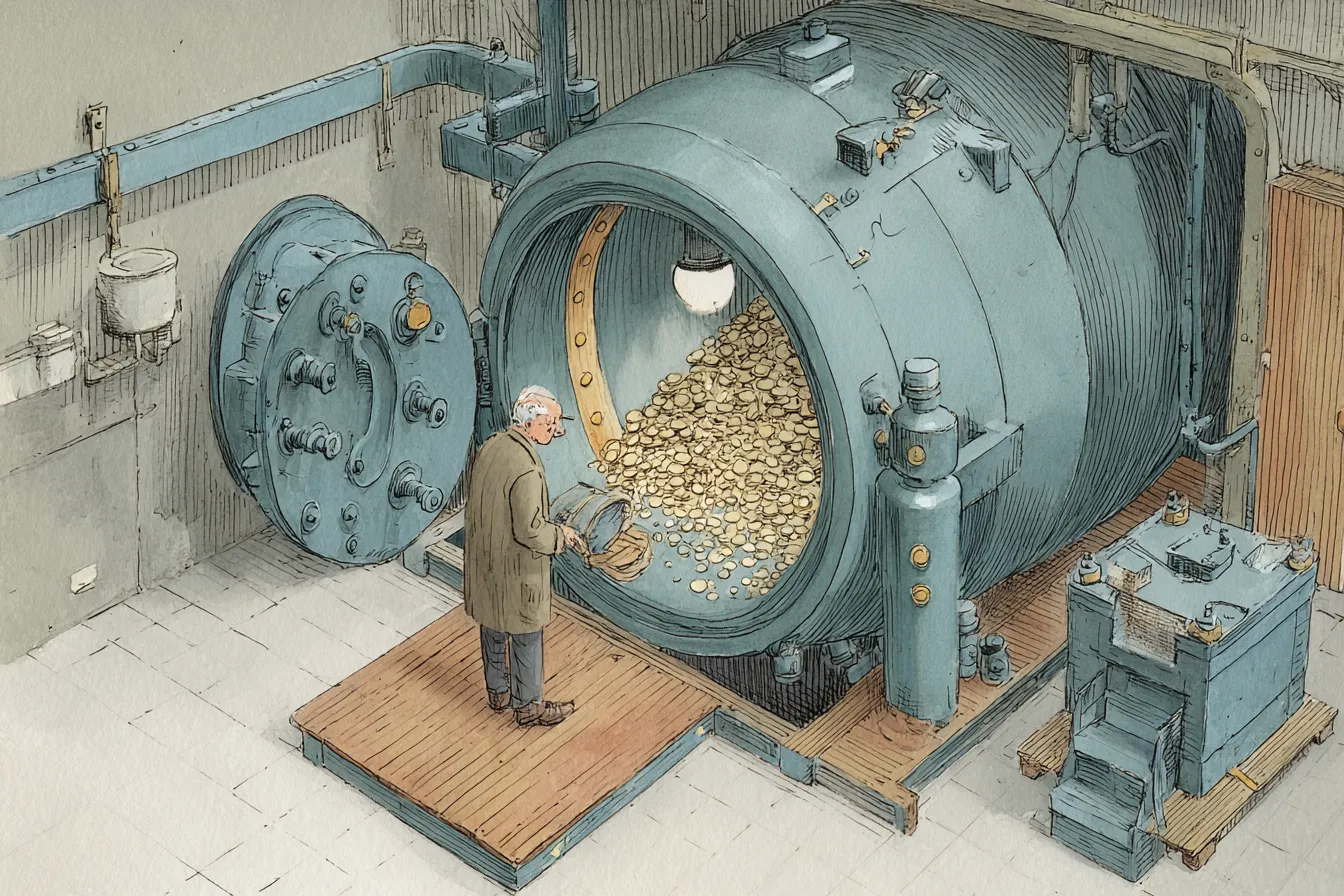

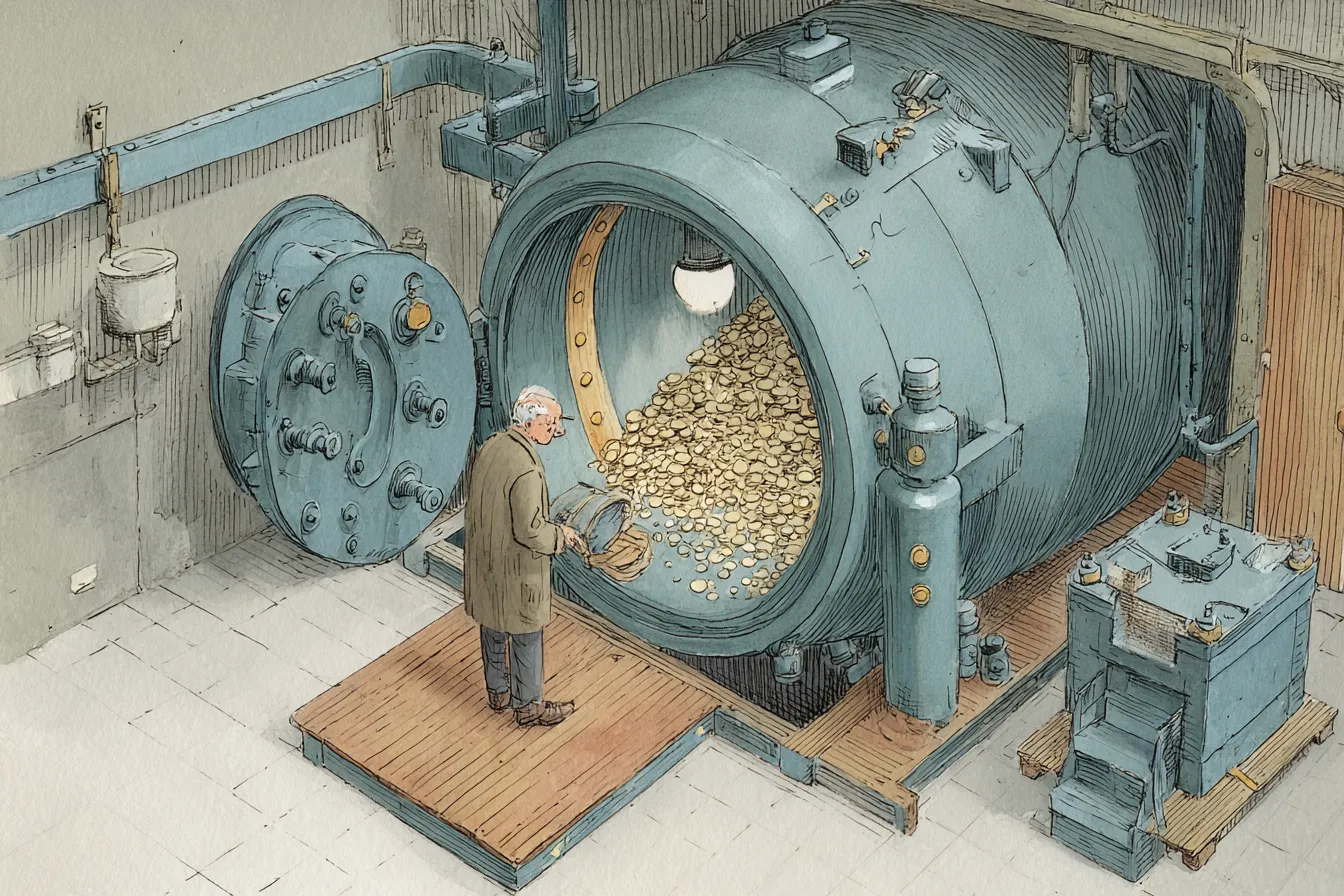

ETH Pullback Joins BTC Sell-off in $1 Billion Wipeout as Treasuries Keep Buying the Dip

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Key Takeaways

- BTC slid under $110K for the first time in 47 days, triggering ~$895 million liquidations in 24h with over 92% of the liquidations long positions. ETH dropped ~7% from its ATH $4,955 to $4,415, wiping ~$266 million in long/short positions.

- Despite weakness, corporate/treasury bids remain active. Strategy added 3,081 BTC worth $343 million, Goldman Sachs made a $194 million purchase of BTC, Remixpoint acquired 41.5 BTC, Metaplanet added 103 BTC, and ETHZilla purchased 7,562 ETH worth $35 million. These treasury inflows highlight selective accumulation into stress.

- BTC RSI at 43.6, edging toward oversold, along with Net Unrealized Profit/Loss falling to 5.1% from 8.8%, flags fading profitability. The key risk is a break of the 200-day EMA at $103.7K or the 200-day SMA at $100.8K which would jeopardize the bull cycle market structure.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/524668.html

Related Reading

AsiaNext Taps FalconX Veteran for Derivatives Leadership

David Martin brings 17 years of institutional trading experience to head Singapore-based platform's ...

Powell Sings a Different Tune, Exposes Tough Road Ahead

Your weekly macro cheat sheet....

B Strategy to Launch US-Listed BNB Treasury Company, Targets $1B Raise

Backed by YZi Labs (formerly known as Binance Labs), the treasury company’s stated goal is to become...