Caution & Uncertainty Persist in Crypto Markets

The market is presently adopting a cautious approach, observing developments before making any decisive moves. The upcoming data on US inflation and jobs will likely have a significant impact on the future movement of Bitcoin and other cryptocurrencies.

On the other hand, global stocks have gained on Fed rate easing bets, with the S&P 500 marking its best day since May on Friday after having fallen for five straight sessions.

But the run-up in stocks since April lows points to some form of a bubble, with any change in the Fed's policy path likely to hit risk assets. Based on this, it appears that cryptocurrency traders are currently anticipating these risks in their positioning and acting accordingly.

Powell's tone change sent bonds higher on Friday, but looking past September, the trajectory of further cuts would depend on economic conditions, as well as the potential for additional gains in US bonds.

Treasury bonds surged, expanding the gap between short- and long-term yields to the widest level in nearly four years—a common response to a more accommodating central bank.

Despite the prevailing sense of relief, there remain some persistent uncertainties regarding the extent to which interest rates will fall.

Futures traders are not fully convinced that a quarter-point cut will occur during the interest-rate decision on September 17, estimating the likelihood at approximately 80%.

Despite the gains observed on Friday, bond yields remain above the lows recorded earlier this month, as market participants eye upcoming employment and inflation data prior to the next meeting.

Data-Eyed

The measured reaction illustrates the complex dynamics confronting the central bank, which is navigating a weakening job market while also considering the potential for inflation to increase from persistently high levels as the effects of President Trump's tariffs permeate the economy.

For example, this week, the Fed's preferred inflation measure could indicate that price pressures remain strong. The upcoming auctions for two-, five-, and seven-year bonds will gauge the appetite of investors.

Despite Powell's shift in stance, we could see a scenario reminiscent of last year, where the central bank began to loosen its approach, only to halt in January as the economy continued to show unexpected resilience.

That sentiment and uncertainty are driving crypto moves at the moment, even as the Fear and Greed index showed a shift to greed for the latest week.

What Are the Technicals Suggesting?

