Unilabs Finance Takes Center Stage as UAE’s First RWA Partner & BTC Staking Fund

The crypto market has been anything but quiet. Bitcoin has shown a fourth-ever golden cross in the weekly chart. And Unilabs Finance (UNIL) is making crypto history as the first licensed real-world asset (RWA) partner in the UAE.

This tokenized RWA fund will be backed by a BTC staking program. A strategy that will merge traditional finance with digital assets. Technically, BTC’s bullish pattern appears when the 50-week MA moves above the 200-week MA.

This move is already sparking renewed optimism as analysts post positive Bitcoin price predictions. These two major developments are converging to set the stage for a bullish season.

Bitcoin Price Predictions Surge As BTC Flashes Bullish Charts

Bitcoin price has been declining, slipping below $116K as the FED rate cuts reduce optimism in the market. While BTC price is in the red, analysts are not flipping bearish yet, with many of them posting positive Bitcoin price predictions. This is because Bitcoin has triggered the fourth-ever golden cross in the weekly charts.

Typically, it’s a rare positive pattern, where the 50-week MA moves above the 200-week MA. The structure shows up on the chart before a strong rally. This structure has appeared only three times in BTC history.

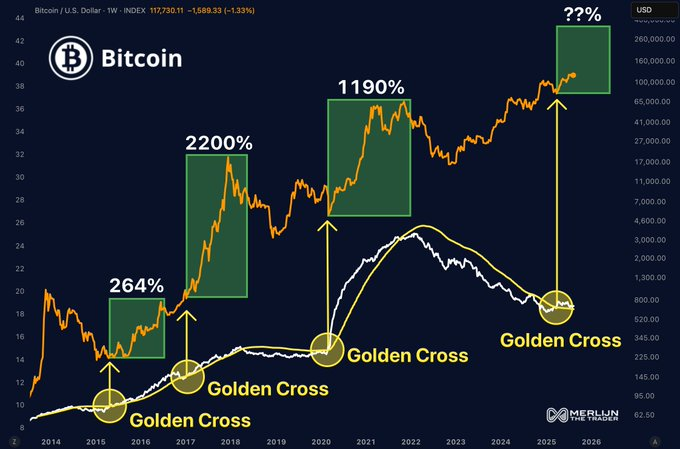

Bitcoin Bullish Chart | Merlijn The Trader

According to crypto expert Merlijn The Trader, Bitcoin flashed this signal in 2016, 2019, and 2020. And each time, it caused major rallies. She noted that previous patterns brought gains of around, +264%, +2,200% and +1,190%, respectively.

Will BTC History Repeat Itself?

Since previous golden crosses staged massive rallies, analysts are making bullish Bitcoin price predictions in the long term. Some Bitcoin price predictions suggest that the pioneer crypto may jump to $250K by the end of 2025. Others are cautious.

There has been a lack of movement by holders on BTC charts. Moreover, there is also declining liquidity, which means that the BTC price may not have an immediate jump. Additionally, they have not specifically put a Bitcoin price prediction in terms of percentage on this current signal.

This is a huge question mark for BTC staking traders, who are concerned about Bitcoin’s 2025 cycle. As they don’t have clarity on how the market will respond. Some are shifting to Unilabs Finance (UNIL) to unlock higher ROI opportunities with the BTC staking program.

Unilabs Presale Soars After Tokenized RWA Program Launch

Unilabs is another token carving out its place in history. The project will be the first licensed RWA partner in the UAE. It launched its tokenized RWA Fund that will be backed by a BTC staking program. This program will link assets like real estate with DeFi.

This approach seeks to bridge the gap between traditional finance and digital assets. With such a fund, investors can easily gain access to tangible exposure. But at the same time, through BTC staking, they can gain stability and growth potential of the pioneer cryptocurrency.

Launching this program in the UAE suggests strong compliance and investor trust. Unilabs now oversees over $32 million in AUM. These developments are attracting huge attention as its cryptocurrency ICO hits another major milestone.

The project has sold out its sixth presale phase, with prices jumping to $0.00108. UNIL token holders have also accumulated over 1.9 billion tokens, making the platform raise over $13.7M.

Unilabs Finance Is More Than Just an RWA Fund

Unilabs has a lot to offer than just an RWA fund. The project uses AI trading tools to help beginners and seasoned investors navigate the volatile crypto market easily. For one, investors can use the AI market pulse to track changes in the market as they happen.

This way, they can easily grab real opportunities. The EASS tools will rank high-potential projects while the Memecoin Idebtification tool caters to high-appetite investors. Alongside the RWA fund, Unilabs offers other crypto funds across BTC, AI, and Mining.

With this features, investors can manage market risks and ensure diversified exposure. For example, through BTC staking, investors will get exposed to BTC and derivatives. This allows investors to match their own strategies.

Its native token, $UNIL, will tie everything together in the platform, making it the best crypto to buy now.

Conclusion

While analysts are offering mixed Bitcoin price predictions, Unilab’s tokenized real estate fund is attracting huge attention. Many say that this $0.00108 altcoin is positioning itself to disrupt the DeFi space.

Traders are not waiting in the fences and are quietly grabbing bags of $UNIL before that happens.

Discover the Unilabs Finance (UNIL) presale :

Buy Presale

Website

Telegram

Chainlink Trend Turns Bullish as Treasury and Reserve Strengthen Outlook: Trading Around $24 Currently

According to market analyst Van de Poppe, Chainlink, going through a continuous downtrend, is now on...

The Crypto With 150% Gains For Early Buyers: BlockchainFX Is One Of The Most Exciting Crypto Presales Today

BlockchainFX presale at $0.02 offers 150% gains, 30% bonus with BLOCK30 code, high-yield staking, an...

Next Crypto to Explode: Cold Wallet, Bitcoin Hyper, Snorter, and SUBBD Presales Heating Up

Searching for the next crypto to explode? Cold Wallet’s $6.2M Stage 18 presale shows a 35× price gap...