Bitcoin Sentiment On Binance Turns Bullish – But Is The Market Setting A Trap?

Over the past two weeks, Bitcoin (BTC) has dropped more than 7%, falling from around $117,400 on August 21 to a low of $108,666 earlier today. Despite the bearish slide, some encouraging exchange data suggests improving sentiment. However, analysts warn this could once again be a setup for institutions to trap retail buyers.

Bitcoin Sentiment Improves, But Maintain Caution

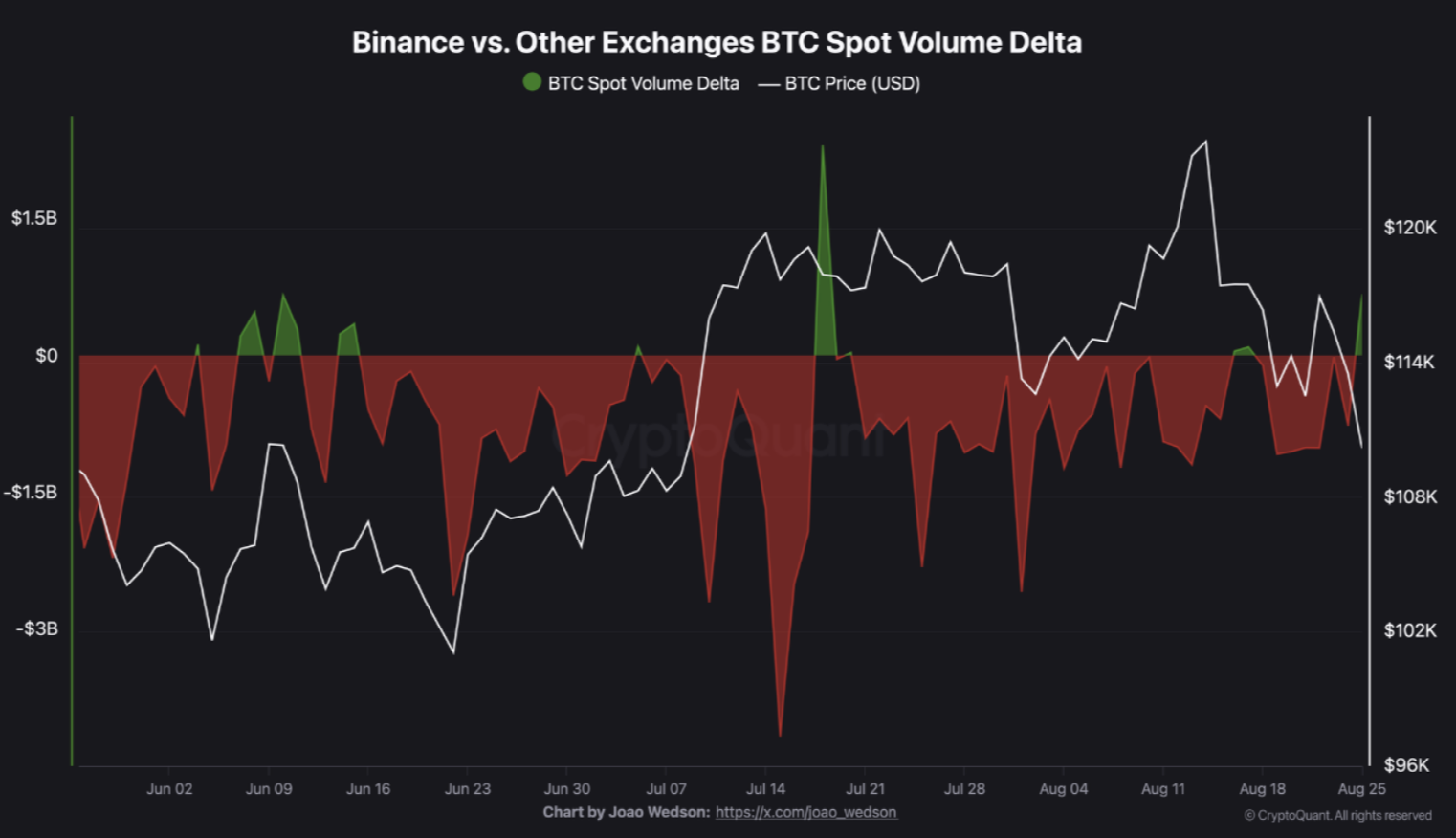

According to a CryptoQuant Quicktake post by contributor BorisD, the Binance vs. Other Exchanges BTC Volume Delta turned positive on August 25, registering $676 million. This indicates that Binance users have shifted decisively into spot buying mode.

Notably, this trend has not been observed on other major exchanges. Since Binance is the world’s largest exchange in terms of liquidity and user base, its flows are often considered a reflection of broader market sentiment.