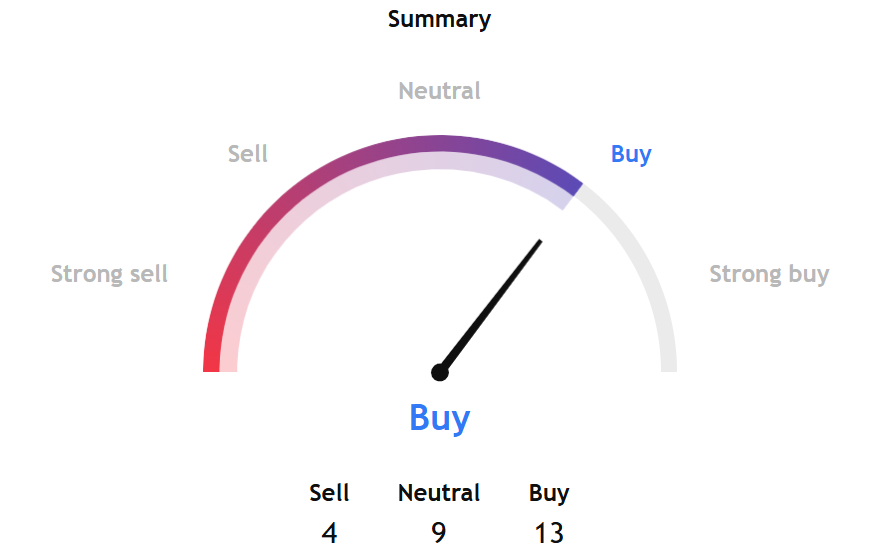

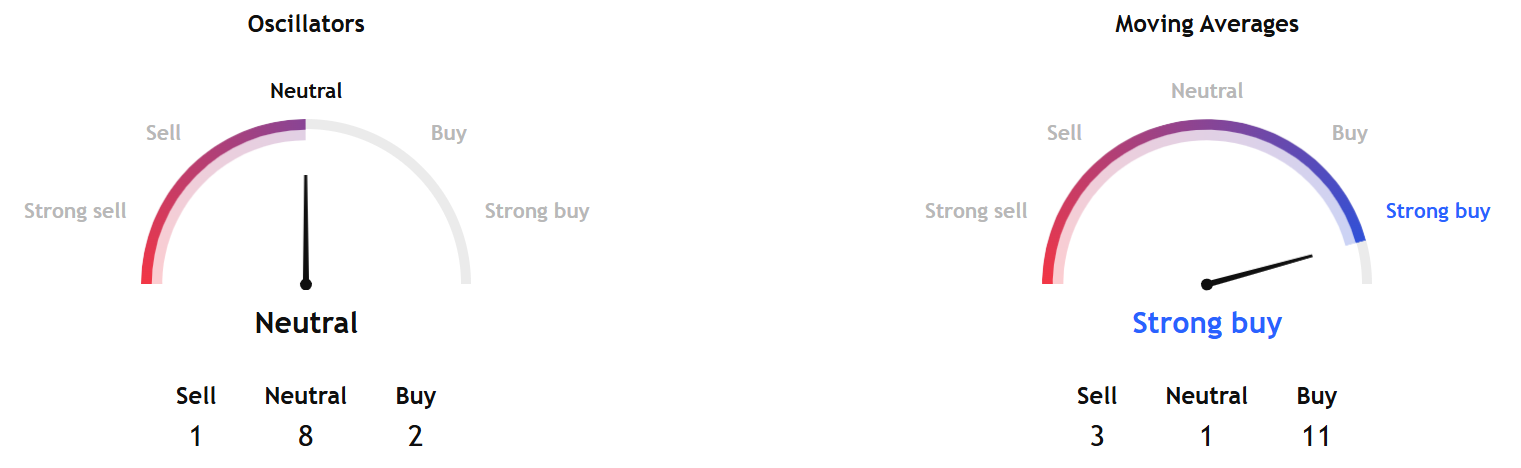

TradingView's BTCUSD technical analysis gave a buy signal for the week ahead.

This tool provides a comprehensive analysis overview based on your chosen timeframe. The overview of Bitcoin is derived from widely used technical indicators, including moving averages, oscillators, and pivots.

But sub-indicators within the technical measures showed a larger number of sell signals than in the previous week, with the oscillators pointing to a neutral stance, while moving averages gave a buy signal.

Separately, InvestTech's Algorithmic Overall Analysis gave a hold signal, with low liquidity risk but high volatility bets.

InvestTech's recommendation for one- to six weeks was negative.

The analysis showed Bitcoin has decisively breached the lower boundary of a short-term rising trend channel. This suggests an initial gradual increase, or the beginning of a more level progression.

The token has fallen below the support level at $113,500, and currently sits at $110,000. This indicates a potential for additional downturns. Should there be favorable responses, resistance will now be observed at the level of $113,500.

Trading volume historically tends to be lower at peak prices and higher at troughs. This diminishes the value of the token.

The RSI curve indicates a downward trajectory, potentially serving as an early indicator of an impending decline in price as well. The token is broadly evaluated as having a negative technical outlook for the near term.

Separately, data from SoSoValue showed a daily total net open interest (delta) of -$542.99 million.

That suggests a rise in open contracts for puts, indicating that market makers are required to sell underlying assets to manage their risk, leading to an increase in the sale of ETFs.

The daily net inflow was also negative as of Friday, with the weekend seeing more sell-off in BTC ETFs.

Overall, technical analysis for the top token shows a slightly negative trend this week.

Elsewhere

Blockcast

Yat Siu on the Future of Crypto: AI, Blockchain, and Creativity

In this episode, the chairman and co-founder of Animoca Brands discusses the implications of AI on jobs, the importance of nurturing creativity in education, and the launch of Moca Network, a new blockchain initiative aimed at enhancing digital identity and reputation. Yat emphasized the need for a shift in how we view data ownership and privacy, as well as the role of speculation in the crypto space.

Access the episode from your preferred podcast platform here .

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Kapil Duman (Quranium), Eric van Miltenburg (Ripple), Jeremy Tan (Singapore parliament candidate), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Samar Sen (Talos), Jason Choi (Tangent), , Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Institutional Interest in Solana Surges as Multiple Treasury Initiatives Launch

Public companies pivot to SOL accumulation strategies as institutional demand for blockchain exposur...

AsiaNext Taps FalconX Veteran for Derivatives Leadership

David Martin brings 17 years of institutional trading experience to head Singapore-based platform's ...

Powell Sings a Different Tune, Exposes Tough Road Ahead

Your weekly macro cheat sheet....