Ethereum Futures Volume Surpasses Bitcoin as Cboe Announces Long-Term Contracts

Ethereum is once again stealing the spotlight in crypto markets, proving that its dominance in the smart contract space is far from over. As institutional adoption accelerates and regulatory clarity improves, a new shift is underway, this time in the futures market. With Ethereum futures trading volume surpassing Bitcoin’s for the first time in months, investor sentiment is leaning heavily toward ETH as the favored altcoin of the fourth quarter.

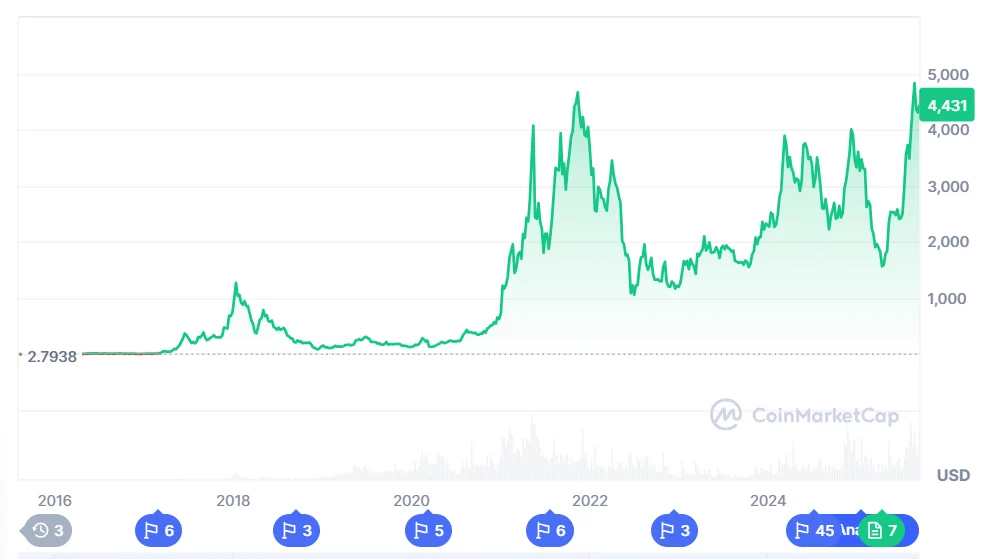

Ethereum price remains above vital technical breakout ranges, making it a prime prospective subject of the next big crypto boom. Analysts are now citing major upside potential, particularly as futures volumes and institutional purchasing patterns are converging to support long-term ETH accumulation.

BullZilla ($BZIL) , meanwhile, is capturing the attention of retail investors. In the midst of meme coin volatility, the project has quickly gained recognition as one of the top crypto presales in 2025, offering structured growth, robust tokenomics, and substantial early-stage engagement.

Ethereum Futures Volume Hits $49.4B, Outpaces Bitcoin

In only 24 hours, Ethereum futures trading volume surged to $49.4 billion, surpassing that of Bitcoin, which reached $42.9 billion, according to Coinanalyze. This boom highlights the recent changes in the derivatives market, where Ethereum is gradually emerging as a more favored asset for speculation and leveraged positions.

Etherem has been holding steady, even though recent ETF outflows have been $668 million. On-chain transactions reveal that more than 78,000 ETH was transferred out of Kraken to four institutional wallets, which points to a great deal of over-the-counter trading. Since U.S. institutions will be able to access regulated ETH exposure through Cboe in the future through its forthcoming offerings, the trend of supporting Ethereum over Bitcoin is likely to persist.

The performance of Ethereum has been particularly striking, with a year-to-date increase of 31%, against that of 19% in Bitcoin. This change in momentum also serves to affirm the rise of Ethereum in high-conviction trades.

Ethereum Price Targets $7,500 Amid Strong Technicals

Ethereum price recently broke above the critical $4,089–$4,283 resistance range and now holds steady near $4,300. With increasing volume and a long-standing ascending trendline intact, analysts are eyeing a push toward $7,000–$7,500 in the coming weeks.

Multiple factors support the bullish structure:

- High-volume reclaim of $4,000

- Macro environment signaling possible rate cuts

- A sharp rise in altcoin dominance market-wide

The next significant resistance sits at the $7,000–$7,500 zone, with Fibonacci extensions supporting this target. Ethereum’s resilience across multiple macro cycles suggests it may continue leading the altcoin recovery narrative into Q4 2025.

BullZilla Presale Achieves Dual Milestones: $350K Raised and 23.4B Tokens Sold

BullZilla has emerged as one of the standout meme tokens of the year, not only because of its Ethereum foundation but also for its structured presale stages and transparent tokenomics. As institutional focus remains on futures and ETFs, BullZilla Presale is fueling strong engagement across retail crypto communities.

BullZilla’s community continues to grow as more traders discover its deflationary burn mechanism (“Roar Burns”) and its viral appeal within meme token circles. With over 23.4 billion tokens already sold and a price increase around the corner, the project is quickly becoming a top contender in the best crypto presale in 2025 conversation.

