Bullish Settles Portion of $1.5B IPO Proceeds in RLUSD on XRP Ledger

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Bullish, a global crypto exchange with multiple tier-1 licenses, has completed a historic U.S. IPO, with part of the $1.5 billion proceeds settled in Ripple USD (RLUSD).

According to a

press release

today, Bullish made arrangements to receive $1.5 billion in proceeds from its recently completed IPO in stablecoins. Notably, proceeds from public offerings are usually paid in fiat currencies like EUR, USD, or GBP, through banks.

However, Bullish adopted an innovative approach that saw it settle the offering using multiple USD and EUR-denominated stablecoins. Popular investment bank Jefferies served as the delivery agent of Bullish’s IPO.

The investment bank collaborated with multiple issuers in the United States and Europe to create, convert, and deliver the stablecoins. Most of the Bullish IPO proceeds were settled in stablecoins on the Solana network, including Circle’s USDC and EURC.

Some Proceeds Settled in RLUSD

Bullish also confirmed that it settled some of the IPO proceeds in Ripple USD (RLUSD). Per the announcement, the RLUSD tokens were minted on the XRP Ledger (XRPL).

San Francisco-based payments company Ripple congratulated Bullish on its successful IPO while acknowledging that a portion of Bullish’s IPO proceeds was settled with RLUSD. In the post, Ripple noted that the Bullish IPO is the first public listing that brought its settlement on-chain.

https://twitter.com/Ripple/status/1957780623743152629

Furthermore, the remaining proceeds of the IPO were settled in other stablecoins like PayPal USD (PYUSD), Agora Dollar (AUSD), USD1, Global Dollar (USDG), and others.

Coinbase to Help Bullish Custody RLUSD and Other Stablecoins

According to the announcement, Coinbase will provide a custody solution for the stablecoins to ensure security. Reacting, Coinbase’s VP of Institutional Products, Greg Tusar, said the exchange is proud to play a crucial role in supporting Bullish’s IPO event.

The Coinbase exec stated that the development reflects how stablecoins can modernize the global financial system. David Bonanno, the CFO of Bullish, emphasized that the company sees stablecoins as one of the most transformative use cases of digital assets. He revealed that Bullish has been leveraging stablecoins internally for cross-border settlements.

RLUSD Market Cap Surges 26%

Meanwhile, there has been a growing adoption of stablecoins since the U.S.

provided

regulatory clarity for the stablecoin market. This is reflected by the surge in RLUSD’s market cap, which has soared 26.31% over the past month to $666.57 million.

Despite the surge, Ripple is actively seeking to bolster RLUSD’s dominance in the stablecoin market and recently

acquired

Rail for $200 million to advance this goal.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/523316.html

