Coinbase CEO Bets On Bitcoin Hitting $1 Million In The Next 5 Years

Coinbase CEO Brian Armstrong put a bold price on Bitcoin this week, saying the token could hit $1 million by 2030.

He posted the prediction on X and pointed to rising institutional interest and clearer rules in the US as reasons for the call.

Short-term moves will still be messy, he warned, but the long-term case is getting stronger.

Armstrong Joins High-Profile Bull Calls

According to Armstrong, the shift in tone from regulators matters. He flagged pending stablecoin legislation and a market structure bill in the Senate as possible catalyst events, saying “something could happen by the end of this year.”

Reports have disclosed that the US government now holds a strategic Bitcoin reserve, a step Armstrong once found unlikely.

I think we’ll see $1M per bitcoin by 2030.

Regulatory clarity is finally emerging, the US government is keeping a BTC reserve, there’s a growing interest for crypto ETFs, among many other factors.

(Not financial advice of course, it’s impossible to guarantee) pic.twitter.com/w5EfcYFvVp

— Brian Armstrong (@brian_armstrong) August 20, 2025

Institutional Flows Are Small, But Growing

According to Armstrong, many large funds currently hold about 1% of their portfolios in Bitcoin. That’s small. It’s also a base to build from if rules become clearer.

Exchange-traded funds have already pulled significant institutional money into the market, and sovereign interest is slowly rising. Armstrong argues that clearer rules will speed the process and unlock more capital.

Big Names Back Big Numbers

Big Names Back Big Numbers

Meanwhile, several well-known figures have been making their own forecasts about the world’s most popular crypto asset.

Author Robert Kiyosaki has argued that rising inflation and the growing US debt load could be key drivers pushing Bitcoin toward higher levels.

Michael Saylor, who leads Strategy , points to Wall Street’s balance sheets, saying a 10% allocation of reserves to Bitcoin could be enough to trigger the million-dollar mark.

Cathie Wood of ARK Invest has set an even loftier target, suggesting Bitcoin could climb to $1.5 million in her firm’s bull scenario.

Together, these forecasts align with Armstrong’s call, though each stems from a different line of reasoning.

Regulation And Risk Still MatterBitcoin has a history of sharp rallies followed by big pullbacks. That pattern hasn’t disappeared. While proponents point to limited supply and growing institutional exposure as reasons to expect higher prices, critics warn that macro shocks, tighter regulation, or a serious technical flaw could reverse gains quickly.

Featured image from Meta, chart from TradingView

The S&P 500 Will Have No Choice But To Buy Bitcoin — Here’s Why

Bitcoin has cemented itself as a trillion-dollar asset class, and institutional adoption is gatherin...

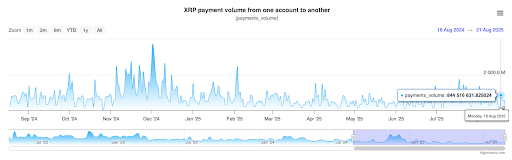

XRP On-Chain Activity Explodes By 500%, What’s Going On?

The XRP Ledger (XRPL) has witnessed a dramatic surge in on-chain transactions, with payment volumes ...

Cardano Whales Scoop Up 100 Million ADA In 24 Hours – Is A Mega Rally Brewing?

Cardano’s momentum is heating up as whale wallets make bold moves. A recent update from Crypto Updat...