BullZilla ($BZIL) Presale Snapshot

| Metric | Value |

| Current Stage | 2nd – “Dead Wallets Don’t Lie” |

| Current Price | $0.00004575 |

| Tokens Sold | 23.4 Billion |

| Presale Raised | $350,000+ |

| Token Holders | 1,200+ |

| ROI to Listing | 11,422.20% |

| Upcoming Price Surge | +14.55% to $0.00005241 |

Conclusion: Ethereum Leads the Futures Surge, BullZilla Drives Retail Buzz

Etherem is entering a new stage of maturity as futures volumes hit new highs, technicals suggest a bullish pattern, and regulated product offerings open the gate to more institutional investors being involved. As Cboe approaches launching with the potential to open up long-term exposure, Ethereum will continue to play a central role in the digital asset marketplace.

BullZilla, on the other hand, is riding a wave of grassroots momentum. As the Bull Zilla Presale powers forward, the token continues to attract both speculative and community-driven capital. In a market split between institutional regulation and retail innovation, Ethereum and Bull Zilla are leading two parallel but equally compelling narratives.

For More Information:

BZIL Official Website

Join BZIL Telegram Channel

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions About Ethereum Futures Surge and BullZilla Presale’s Milestones

What are Cboe Continuous Futures?

Long-term regulated futures contracts for Ethereum and Bitcoin with 10-year expirations and cash-settlement mechanisms.

Why does Ethereum futures volume perform better than Bitcoin?

Speculative traders have increasingly taken an interest in Ethereum in the short run because of its technical arrangement and the futures launch in the future.

What is the future Ethereum price?

Analysts foresee the price rising to $7,000 to $7,500 due to increased support and institutional accumulation.

What is BullZilla ($BZIL)?

BullZilla is an Ethereum-based meme token in presale with a deflationary token model and strong retail interest.

What stage is BullZilla in?

It’s currently in Stage 2, with a scheduled price increase of 14.55% coming soon.

Why is BullZilla considered the best crypto presale in 2025?

Its structured presale model, burn mechanics, and early momentum make it one of the most promising meme token launches of the year.

Is Ethereum using Bitcoin in the lead this year?

Yes, Ethereum an up 31% YTD versus 19% Bitcoin, which has been fueled by both speculative futures trading, and the rotation of other coins.

Glossary of Key Terms

- Ethereum (ETH): A leading smart contract blockchain powering DeFi, NFTs, and dApps.

- Ethereum Price: The current market value of ETH is influenced by technical, speculative, and institutional factors.

- Cboe: Chicago-based global exchange group launching long-term crypto futures.

- Futures Volume: The total trading activity in futures contracts over a given time.

- OTC (Over-the-Counter): Direct asset purchases between parties, often involving large institutions.

- BullZilla ($BZIL): A meme token on Ethereum with deflationary tokenomics and growing community traction.

- Bull Zilla Presale: Early sale phase where tokens are distributed before exchange listing.

- Roar Burns: BullZilla’s mechanism for reducing total token supply.

- Best Crypto Presale in 2025: A term used to describe standout early-stage tokens with strong community and ROI potential.

- Retail vs. Institutional: Retail refers to individual investors; institutional includes hedge funds, asset managers, and large firms.

Article Summary

Ethereum is also experiencing industrial backing, with future trades outpacing those of Bitcoin as a result of speculation, and with future regulated contracts imminent at Cboe Global Markets. Ethereum price does not fall below the mark of more than $4,283, and analysts think that it will break out to reach 7500. Meanwhile, retail interest is gravitating toward BullZilla ($BZIL), which has sold over 23.4 billion tokens in its current presale stage. Known for its unique burn mechanics and community appeal, Bull Zilla is emerging as the best crypto presale in 2025. As institutions focus on Ethereum’s long-term exposure through futures, retail investors continue to back innovative meme tokens with high upside potential. Both markets appear primed for an active Q4.

Disclaimer

It is an informative article and should not be considered as financial or investment advice. Bitcoin and other cryptocurrencies have unstable markets and are risky. You would always wish to do your research and consult with a licensed financial advisor before making any economic decision. The loss suffered by individuals in the loss of investment in regard to this content is not the responsibility of the author or the publisher.

This article is not intended as financial advice. Educational purposes only.

XRP Is Predicted to Continue Rising, With Investors Holding XRP Earning $6,875 Daily on Profitablemining

$XRP nears $4 as whales accumulate, and investors turn to cloud mining for daily passive income. Pro...

Solana Price Prediction In 2025: SOL Holders Bet Big On This Viral Altcoin That Could ‘Break The Internet’

Solana stays strong above $200, but traders eye Layer Brett — a $0.0055 Ethereum L2 token with 10K T...

Pepe Price Forecast For 2026; Why New Crypto Investors Favour This Altcoin As Their First Crypto Investment

Pepe remains volatile, BONK struggles for stability, but Layer Brett offers 10K TPS, $0.0001 fees, 6...