before Downturn, CEO Says

Bitcoin’s recent climb looks steady but measured. Prices hovered at $118,350 when the key calls were made, and short-term technical models point to a possible rise of about 11% to $129,690 by September 15, 2025.

Market gauges are in Bullish territory. The Fear & Greed Index sits at 64 (Greed), and over the last 30 days Bitcoin recorded 13/30 (43%) green days with price volatility around 1.65%. Those figures show momentum, but not runaway behavior.

CEO Issues A Cautionary Call

According to Canary Capital CEO Steven McClurg, there may be no more than 27% of upside left in this cycle before a downtrend begins.

He told viewers there is a greater than 50% chance Bitcoin hits the $140–$150k band this year. At $118,350 that would mean gains in the neighborhood of 20% to 30%. That is the scenario he laid out — a controlled move higher that then rolls over if key buyers step back.

Institutional Flows Drive Recent Gains

Reports have pointed to spot Bitcoin ETF inflows and large treasury purchases as the main drivers of recent price action.

McClurg said sovereign wealth funds and insurance companies have been asking questions and moving into allocations, and he expects some of that buying to peak in the coming months. If those big buyers slow or pause, the price path becomes harder to justify at higher levels.

Macro Signals And Fed Timing

Macro Signals And Fed Timing

McClurg also expressed concern about the broader economy and the timing of US monetary policy. He said he does not like the economic standing now and argued the US Federal Reserve should have cut rates earlier.

Still, he expects cuts in September and October, and market pricing via a popular CME gauge places the odds of a September cut at roughly 92%. A Fed move can lift risk assets, or it can unsettle markets if it signals deeper trouble — either outcome matters for Bitcoin.

Bulls Offer A Different TimelineNot all voices are cautious. Cathie Wood (ARK Invest) projects a big upside — a bull case around $1.5 million by 2030, with lower-case scenarios in the high hundreds of thousands. She links the thesis to growing institutional demand and Bitcoin’s fixed supply.

Strategy executive chairman Michael Saylor said recently that “Winter is not coming back,” and he went as far as saying that if Bitcoin is not going to zero it could reach $1 million.

Mike Novogratz (Galaxy Digital) gives a range: midterm targets like $150k are possible, and under stronger adoption scenarios he talks about $500k–$1M longer term. He stresses those outcomes depend on macro conditions and large buyers.

Featured image from Unsplash, chart from TradingView

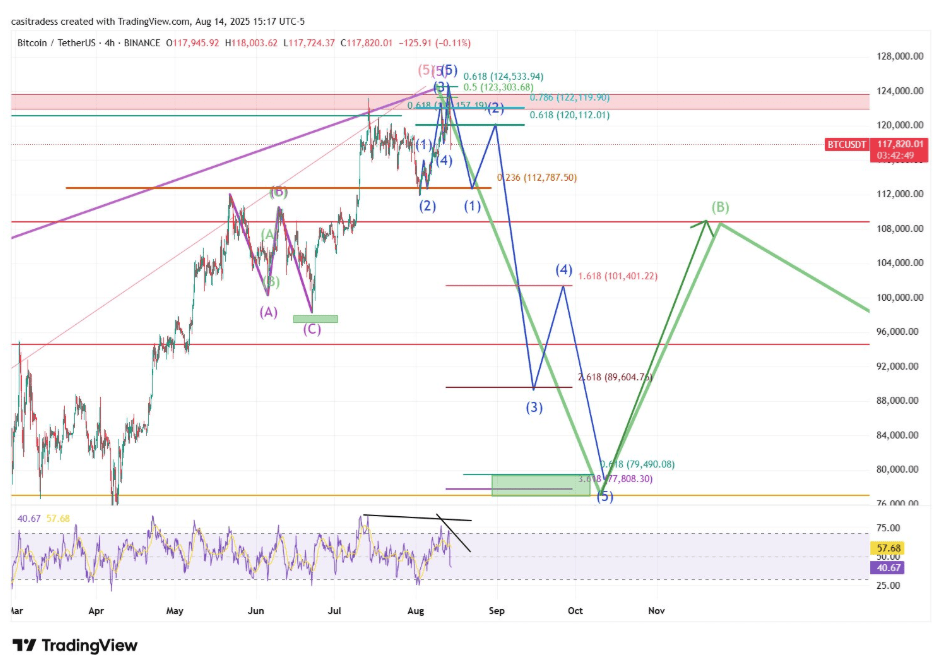

Bearish Case For Bitcoin: Analyst Warns Macro Top Is In

Bitcoin’s price rally has hit turbulence over the past 48 hours, and this has opened the door for be...