At present, retail investors appear to be fueling buying pressure. While this can support demand for BTC, it also creates an opening for institutional investors to drive prices lower, flushing out retail positions before the market resumes an upward move.

BorisD highlighted that historically, when Binance users increase spot buying, Bitcoin’s price often declines. On the contrary, when selling pressure rises, BTC tends to recover in price. He explained:

This dynamic highlights the clear difference between retail and institutional behavior. Retail traders often act emotionally and position themselves on the wrong side, while institutions strategically engineer liquidity around these flows.

In conclusion, the analyst said that although rising spot buying on Binance is encouraging, a positive delta does not always mean a bullish signal. On the contrary, it can expose retail buying pressure than can be exploited as an opportunity by institutions.

Will BTC Fall Below $100,000 Price Level?

Analysts remain divided on whether Bitcoin can set a new all-time high (ATH) in the near term. Some stress that BTC must hold above the $100,000 level to preserve its overall bullish structure.

In a separate analysis, crypto analyst Alphractal remarked that the BTC market seems to be getting ready for its next major move in the coming weeks. Meanwhile, the Bitcoin Bull Score Index is giving signs of fading momentum, increasing risk of further downside.

The Bitcoin market is also witnessing early signs of exhaustion, as asset manager BlackRock recently went on a BTC selling-spree , dumping about $500 million of the digital asset.

Still, a number of analysts remain optimistic, with some forecasting a potential ATH of as high as $183,000 later this year. At press time, BTC trades at $109,841, down 1.8% in the past 24 hours.

Cardano Retests Key Support As SEC Delays ETF Decision – Is An October Rally Brewing?

As the decision on Grayscale’s spot Cardano (ADA) Exchange-Traded Fund (ETF) has been delayed, the a...

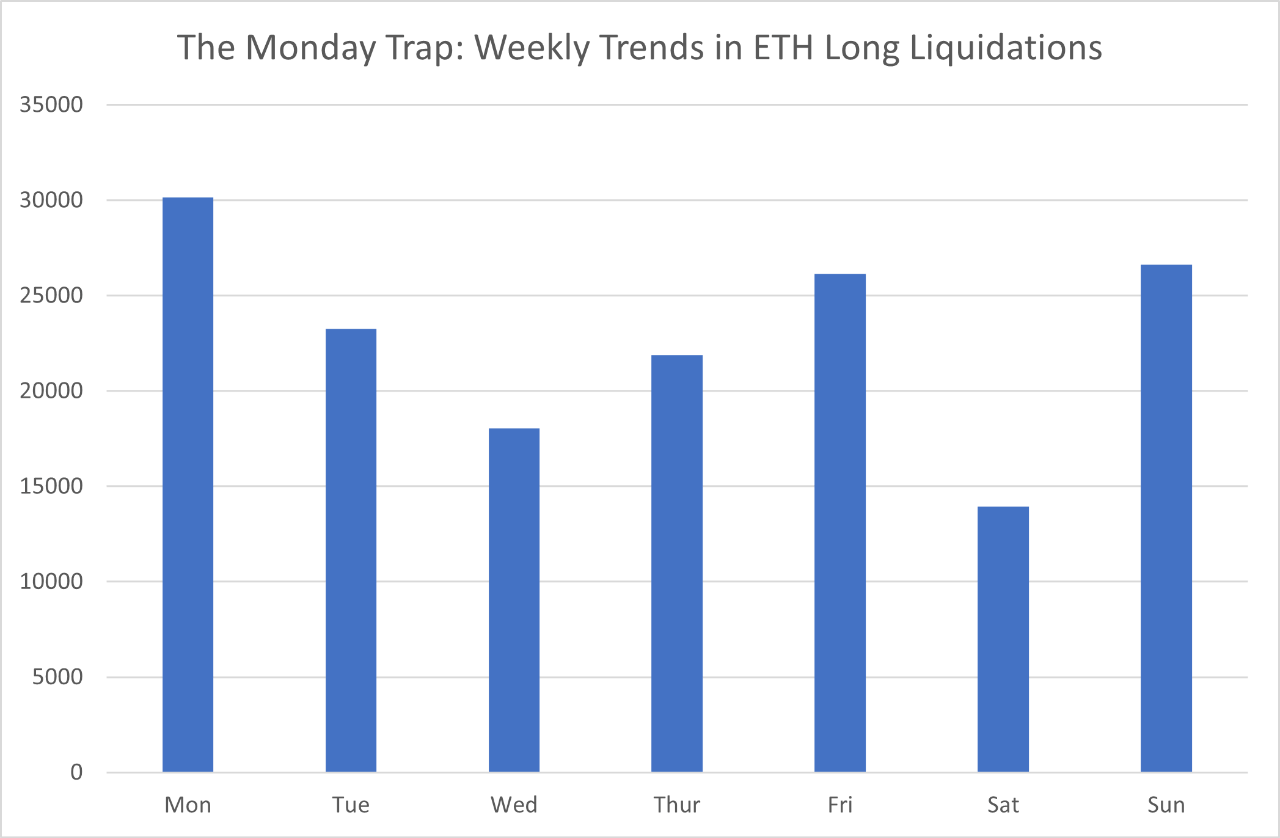

Ethereum Longs at Risk? Analyst Warns of Recurring Weekly Liquidation Pattern

Ethereum (ETH) recently broke through to a new all-time high above $4,900 before undergoing a correc...

