Ethereum News: Expert Sees Extended Ethereum Run, Yet Bullishness Builds for Low-Cap ETH-Based Tokens

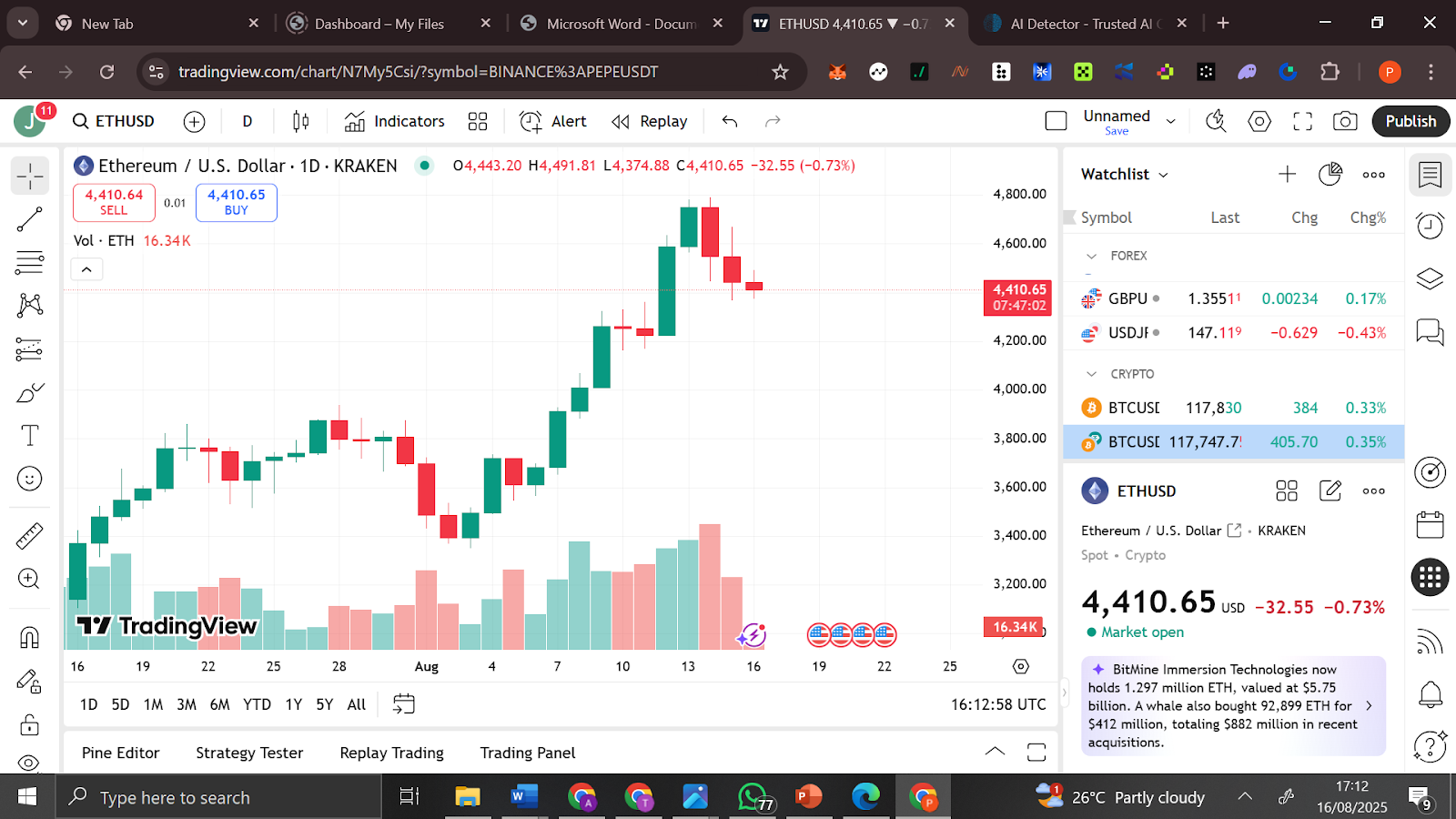

Ethereum (ETH) remains under close watch after a slight 2% drop on Friday following SharpLink Gaming’s quarterly report showing $103 million in losses, despite growing its Ethereum treasury to 728,000 ETH.

While ETH’s longer-term trajectory appears promising due to ongoing network adoption and staking activity, investors are increasingly scanning the market for low-cap, high-potential Ethereum-based tokens. Among these, Remittix is gaining traction as a utility-driven altcoin that could outperform larger assets in 2025.

Ethereum Market Update Highlights Institutional Activity

Ethereum’s market movements remain influenced by large holders and treasury-based companies. SharpLink’s report shows significant staking returns of 1,326 ETH since the start of its strategy, though non-cash impairments caused headline losses. Despite these accounting losses, the Ethereum network continues to see robust institutional accumulation.

Other treasury firms are following suit and now BitMine Immersion has 1.2 million ETH of the 2.7 million ETH Ethereum-focused treasuries have amassed.

Key Takeaways for Ethereum Investors

- Treasury Expansion: Over 2.7M ETH now held by institutional investors

- Staking Growth: Yield accumulation highlights Ethereum’s utility

- Price Volatility: Non-cash impairments causing short-term drops

These indicators suggest that while Ethereum may face short-term swings, the network’s fundamentals remain solid, attracting interest in complementary low-cap tokens like Remittix.

Why Investors Are Turning to Remittix

While Ethereum establishes itself as a secure store of value and staking vehicle, Remittix is capturing attention for its real-world utility in cross-border payments and decentralized finance. Currently priced at $0.0944, the project has raised over $19.8 million and sold more than 604 million tokens, reflecting growing investor confidence.

Remittix Features That Stand Out

- Cross-Border Payments: Seamless crypto-to-fiat transfers.

- Low-Fee Transactions: Designed for global accessibility.

- Q3 Wallet Launch: Beta release set for early adoption.

- 40% Bonus Window: Limited-time token incentive for early supporters.

- Utility and Adoption: Focused on practical applications beyond speculation.

Remittix is endowed with a potent roadmap, utility-first design and community-driven momentum, hence an appealing alternative to Ethereum investors who want to diversify their portfolio through high-growth ETH-based initiatives.

Outlook: Ethereum Stays Steady, Low-Cap Tokens Gain Attention

Although Ethereum still forms a strong pillar in the decentralized financial world, its sluggish development amid accounting-related losses has made investors consider high-potential options.

Tokens such as Remittix have the advantage of being usable in the real world, being in the early stages of development, and high levels of community interest, which makes them promising performers in the months ahead.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials:

https://linktr.ee/remittix

$250,000 Giveaway:

https://gleam.io/competitions/nz84L-250000-remittix-giveaway

XRP and Solana Struggle to Match Cold Wallet’s Security and 50× Growth as 2025’s Best Crypto Investment

Explore why Cold Wallet’s biometric access, storage safety, and 50x ROI make it the best crypto inve...

Crypto Market Greed Surges with the Rising Bullish Sentiments

The crypto market sentiment climbs as the Fear and Greed Index reaches 64, indicating rising bullish...

Best Crypto to Buy Now as Gemini Files for Nasdaq Listing

Gemini files for a Nasdaq listing as Bitcoin holds $117K and Ethereum sees ETF inflows. Analysts hig...