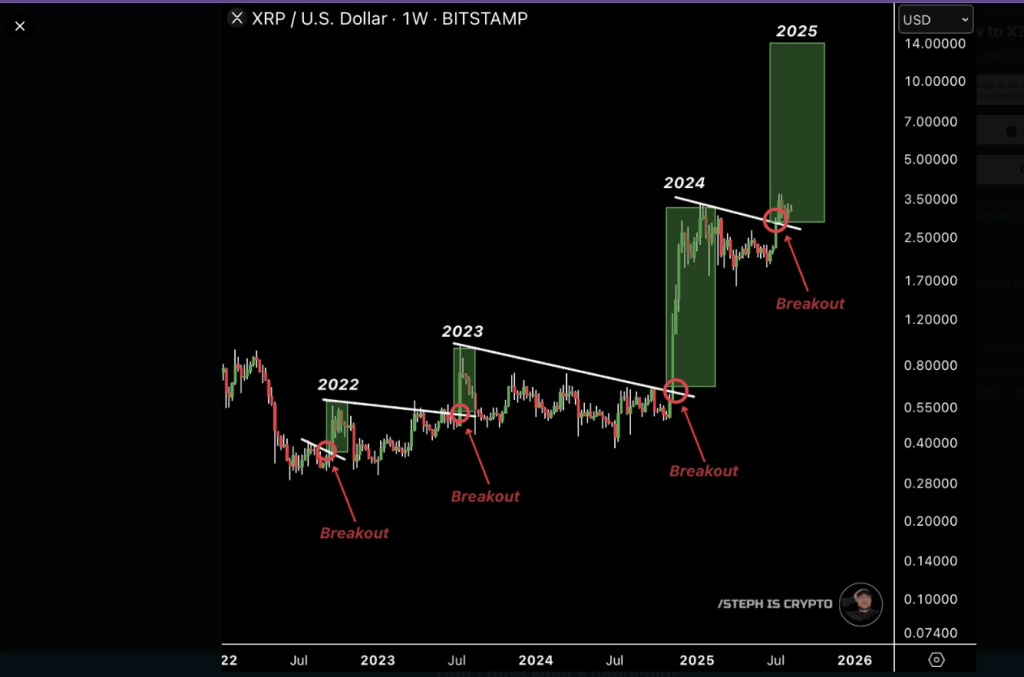

XRP’s Toughest Bull Run Could Lead To Big Gains, Analyst Claims

Bitcoin’s smaller cousin, XRP, has drawn fresh bullish bets after it held above the $3 mark in July....

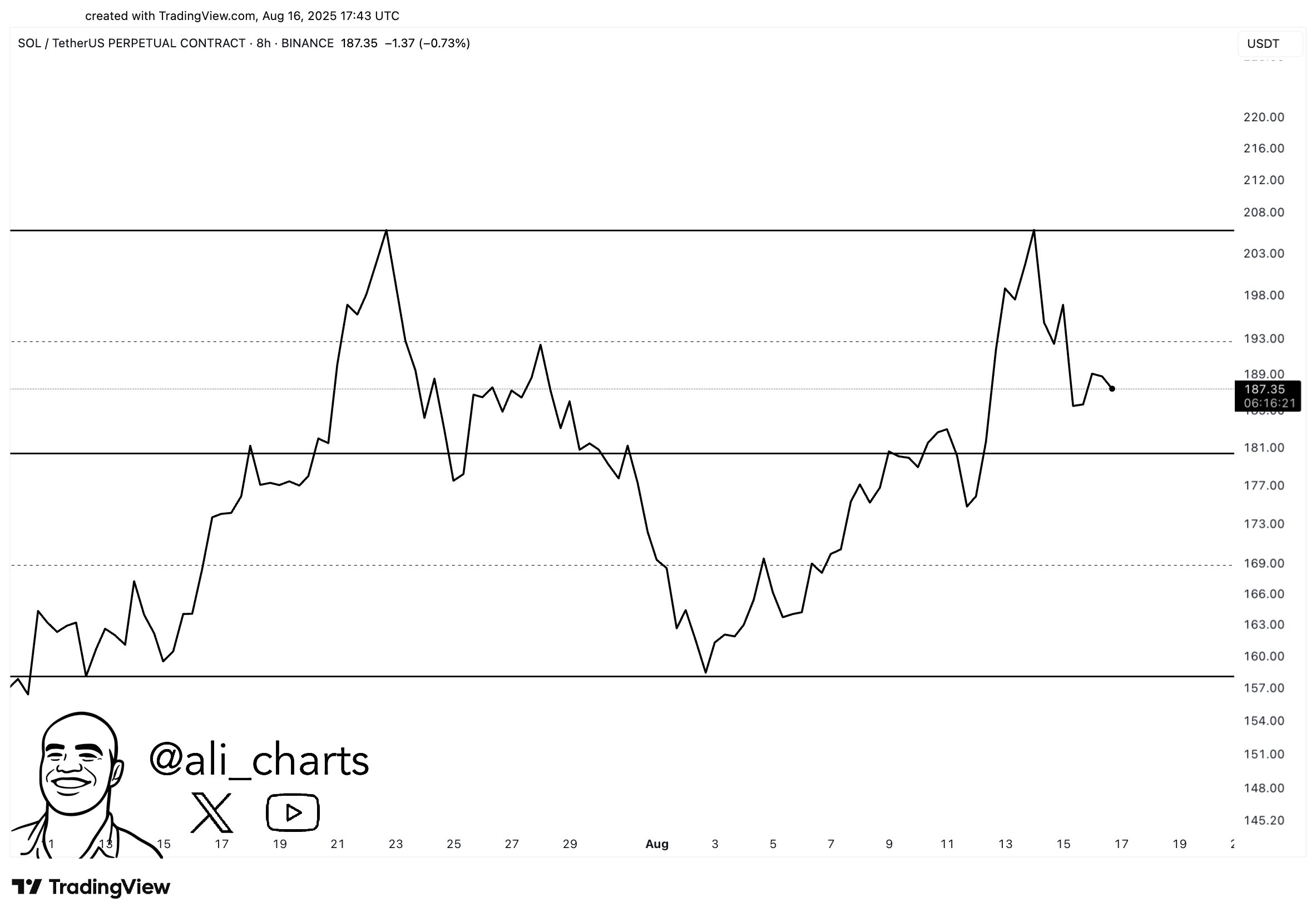

Solana Trading Range Indicates Potential Price Fall To $160 – Analyst

The Solana (SOL) market has registered a near 2% price increase in the last 24 hours, representing s...