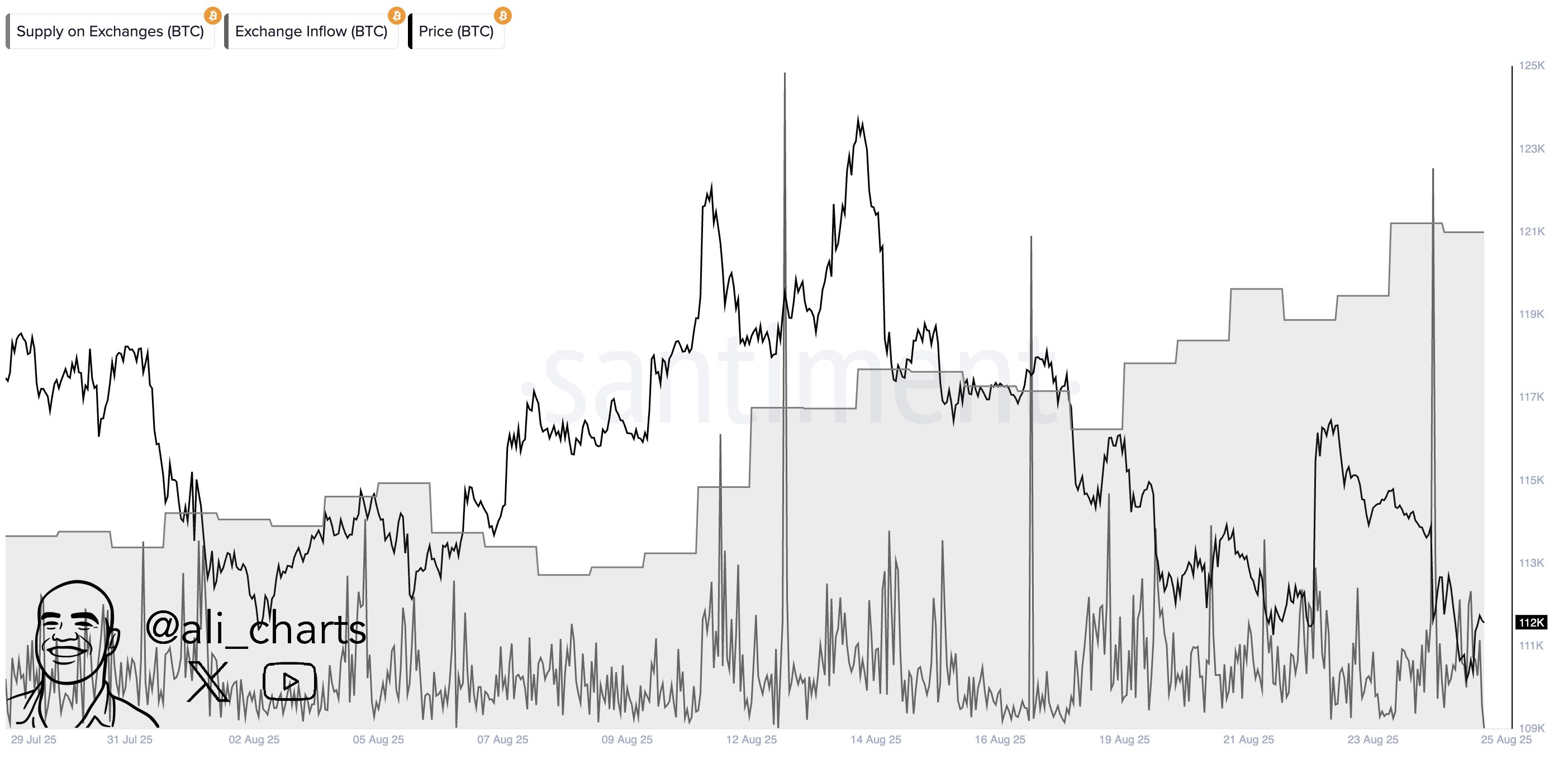

Bitcoin Selloff: $2.2 Billion In BTC Floods Exchanges

On-chain data shows exchanges have received heavy Bitcoin inflows over the last couple of weeks, a p...