Previous:博雅互动研报:迎接二次飞跃,比特币储备计划进入加速期

Related Reading

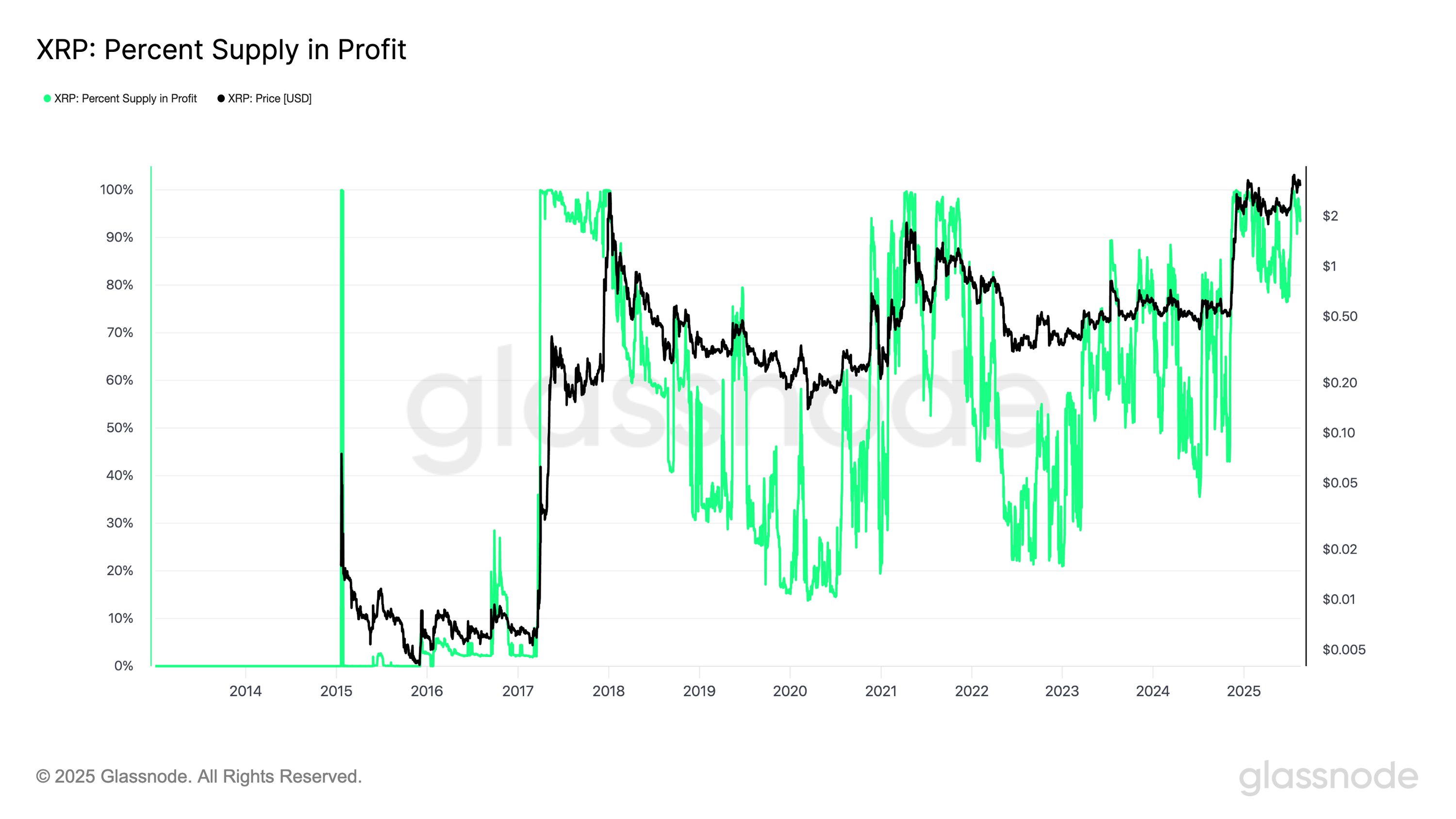

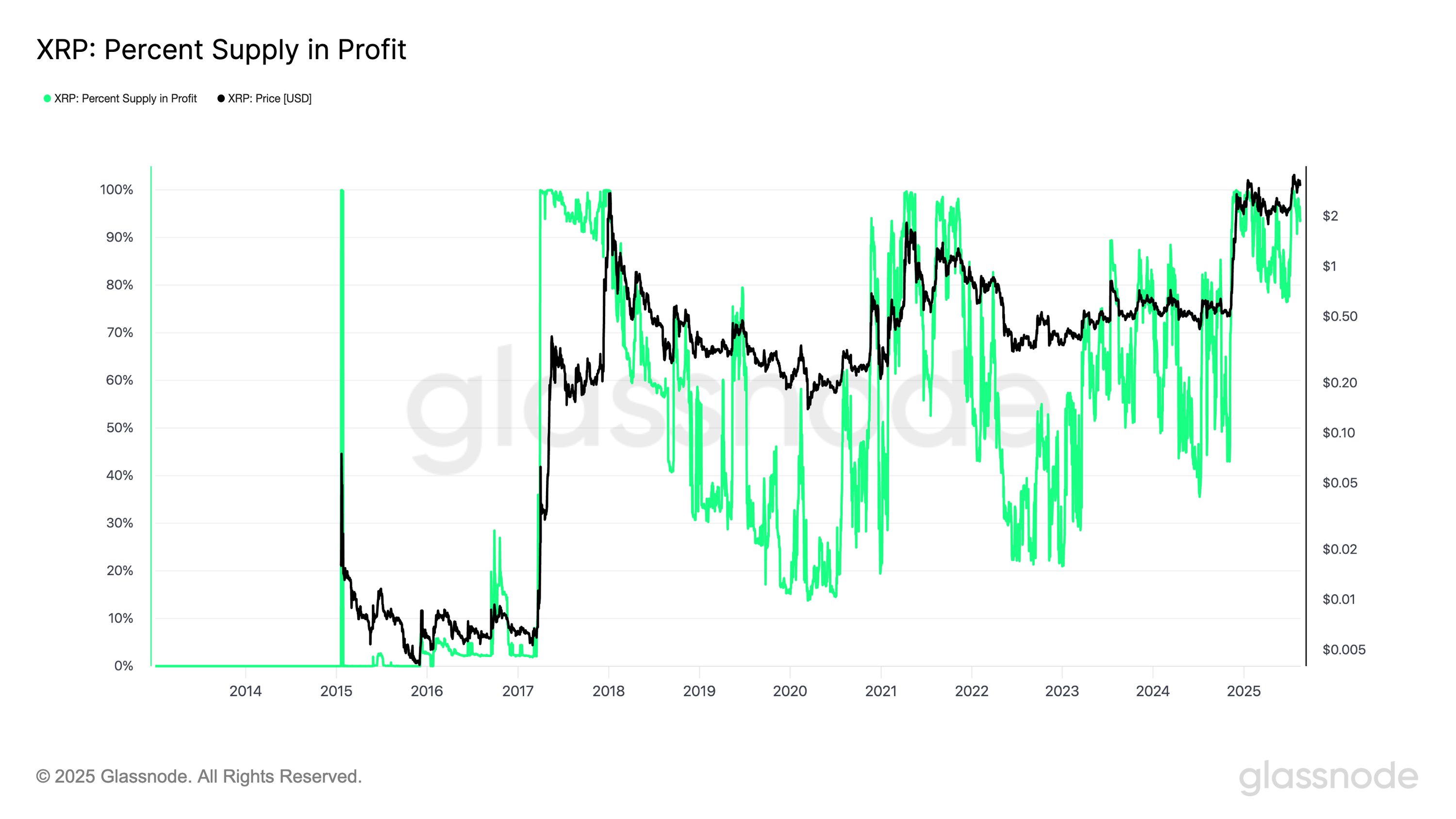

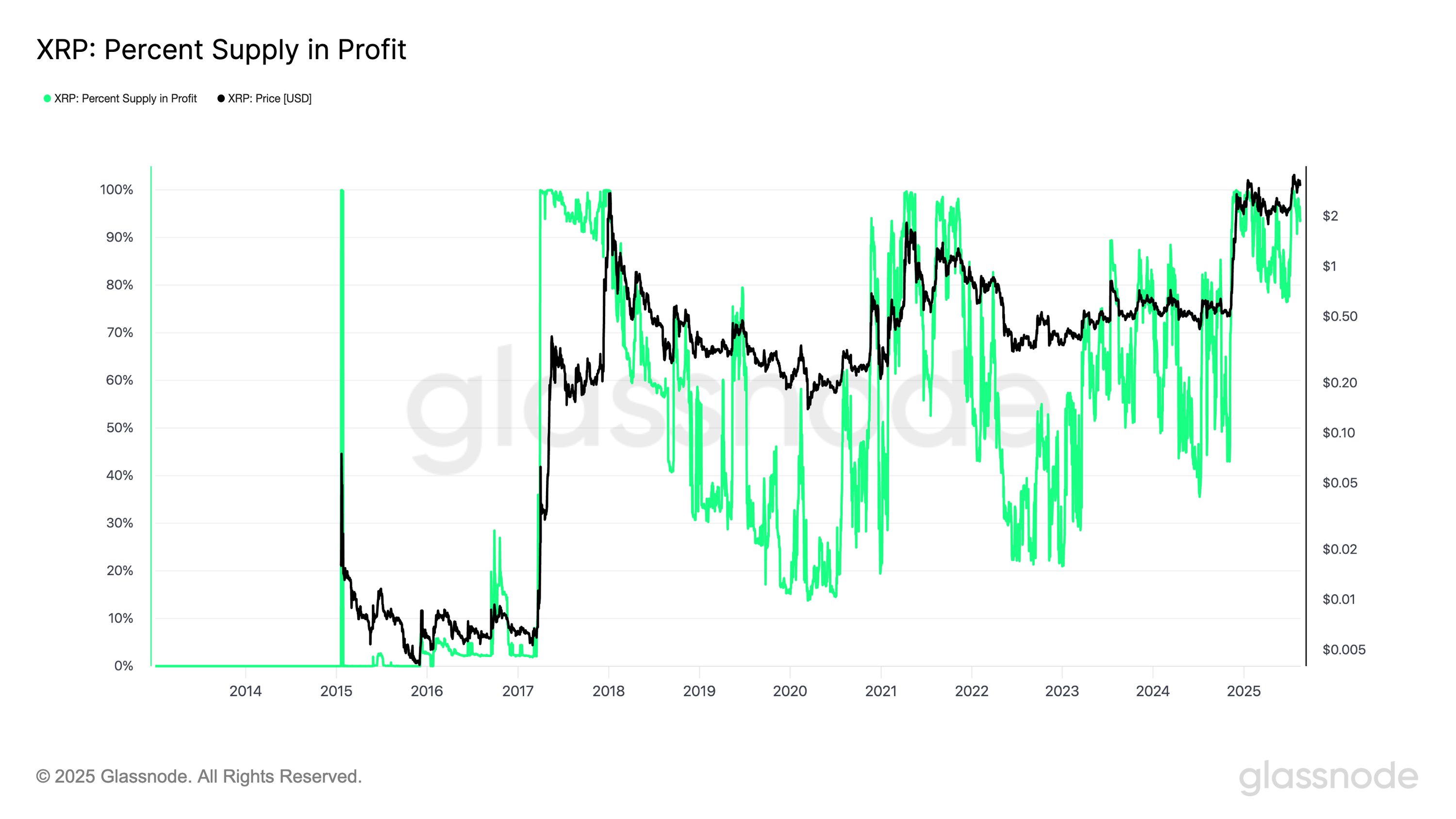

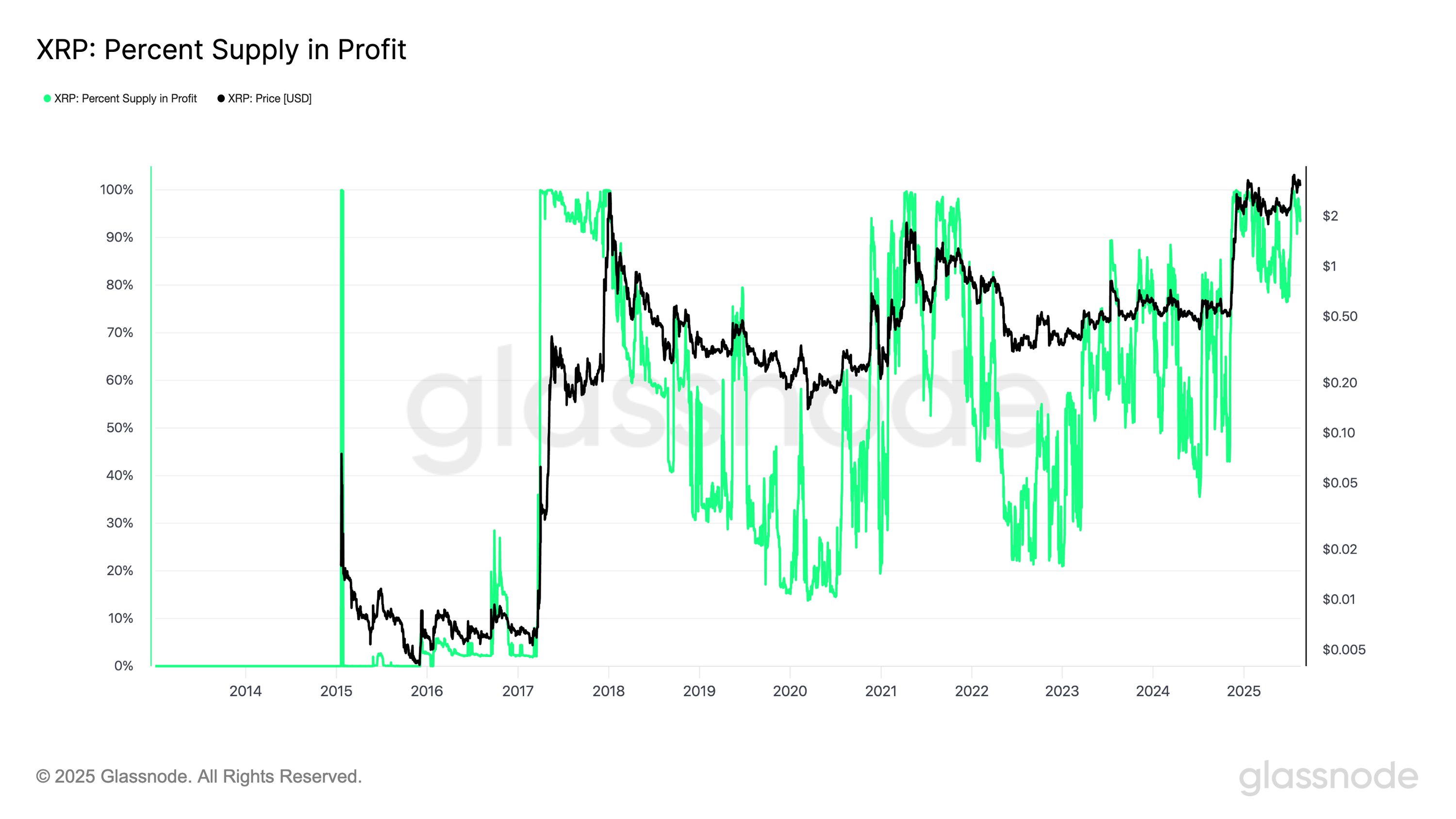

Someone Eventually Sells as 94% of XRP Wallets Now in Profit, but Here’s Why Now Could be Different

With more than 90% of XRP holders now seeing profit, an expert has teased imminent selling pressure,...

Someone Eventually Sells as 94% of XRP Wallets Now in Profit, but Here’s Why Now Could be Different

With more than 90% of XRP holders now seeing profit, an expert has teased imminent selling pressure,...

Wyoming Launches First State-Issued Stablecoin in the U.S

Wyoming has officially rolled out the Frontier Stable Token (FRNT), becoming the first U.S. state to...